Hwaway Technology Corporation Limited (SZSE:001380) Shares Surge 26% But May Still Be a Buy

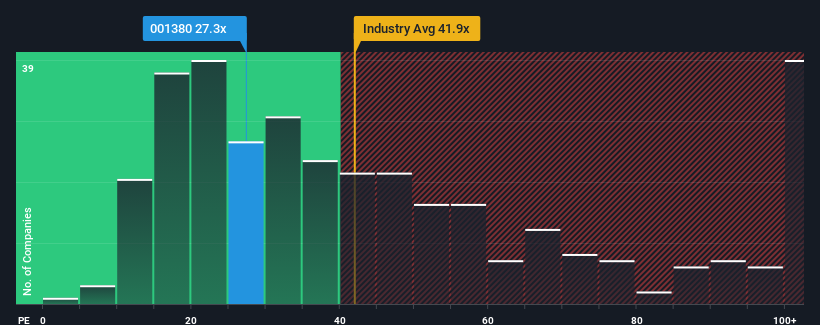

The stock of Hwaway Technology Corporation Limited (SZSE:001380) has performed exceptionally well recently, experiencing a substantial gain of 26% over the past month. This brings the annual increase to a noteworthy 61%. Despite this price surge, the company’s price-to-earnings (P/E) ratio of 27.3x might indicate a buying opportunity when compared to the Chinese market overall.

In China, approximately half of all companies have P/E ratios exceeding 40x, with some even surpassing 78x. However, a deeper analysis is required to determine the rationale behind Hwaway Technology’s relatively lower P/E ratio.

The company’s earnings growth over the past year is considered acceptable for many companies. It’s possible that the market anticipates a decline in this performance, leading to the suppressed P/E. Investors who are optimistic about the company’s prospects would likely hope this is not the case, enabling them to purchase stock while it is potentially undervalued.

Growth Trends

One would assume that a company achieving Hwaway Technology’s P/E ratio is underperforming the market. Reviewing the past year, the company increased its earnings per share (EPS) by a considerable 9.6%. This followed a period of robust growth, with EPS up by an aggregate of 152% over the last three years. Shareholders have likely welcomed these rates of earnings growth in the medium term.

Comparing the recent medium-term earnings trend with the market’s one-year forecast of 37% expansion shows comparable annualized figures. Given these factors, it’s somewhat surprising that Hwaway Technology is trading at a P/E lower than the market average. This could mean that many investors are unconvinced the company can maintain its recent growth rate.

The Bottom Line

Despite Hwaway Technology’s share price momentum, its P/E ratio remains lower than most other companies. While the P/E ratio alone is not a sole indicator for selling stock, it can offer valuable insights into the company’s future prospects. The analysis indicates that the three-year earnings trends aren’t impacting its P/E as significantly as anticipated, given that they seem similar to current market expectations. Unidentified threats to earnings might be preventing the P/E ratio from aligning with the company’s performance.

Moreover, the potential for a price decline appears limited if the recent medium-term earnings trends continue, though investors may be factoring in potential future earnings volatility.

It’s crucial to consider risks. Hwaway Technology has three warning signs, with one being significant, that investors should be aware of. There might be better investment options available. Investors can explore potential candidates by consulting a free list of companies trading at a low P/E ratio while demonstrating earnings growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation.

_We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:001380 Hwaway Technology

Hwaway Technology engages in the research and development, production, and sale of elastic components in China and internationally.