Auditing Cryptocurrency: Navigating the New Landscape

The introduction of Accounting Standards Update 2023-08, Subtopic 350-60, marks a significant shift in how cryptocurrency assets are accounted for, audited, and reported. This update, effective for fiscal years beginning after December 15, 2024, mandates that crypto assets be measured at fair value, with changes in value recognized in net income each reporting period. Auditors must adapt their approaches to address new challenges in this evolving market.

This new guidance imposes several key requirements:

- Measuring cryptoassets at fair value.

- Recognizing changes in value in income every reporting period.

- Ensuring proper disclosures in financial statements.

These standards aim to improve the accuracy and reliability of financial reporting for companies holding cryptoassets. However, challenges persist due to the unique technological aspects of blockchain and cryptocurrency transactions, which can complicate the auditing process and elevate the risk of material misstatement. Auditors have crucial responsibilities related to verifying fair value measurements, recognizing value fluctuations, and guaranteeing the accuracy of disclosures. Compliance with these GAAP requirements is essential for preserving financial statement integrity.

Specific Challenges Related to Cryptocurrency Auditing

Auditing cryptocurrency transactions presents unique hurdles that auditors must address to ensure accurate and reliable financial reporting:

- Ownership and Control Verification: The cryptographic nature of blockchain makes it difficult to verify control over crypto assets.

- Valuation Challenges: The volatility of crypto markets and the existence of multiple exchanges complicate valuation.

- Completeness of Transaction Records: Capturing and recording all crypto transactions accurately requires specialized tactics.

Managing Access and Security in Crypto Audits

Managing access controls is crucial for ensuring the integrity of crypto audits. This includes preventing inappropriate access and preventing critical crypto assets from being inaccessible.

Loss of access, such as losing private keys, poses a significant risk and may impact financial reporting integrity. Auditors must verify access throughout and after the audit period to prevent reputational damage due to lost access.

What Accountants Can Do to Prepare for Crypto Audits

Staying informed and adapting to the crypto landscape is critical for accountants and auditors. Here’s how to prepare:

- Understand Crypto Technology: Cryptocurrency transactions on the blockchain use wallet addresses rather than personal information, but accountants and auditors can still access crypto information in real time.

- Manage Crypto Compliance: While capital gains and losses are essential for tax compliance, auditors must also consider the broader implications of crypto events and transactions for financial statement (GAAP) reporting.

- Assess Unique Audit Risks: These include determining ownership and control, addressing valuation challenges, and ensuring all transactions are thoroughly recorded.

Auditor Responsibilities in Crypto Audits

Auditors play a crucial role in maintaining the accuracy and reliability of financial statements, particularly concerning cryptoassets. Their primary task is to identify and evaluate the risks of material misstatements. This requires a deep understanding of the company’s landscape, especially the intricacies of crypto transactions.

Auditors should also closely examine the accounting policies and disclosures related to a company’s crypto activities, paying close attention to how cryptoassets are recognized, measured, presented, and disclosed. They must also assess the company’s internal controls, focusing on private key protection and the use of blockchain technology as audit evidence.

Audit Reporting Considerations on Cryptocurrency

When conducting audits involving cryptocurrency, several unique factors must be addressed in the audit report:

- Emphasis of Matter Paragraphs: These paragraphs can highlight material crypto holdings or activities.

- Key Audit Matters: Auditors must communicate relevant information about cryptocurrency if applicable.

By addressing cryptocurrency-specific considerations in the audit report, auditors enhance clarity regarding the implications of crypto transactions and holdings. This ensures compliance with professional standards and increases the value of the audit report.

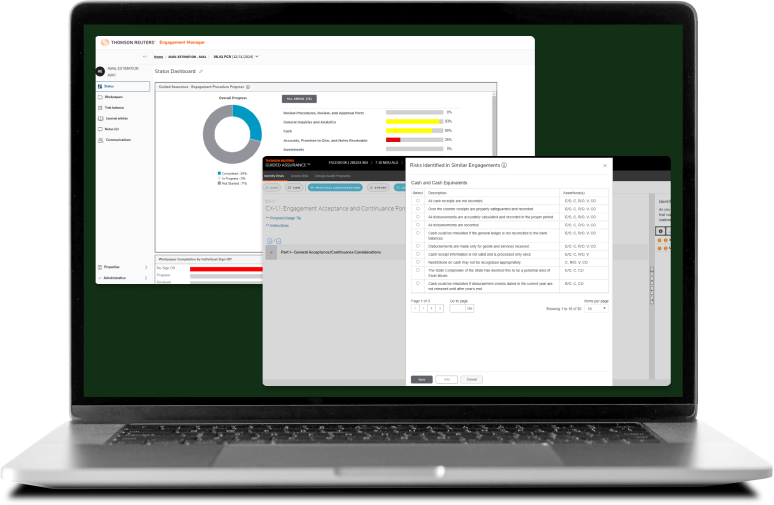

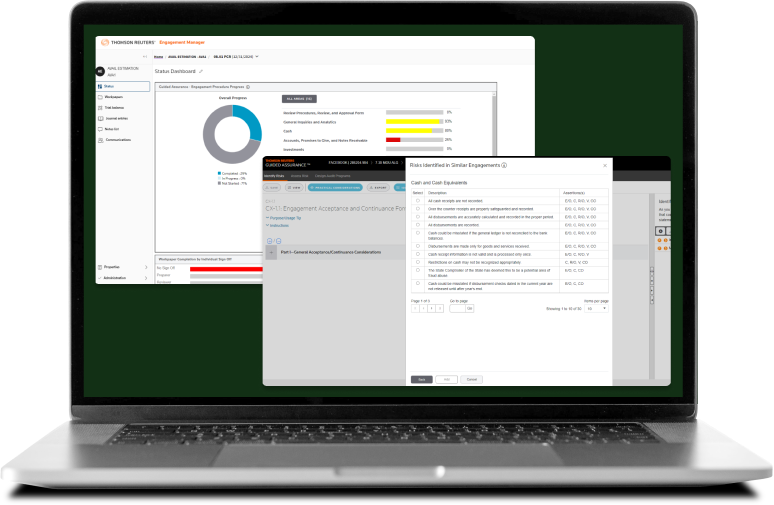

What to Look for in Cryptocurrency Audit Software

Specialized cryptocurrency audit software is essential for enhancing accuracy and security in the auditing process.

When choosing crypto audit software, consider these features:

- AICPA SOC 1 & 2 Audited: Ensures data security.

- Client and Team Management: Provides visibility into the workflow.

- Complete Fee Accounting: Allows cost basis calculations.

- Current Year Gains and Losses: Promotes client engagement.

- Transaction Matching: Tracks holdings and cost basis.

- Exclusive Integration: Makes for easy tax prep integration.

Audit Solutions for Accounting Firms

Accounting firms can leverage technology and automation to succeed in today’s complex environment. Staying ahead of the curve is crucial, which means:

- Continuously updating knowledge of cryptocurrency technology and regulations.

- Developing tailored audit approaches for crypto-specific risks.

- Investing in specialized software tools.

- Enhancing firms’ capabilities to offer value-added services.

These steps can mitigate regulatory risks and capitalize on new opportunities in the digital asset space. Firms with expertise in cryptocurrency audits will be well-positioned to provide high-quality, reliable services.