Lite-On Technology: Analysts Maintain Steady Outlook Despite Mixed Results

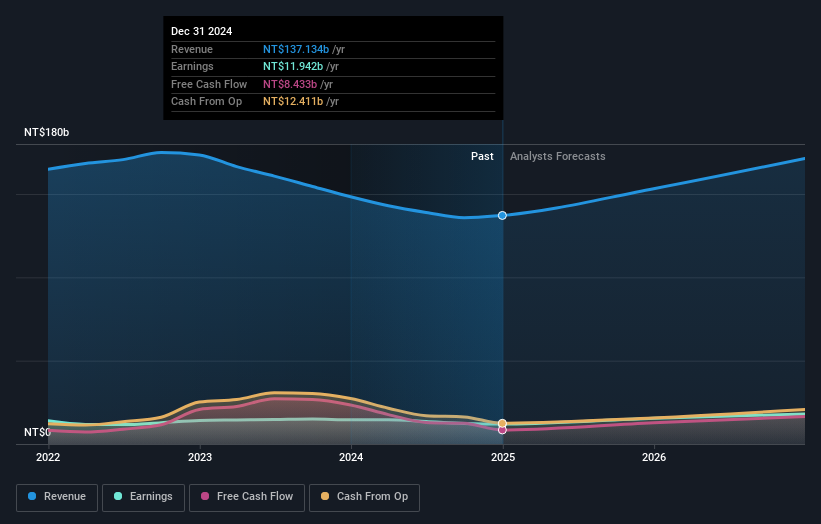

Lite-On Technology Corporation (TWSE:2301) recently released its full-year financial results. While the company met revenue expectations, statutory earnings fell short of analyst predictions. This report examines the latest analyst forecasts to assess the impact of these results on their outlook for the company.

Revenue and Earnings Forecasts for 2025

Following the earnings release, nine analysts have provided updated forecasts for Lite-On Technology. They project revenues of NT$153.2 billion in 2025, representing a 12% increase compared to the previous year. Statutory earnings per share (EPS) are predicted to rise by 29% to NT$6.68.

No Significant Change in Analyst Sentiment

Prior to the recent report, analysts were estimating revenues of NT$151.7 billion and earnings per share (EPS) of NT$6.68 for 2025. Because the actual results aligned with previous expectations, there has been no major revision to their estimates. Analysts have reconfirmed their price target of NT$118, suggesting that the company is performing in line with their expectations.

Range of Price Targets

Analyst price targets ranged from NT$95.00 to NT$132 per share, indicating varying perspectives on the company’s future. However, this range is not wide enough to suggest extreme divergence in opinion.

Comparison with Industry Growth

Lite-On Technology is projected to grow more rapidly than it has in the past. Revenue is expected to increase by 12% annually until the end of 2025, a significant improvement over the 3.6% annual decline experienced over the past five years. However, the broader industry is expected to have 18% annual growth for the foreseeable future, meaning Lite-On Technology may grow slower than the industry.

Conclusion

The financial results have not significantly altered the analysts’ outlook on Lite-On Technology. The consensus remains consistent with past estimates. Their expectations for revenue are on track, and the price target has been reconfirmed at NT$118.

While Lite-On Technology’s revenue growth is anticipated to improve, it is still expected to be slower than the broader industry’s growth. Remember to consider any potential risks, as Lite-On Technology has one warning sign to be aware of.