ShenZhen YUTO Packaging Technology Co., Ltd. (SZSE:002831): Insider Ownership and Recent Market Performance

ShenZhen YUTO Packaging Technology Co., Ltd. (SZSE:002831) has seen its market cap increase recently, and the company’s most bullish insider, Senior Key Executive Lanlan Wu, is likely pleased with the positive trend, as the stock gained 4.8% recently.

Key Insights

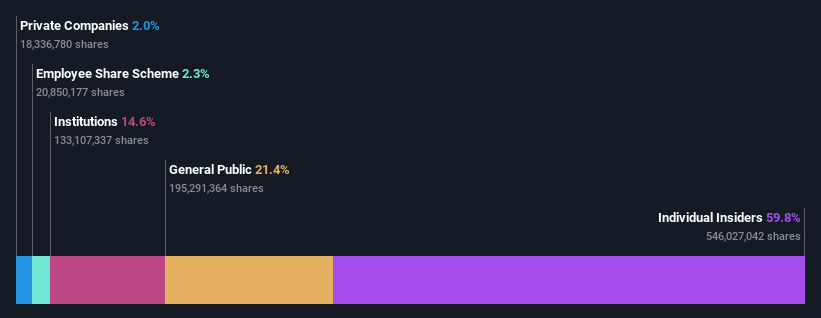

- Significant Insider Ownership: A substantial portion of ShenZhen YUTO Packaging Technology is owned by insiders, indicating a strong alignment of interest in the company’s success.

- Majority Stake by Insiders: Individual insiders collectively hold approximately 60% of the company’s shares.

- Institutional Ownership: Institutions own 15% of the company’s shares.

The ownership structure of ShenZhen YUTO Packaging Technology Co., Ltd. (SZSE:002831) reveals the influence of different shareholder groups. Determining who holds the most shares can provide insight into potential motivations and the direction of the company.

Breakdown of Ownership

Individual insiders represent the largest shareholder group, controlling about 60% of the shares. This strong insider ownership means those individuals stand to gain or lose the most from their investment. The recent market cap increase of CN¥1.1b last week likely benefited these insiders significantly. The second-largest shareholder holds about 11% of the outstanding shares, and the third-largest shareholder owns 3.7% of the shares.

Institutional Ownership

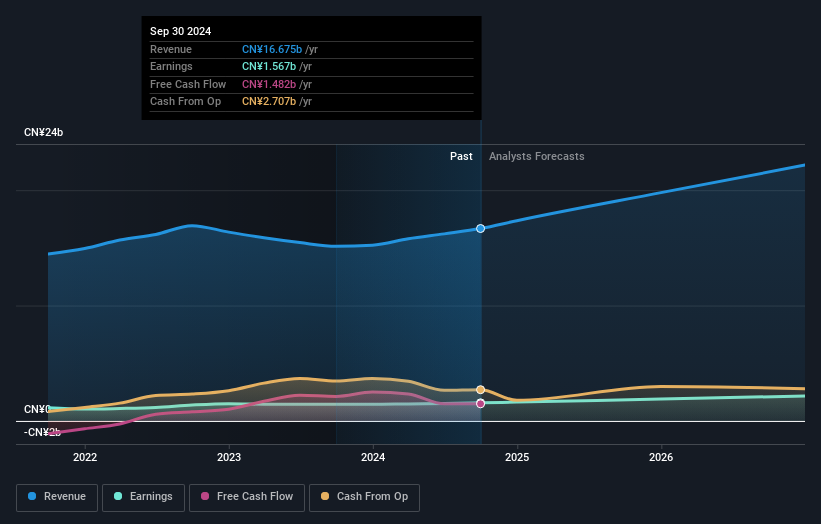

Institutional investors, which include mutual funds and pension funds, often measure their performance against market indices and tend to focus on companies within those indices. The presence of institutions in ShenZhen YUTO Packaging Technology’s shareholder registry suggests positive evaluation by analysts working for those institutions. However, like any investment, there is always a risk. Large institutional investors selling out of a stock simultaneously can cause a price drop. Investors should also consider the company’s past earnings trajectory.

Hedge funds hold a relatively small number of shares in ShenZhen YUTO Packaging Technology. The Senior Key Executive, Lanlan Wu, is the largest individual shareholder, holding 49% of the shares. Substantial insider ownership is viewed as a positive signal, showing that company leaders are investing in the company’s future. The second-largest shareholder, Huajun Wang, also serves as the Chief Executive Officer, which highlights strong insider involvement among the company’s leading shareholders.

Implications of Insider Ownership

With the top two shareholders jointly controlling more than half the shares, they have considerable influence over company decisions. While institutional ownership is a valuable factor, investors should also consider analyst recommendations to assess a stock’s performance potential.

Insider ownership is often seen favorably because it suggests that management’s interests are aligned with those of other shareholders. However, when too much power is concentrated in this group, it is important to observe how it affects the company’s direction.

Insiders own more than 50% of ShenZhen YUTO Packaging Technology Co., Ltd., giving them effective control. Given the company’s market cap of CN¥24b, insiders have a substantial investment in the company. The general public, typically individual investors, holds a 21% stake and can also have a significant impact.

Next Steps for Investors

Analyzing ownership is helpful, but a complete understanding requires considering other factors. Investors should examine risks, such as the one warning sign associated with ShenZhen YUTO Packaging Technology. It is important to assess the company’s future potential.