Darwinbox, an Indian startup specializing in a Software-as-a-Service (SaaS) platform for human resources, has secured $140 million in a recent funding round. The company plans to leverage this capital to broaden its international footprint, with a particular focus on the U.S. market, and to compete with established players like Rippling and Deel.

The investment round was co-led by KKR and Partners Group. The funding includes a combination of primary and secondary share sales, with several unnamed investors selling a portion of their holdings. Notable existing investors in Darwinbox include Microsoft, Salesforce, Sequoia, TCV, Peak XV (formerly Sequoia India), and Lightspeed. To date, Darwinbox has raised approximately $270 million in total funding. While the company declined to comment on its current valuation in this round, co-founder Jayant Paleti confirmed to TechCrunch that it represents an up-round. (Reports in the local press last week initially pegged the company’s value at $950 million.) Previously, Darwinbox raised funding in 2022 at a valuation exceeding $1 billion.

For context, the HR-tech sector has significant players such as Deel and Rippling, each valued at around $12 billion to $13 billion. Darwinbox also competes with various point solution providers as well as older, more established companies like SAP, Oracle, and Workday, among numerous others.

Despite being smaller than some of its rivals, Darwinbox presents an intriguing case for several reasons.

Firstly, it exemplifies the rise of home-grown enterprise startups from India and Southeast Asia. These businesses have emerged over the last few years as the region’s technology ecosystem has matured and expanded beyond e-commerce. As an industry investor once noted, it represents “the SaaS-ification of Asia.” This, combined with the significant capital flowing into the region and its substantial collective population, makes it a prime area to watch for the next major tech innovations.

Secondly, Darwinbox is a notable example of an Indian company succeeding beyond its regional borders and gaining traction in the U.S. market. The company reports over 1,000 enterprise customers and provides employee administration tools for more than 3 million people. The platform targets mid-market companies with 3,000 or more employees. Darwinbox stated that approximately 60% of its revenue now comes from outside of India. Paleti, who co-founded the company with Rohit Chennamaneni and Chaitanya Peddi, revealed to TechCrunch that the U.S. is the company’s fastest-growing market. He has relocated to Texas to capitalize on the opportunities there.

The third factor is Darwinbox’s ambitious, all-in-one approach to HR. Paleti observed that HR represents one of the oldest enterprise software categories. While this means there is a lot of outdated technology, there’s also a lot of established infrastructure. A large portion of the startup’s sales efforts involve both convincing potential clients that their existing systems are inadequate and that Darwinbox offers an advantageous solution. Paleti notes, “When we started in 2015, it almost felt overwhelming… Here we were, a small band of three people in a corner of Asia, and we wanted to build this global company that will take on these legacy players.”

In an amusing sign of how Darwinbox has disrupted the market, a Google search for the company’s name recently returned a link to a competitor, Sage, as the first result. Furthermore, other competitors, including Oyster, have been buying placements against searches for Darwinbox.

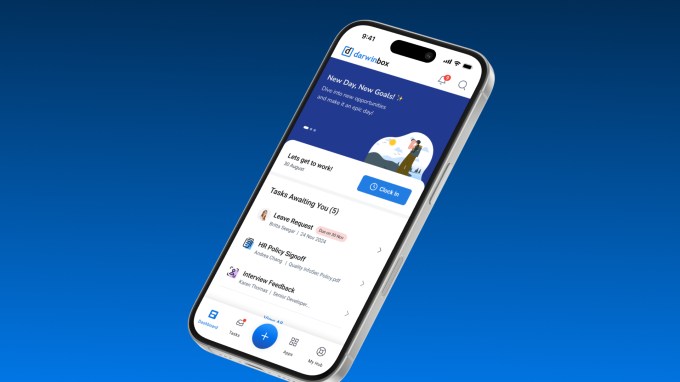

While other companies have debated the merits of point solutions versus comprehensive platforms, Darwinbox has maintained a singular focus: to build an end-to-end platform. That platform helps with recruitment and management, and also facilitates new employee onboarding. It also helps with employee administration tasks throughout employment, including expense management, time off requests, payroll processing, and more. Paleti mentioned that the next stage of product development will likely feature significantly more AI, which the company believes it is well-positioned to implement effectively because of its platform approach.

“We are the system of record for HR,” he said. Cyrus Driver, Managing Director for Private Equity at Partners Group, one of the lead investors in the round, stated that his firm is investing $75 million in Darwinbox as part of this deal. Driver revealed that his firm had been looking to invest for several years but only got the chance in this latest round. Driver said that they “see them as one of a handful of disruptors in the bigger space displacing global majors,” also noting that the startup’s proficiency in localizing its product has been an outstanding feature. “We did a lot of due diligence, and they have a conviction on the right to win.”

Updated to include more detail about the valuation, confirming it’s an “upround.”