The market has recently experienced a correction, largely driven by a sell-off in artificial intelligence (AI) stocks. While this can be unnerving for investors, market downturns often create opportunities. I believe the selling pressure is starting to subside, making it the perfect time to identify stocks poised for a strong rebound. I’ve pinpointed four companies that are positioned to deliver impressive returns throughout 2025, making them compelling buys right now.

The AI Arms Race: A Prime Opportunity

The four stocks I’m watching closely are Nvidia (NVDA -2.01%), AMD (AMD -3.15%), Broadcom (AVGO -3.95%), and Taiwan Semiconductor Manufacturing (TSM -2.77%). These companies are all vital contributors to the supply side of the AI arms race, providing the essential computing power necessary to build and operate sophisticated AI models. Each company’s success is significantly tied to the overall growth of the AI market.

Taiwan Semiconductor: The Critical Supplier

I’ll start with Taiwan Semiconductor, as it’s a crucial supplier to the other three companies. Nvidia, AMD, and Broadcom trust Taiwan Semiconductor to manufacture their chips. Because these companies compete to some extent, Taiwan Semi is in a great neutral position to benefit from whoever is winning the AI arms race at the moment. However, it also caps its high-end potential if one of the companies runs away with it (like Nvidia has been doing). Regardless, this position gives TSMC’s management an unparalleled vision of the future in terms of chip demand. Management has a very bullish outlook, as it expects AI-related chip revenue to grow at a 45% compound annual rate over the next five years.

This astonishing growth, even in the face of recent market corrections, suggests the current sell-off is a temporary blip in an otherwise unstoppable trend.

Nvidia, AMD, and Broadcom: The Competition for AI Supremacy

The race for AI hardware supremacy is heating up. Nvidia, AMD, and Broadcom are all vying to equip AI hyperscalers’ data centers with their technology. Nvidia has emerged as the clear leader, with revenue consistently rising quarter after quarter. Projections for the first quarter of fiscal year 2026 indicate continued strong performance, with revenue expected to increase by 65%. This growth is largely driven by the robust demand for Nvidia’s next-generation Blackwell architecture, which offers significant performance improvements in AI training and inference.

AMD hasn’t matched Nvidia’s dominance in the AI sector. It has mostly served as an alternative to Nvidia’s GPUs, meaning its clients aren’t tied exclusively to one provider. This has caused AMD’s data center business to grow at a slower rate than Nvidia’s, despite its substantially smaller size. However, AMD is still experiencing healthy growth and is estimated to have revenue growth above 20% in both 2025 and 2026.

Lastly, Broadcom, while not as focused on computing hardware as AMD and Nvidia, has a thriving segment dedicated to custom AI accelerators, known as XPUs. XPUs can outperform GPUs when the workload is set up properly. However, they are less useful when a more broad AI training situation is encountered, but they are incredibly useful for specific training tasks. Broadcom currently has three companies using XPUs specifically designed for their clients’ needs. Broadcom’s serviceable addressable market for XPUs could reach $60 billion to $90 billion in 2027 alone. This figure doesn’t account for the four other clients in the process of implementing their XPUs, which will dramatically expand this opportunity. With AI revenue representing only a fraction of Broadcom’s total revenue, dramatic growth is expected throughout 2025 and beyond.

Valuation and the Path Forward

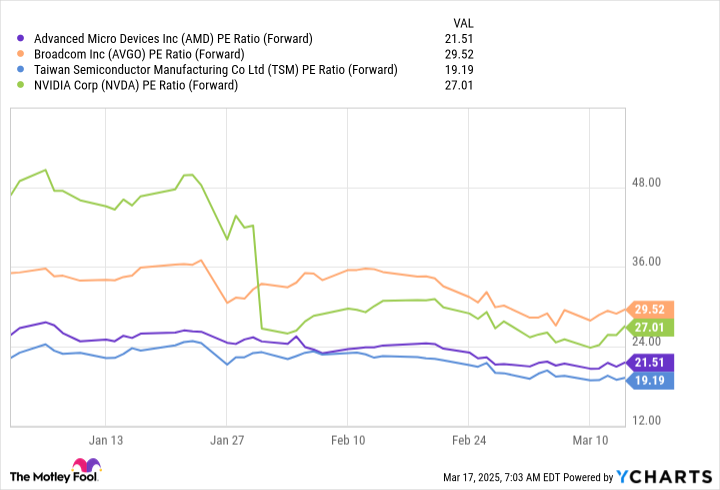

To further bolster the investment case for these four companies, let’s examine their forward price-to-earnings (P/E) ratios to assess how much they’ve gone on sale following the recent market correction.

Taiwan Semiconductor stands out as the most affordable, trading below the S&P 500, which has a forward price-to-earnings ratio of 20.5. AMD is trading at a discount to Broadcom and Nvidia, which makes sense considering its recent execution. However, it’s priced around the same price as the S&P 500 index, which only grows at about a 10% pace per year, whereas AMD is projected to grow at a 20% pace. Lastly, Broadcom and Nvidia have a premium valuation to the broader market, but their growth over the next few years is expected to be monstrous, so this premium is earned.

As the economy continues to adapt to the increasing relevance of AI as a whole, these four stocks are poised to deliver substantial returns. Investors looking to capitalize on this technology’s growth should consider adding these stocks to their portfolios before their price increases again.