3 AI Hardware Stocks Poised to Thrive Despite Tariff Concerns

The specter of tariffs casts a shadow over many corporations, as import costs rise. If procuring essential products relies solely on imports, consumers and businesses alike may hesitate to purchase, anticipating tariff reductions. Furthermore, escalating prices due to tariffs could erode consumer confidence, potentially triggering a broader spending downturn. This situation worries many investors, contributing to the recent stock market sell-off.

However, I believe three companies are well-positioned to navigate the challenges posed by potential tariff policies, and each presents a compelling buy opportunity following the market correction. Nvidia and Broadcom are key hardware providers. While many firms could, and likely will, weather these tariffs, I am concentrating on AI hardware suppliers, as these companies are most directly impacted.

Nvidia (NVDA -0.75%), Taiwan Semiconductor Manufacturing (TSM -0.56%), and Broadcom (AVGO 0.55%) are all critical suppliers for AI hyperscalers. My assessment is that these companies will perform well amid the tariff uncertainty. Why? The major AI firms are highly dependent on these hardware suppliers’ products.

Nvidia specializes in graphics processing units (GPUs), which are deployed extensively for training AI models and operating them once deployed. Its GPUs and the supporting infrastructure are industry-leading, with minimal competition. Even competitors also source components from outside the U.S., exposing them to similar tariff risks.

Given the critical role of GPUs in the advancement of AI, Nvidia is well-positioned for continued success. Broadcom operates in a similar market, producing connectivity switches and custom AI accelerators, dubbed XPUs. Both product lines are expected to generate substantial growth in the upcoming years. Currently, only three companies use Broadcom’s XPUs, but by 2027, this division anticipates a market opportunity of $60 billion to $90 billion. With four additional customers onboarding, this opportunity is set to expand.

Considering the company’s $54 billion revenue over the past 12 months, this signifies substantial growth. While tariff concerns exist for both companies, the pursuit of AI supremacy is far more significant. Consequently, investors should consider the long term, acknowledging the substantial potential of Nvidia and Broadcom.

Taiwan Semiconductor: Avoiding the Tariff Crosshairs

Taiwan Semiconductor (TSMC) is a crucial supplier for both Nvidia and Broadcom. Both companies rely on TSMC for chip manufacturing, and it’s the foremost option for high-end chips. While President Trump initially considered imposing tariffs on Taiwan, that threat seems to have dissipated following TSMC’s recent announcement of another $100 billion investment in U.S. semiconductor production facilities. Although Taiwan’s president and the CEO of TSMC denied that President Trump forced this expansion, the outcome remains the same: Trump achieved his goal by having TSMC shift more of its production to the U.S.

Therefore, one of the most important suppliers, which could have driven up costs for Nvidia and Broadcom’s products, doesn’t need to worry about tariffs currently. These three are free from these burdens, at least for now. Until the market fully recognizes the diminished tariff threat, these three companies are likely to continue to experience a sell-off, presenting investors with an excellent opportunity to acquire shares at favorable prices.

Valuation and Investment Opportunity

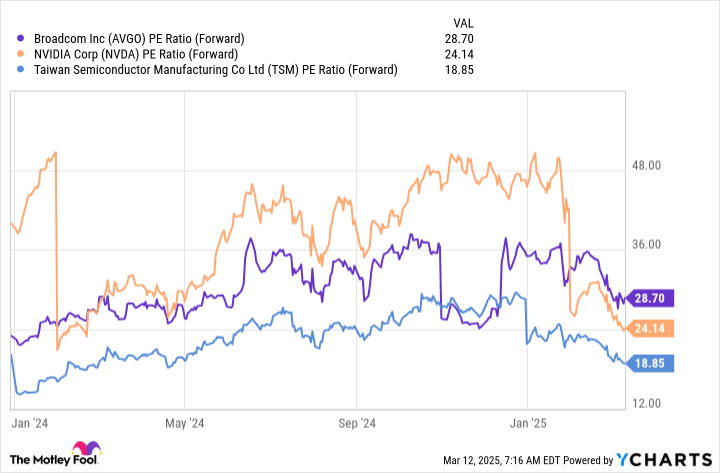

Following the recent market sell-off, these three stocks are trading at price points rarely seen over the past year.

While it is difficult to determine a bottom in the market during a sell-off, and the threat of tariffs lingers, investors should be aware of the opportunity:.

First, Taiwan Semiconductor appears significantly undervalued with a forward earnings multiple of 18.8. Despite being one of the world’s most important companies, it trades at a lower multiple than the broader S&P 500 (^GSPC 0.08%), which has a 19.8 forward earnings multiple. This pricing discrepancy doesn’t align with market factors, presenting an appealing entry point for value-focused investors.

Nvidia is also comparatively inexpensive, given the vital role of its GPUs. The decline from the high valuations of 2024 represents another excellent chance to acquire shares at a reduced cost. Finally, while Broadcom is the most expensive, the potential success of the XPU market could make this a bargain. All three stocks appear to be solid buys for investors with a long-term outlook.

Over a three- to five-year timeframe, these investments are likely to be successful. However, some short-term volatility could continue, given the difficulty of pinpointing the market bottom amid a continuous sell-off.