Lite-On Technology: Analysts Hold Steady After Full-Year Report

Lite-On Technology Corporation (TWSE:2301) recently released its full-year financial results. While the company’s revenue met analyst expectations, statutory earnings per share fell slightly short of the mark.

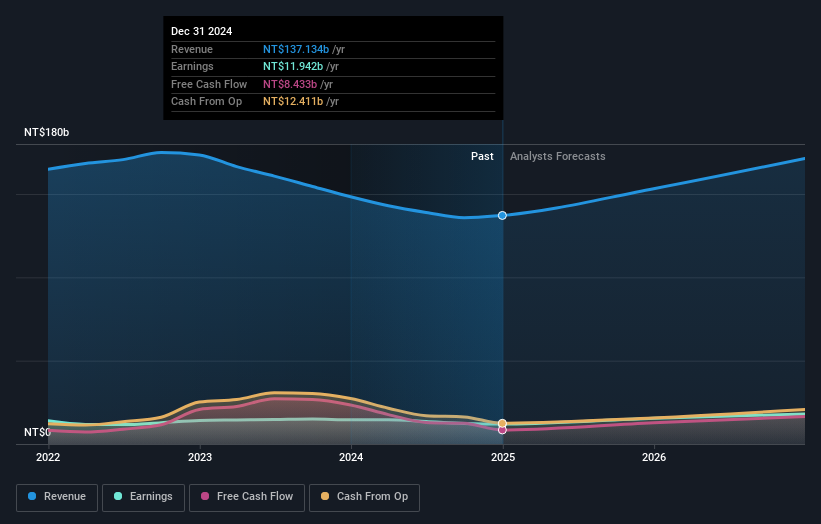

Image shows a chart representing the earnings and revenue growth of Lite-On Technology. The chart is dated March 4th, 2025.

Following the earnings release, analysts have updated their forecasts for the company. This analysis examines the latest estimates to determine whether the market’s perception of Lite-On Technology has shifted.

Financial Outlook

According to the consensus of nine analysts, Lite-On Technology is projected to achieve NT$153.2 billion in revenue during 2025. This represents a 12% increase compared to the previous 12 months. Statutory earnings per share are also expected to increase, rising by 29% to NT$6.68.

Prior to the report, analysts had been anticipating revenues of NT$151.7 billion and earnings per share (EPS) of NT$6.68 for 2025. Essentially, there’s been no major change to their estimates.

Price Target

The analysts have reconfirmed their price target of NT$118, indicating that the business is performing well and in line with expectations. There is a range of price targets among analysts, with the most optimistic valuing the company at NT$132 per share and the most pessimistic at NT$95 per share.

Industry Comparison

A key point from these estimates is that Lite-On Technology is expected to experience faster growth in the future compared to its historical performance. Revenue is forecast to increase by 12% annually through the end of 2025. This is a significant improvement over the 3.6% annual decline observed over the past five years.

However, the broader industry is expected to grow at an even faster rate. Analyst estimates for the industry suggest an 18% annual revenue growth rate for the foreseeable future. While Lite-On Technology’s revenue growth is improving, it’s still anticipated to lag behind the industry average.

Conclusion

The overall consensus is that the recent financial results haven’t significantly altered the outlook for Lite-On Technology. Analysts have maintained their earnings forecasts, and reconfirmed their revenue estimates.

It’s important to note that, although our data suggests Lite-On Technology’s revenue may underperform the wider industry, the analysts have not been swayed to change their price targets.

The long-term trajectory of the company’s earnings is more significant than short-term fluctuations. For additional analysis, you can access the future estimates from multiple Lite-On Technology analysts.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. It does not constitute a recommendation to buy or sell any stock.