Bull markets are generally pleasant affairs, with stock prices trending upwards. However, this can inflate valuations, potentially diminishing long-term returns. Recent market volatility could provide a buying opportunity for undervalued, high-potential stocks.

Three Motley Fool contributors have identified CrowdStrike Holdings (CRWD), Amazon (AMZN), and Tesla (TSLA) as attractive options should the market experience a downturn. These companies are at the forefront of artificial intelligence (AI) innovation.

CrowdStrike Holdings: Cybersecurity Leader

CrowdStrike’s Price History

According to Justin Pope, CrowdStrike Holdings offers significant appeal for investors. The increasing sophistication of cyber threats and the potential for massive financial losses from data breaches have created a strong demand for advanced cybersecurity solutions. CrowdStrike’s cloud-based platform, leveraging AI and data analytics, offers faster threat detection compared to traditional antivirus programs. The company’s technology has been widely recognized, which is reflected in its financial performance. They currently protect 300 of the Fortune 500 companies and 543 of the Fortune 1,000.

CrowdStrike’s financials are robust, generating over $4 billion in annual recurring revenue, converting 23% of sales to free cash flow, and demonstrating GAAP profitability. The balance sheet boasts $3.5 billion in cash (net of debt), and revenue grew by more than 28% year-over-year in the last quarter. The cybersecurity sector is experiencing rapid growth, indicating steady demand for CrowdStrike’s services. Management estimates a total addressable market of $116 billion, far exceeding its current market share. Pope suggests that CrowdStrike’s valuation may be its primary downside. Its price-to-sales ratio of 26 is relatively high compared to other stocks. Despite a valuation that has remained resilient, given its recent difficulties, it may take market-wide volatility to reduce its price tag. If that happens, Pope advises investors to see it as a buying opportunity.

Amazon: AI-Driven E-commerce and Cloud Leader

Will Healy emphasizes Amazon’s strategic use of AI across multiple sectors. As a dominant cloud infrastructure provider, Amazon Web Services (AWS) provides the platform for numerous companies to utilize AI-driven tools and services. Through this technology, Amazon helps its customers automate tasks, analyze data and create new applications. AI also improves other segments, too.

Amazon’s e-commerce operations utilize AI to personalize customer preferences, streamline supply chains, and generate product descriptions. In addition, AI-driven efficiencies are employed in the North American and international segments. Amazon’s stock is trading over $215 per share, and its recent 11% drop into correction territory, alongside a P/E ratio of 39, makes it an attractive investment opportunity. Healy notes that this valuation is inexpensive compared to the history of the company. Despite its $2.3 trillion market cap, analysts forecast 10% revenue growth in 2025 and 2026, illustrating its growth potential. The extensive utilization of AI across both AWS and e-commerce segments, combined with the current correction, makes Amazon an intriguing pick.

Tesla: Undervalued AI Stock

Jake Lerch suggests investors consider adding Tesla shares, considering that Tesla is an underestimated AI stock. While the majority of its revenue stems from electric vehicle sales, the company’s long-term success hinges on its AI-powered innovations. This includes robotaxis, full self-driving technology, and its Optimus humanoid robot, all of which will require rapid AI advancements.

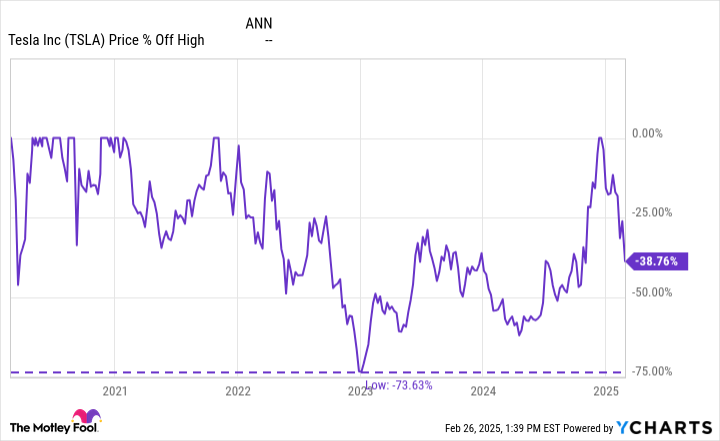

Tesla is making significant investments in AI, including its Dojo and Cortex supercomputers, which are engineered to process the vast amounts of real-world data collected by Tesla vehicles. However, the return on this investment may take years to be realized. Tesla shares are currently down by over 37% from their recent all-time high.

Lerch notes that significant pullbacks are not unusual for Tesla. Historically, these dips have provided opportunities for long-term investors. Since 2020, a $10,000 investment would now be worth over $121,000, despite the recent stock decline. He advises ignoring market noise and using the recent correction as an entry point for long-term growth.