Inno Laser Technology Co., Ltd. (SZSE:301021) shareholders are likely pleased with the stock’s recent performance. The share price saw a significant boost, climbing 27% over the past month, rebounding from previous declines. Looking at the bigger picture, the stock has also shown impressive growth, increasing by 95% in the last year.

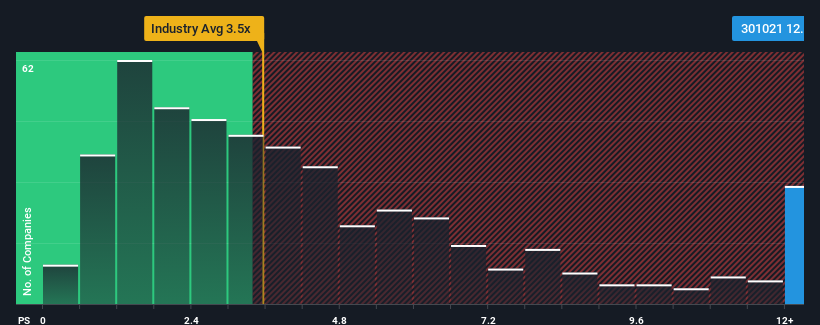

However, a closer look at the company’s valuation raises some questions. With a price-to-sales (P/S) ratio of 12.6x, Inno Laser Technology appears expensive, especially when considering that almost half of the companies in China’s Machinery industry have P/S ratios below 3.5x. While the recent price increase is encouraging, the high P/S ratio suggests the stock may be overvalued, which investors need to consider.

Recent Performance and Market Expectations

During the past year, Inno Laser Technology has demonstrated strong revenue growth. This could be due to higher-than-expected future revenue, which has led to increased interest in the stock. The company’s ability to continue its growth path is key to maintaining its current valuation. Investors, therefore, need to consider the company’s potential for future revenue growth to analyze the stock’s financial health.

To gain more insights, interested parties can access a free report detailing Inno Laser Technology’s earnings, revenue, and cash flow, which can help assess the company’s prospects.

Revenue Growth vs. P/S Ratio

The high P/S ratio typically indicates expectations of robust growth. Looking back, the company posted an impressive 44% increase in revenue over the past year. Nevertheless, total revenue has barely changed over the past three years. This mixed performance makes the current P/S ratio appear less justified.

When compared with the broader industry, which is predicted to achieve 23% growth in the following 12 months, Inno Laser Technology’s growth momentum seems weaker. This difference is concerning, particularly given the company’s elevated P/S ratio compared to its peers. Many investors appear to be looking past the recent growth limitations and are hoping for improvements in the company’s business.

Given current trends, a continuation of the company’s revenue growth rate is probably unsustainable. Investors are urged to consider this.

Key Takeaways

Inno Laser Technology’s P/S ratio has increased over the last month, driven by the rise in share price. Analyzing the P/S ratio is an effective way to evaluate the market’s perception of a company’s financial state. The fact that Inno Laser Technology trades at a higher P/S relative to its sector is noteworthy, particularly when considering that its recent three-year growth rate is lower than the industry average.

When a company demonstrates slower-than-industry revenue growth while having a higher P/S ratio, the risk of a share price decline rises, which would decrease the P/S. Without substantial improvements in the company’s medium-term performance, the P/S ratio is unlikely to fall to a more reasonable level.

Investors should also be aware of the potential for future risk. The company has three identified warning signs that need to be considered and the company needs to improve its growth rates to maintain its valuation.