ShenZhen QiangRui Precision Technology’s P/E Ratio Raises Questions After Stock Surge

ShenZhen QiangRui Precision Technology Co., Ltd. (SZSE:301128) shareholders have enjoyed a substantial reward recently, with the stock price climbing 54% in the last month. This surge contributes to an impressive 98% gain over the past year.

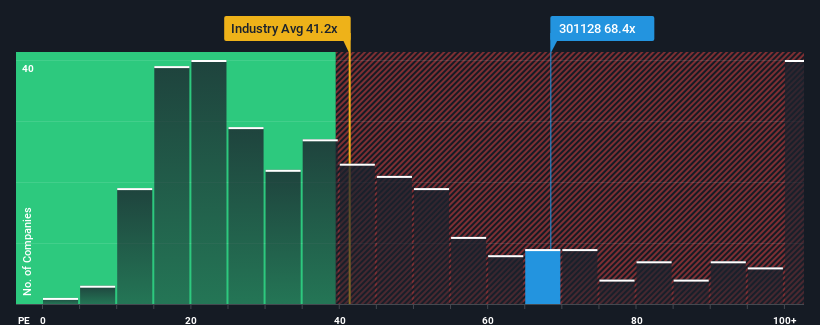

Following this increase, the company presents a potentially bearish signal with a price-to-earnings (P/E) ratio of 68.4x. This figure is notably high, considering that almost half of all Chinese companies have P/E ratios below 38x, and ratios lower than 21x are not uncommon.

It’s important to look beyond the surface of this elevated P/E ratio, as there might be key factors at play. ShenZhen QiangRui Precision Technology has experienced rapid earnings growth. Investors might believe that this robust earnings expansion will enable the stock to surpass the broader market’s performance soon.

Without these expectations, the current valuation appears high. Recent data indicate that the company’s earnings per share (EPS) increased by an impressive 139% last year. Moreover, EPS has cumulatively risen by 31% over the past three years, thanks to the growth in the last twelve months, demonstrating solid earnings growth.

The market is predicted to see 37% growth in the next 12 months, but the company’s momentum appears weaker based on its recent performance. Therefore, the high P/E ratio is concerning. Many investors seem to have a more positive outlook than the company’s recent history would suggest, as they are unwilling to sell at the current price.

Sustaining this price may be challenging because future earnings trends are expected to affect the share price. The strong share price increase has caused ShenZhen QiangRui Precision Technology’s P/E to rapidly rise. Instead of being a valuation tool, the P/E ratio is useful for assessing current investor sentiment and future expectations.

Analysis has revealed that the three-year earnings trends don’t fully account for the high P/E ratio, and the current outlook is worse than what the market anticipates. When earnings are weak, and growth is less than the market average, the share price is at risk. If this continues, it will place shareholders’ investments and potential investors at risk of overpaying.

There are also warning signs to consider with ShenZhen QiangRui Precision Technology.

Disclaimer: This article is based on historical data and analyst forecasts. It is not financial advice, nor a recommendation to buy or sell any stock. Always consider your own objectives and financial situation.