Carpenter Technology’s Impressive Rise: A Closer Look

Carpenter Technology Corporation (NYSE:CRS) has experienced a significant surge in its stock price, with a 25% gain in the last month alone. This follows a broader trend; the stock is up an impressive 166% over the past year, drawing considerable attention from investors.

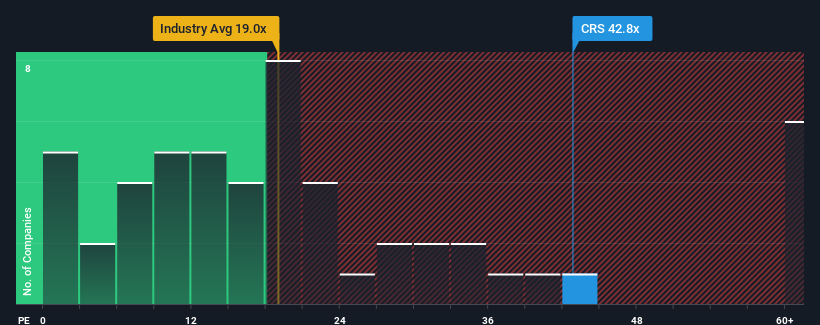

Given this considerable price increase, potential investors might be wary. With the median price-to-earnings (P/E) ratio in the U.S. hovering below 19x, Carpenter Technology’s P/E of 42.8x raises questions. Is the company overvalued, or is there a compelling reason for this elevated multiple?

Analyzing Carpenter Technology’s Growth

Carpenter Technology has demonstrated strong earnings growth recently, outperforming many of its peers. It is likely that many investors expect this earnings momentum to continue, which partly explains the high P/E ratio. If this growth doesn’t materialize, investors could be paying a premium without sufficient justification.

To justify its current P/E, Carpenter Technology will need to exhibit exceptional growth, surpassing market averages by a considerable margin. The company did deliver an impressive 108% increase in its bottom line last year. However, its longer-term performance has been less consistent, with minimal EPS growth over the last three years. This inconsistency may disappoint some shareholders.

Looking ahead, analysts project an average annual growth of 30% over the next three years. This is substantially higher than the projected 11% average growth rate for the broader market. Considering these optimistic forecasts, the fact that Carpenter Technology’s P/E is higher than most other companies seems reasonable. Many investors appear to be betting on this strong future growth, making them willing to pay extra for the stock.

The Bottom Line

Carpenter Technology shares have gained significant momentum, leading to an inflated P/E ratio. While P/E ratios alone should not dictate investment decisions, they can offer insights into market sentiment. Our analysis of analyst forecasts suggests superior earnings potential is pushing the P/E higher.

At present, shareholders appear comfortable with the P/E, given their confidence in continued earnings growth. The share price is unlikely to fall significantly in the short term from this angle.

To gain a deeper understanding of Carpenter Technology, consider exploring a free report that provides a comprehensive analyst estimate.

Disclaimer: This is an analysis based on historical data and analyst forecasts and should not be considered financial advice.