Guangdong Huicheng Vacuum Technology: Assessing Fair Value

This analysis examines the fair value of Guangdong Huicheng Vacuum Technology Co., Ltd. (SZSE:301392) using a discounted cash flow (DCF) model.

Key findings:

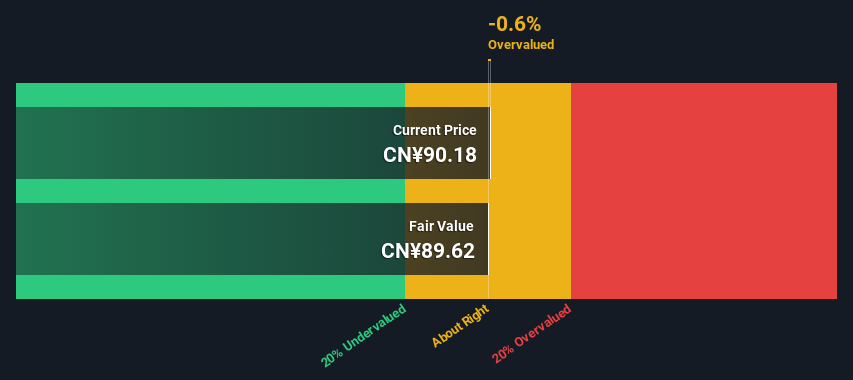

- Fair Value Estimate: Based on a two-stage DCF model, the projected fair value for Guangdong Huicheng Vacuum Technology is CN¥89.62. With a current share price of approximately CN¥90.18, the stock appears to be trading near its estimated fair value.

- Industry Comparison: The company’s valuation appears reasonable compared to its peers, which trade at a higher premium to fair value.

Discounted Cash Flow (DCF) Methodology

This analysis employs the DCF model, a method for estimating a company’s intrinsic value by discounting its projected future cash flows to their present value. The model is not without its limitations; however, it provides a useful framework for valuation.

The core principle of the DCF model is that a company’s value equals the present value of all cash it will generate in the future. This analysis uses a two-stage DCF model, which accounts for two growth phases: an initial high-growth period followed by a steady-state growth phase.

Cash Flow Projections

To perform the DCF analysis, estimated free cash flows (FCF) were used over a ten-year period. Analyst estimates were used when available, but when not, prior FCF was extrapolated. It is assumed that companies with declining free cash flow will slow their rate of decline and growing companies will experience slower growth over this period.

- “Est” denotes FCF growth rate estimated by Simply Wall St.

Present Value of 10-year Cash Flow (PVCF) = CN¥2.2b

Terminal Value Calculation

The terminal value (TV), calculated using the Gordon Growth formula, accounts for all future cash flows beyond the ten-year period. The TV uses a future annual growth rate equal to the 5-year average of the 10-year government bond yield of 2.7%. Those cash flows are discounted to their present value at a cost of equity of 8.1%.

- Terminal Value (TV) = FCF2034 × (1 + g) ÷ (r – g) = CN¥765m × (1 + 2.7%) ÷ (8.1% – 2.7%) = CN¥15b

- Present Value of Terminal Value (PVTV) = TV / (1 + r)^10 = CN¥15b ÷ (1 + 8.1%)^10 = CN¥6.8b

Total Equity Value

The total value is the sum of the present values of the next ten years’ cash flows and the discounted terminal value. This results in a Total Equity Value of CN¥9.0b. Dividing this by the total number of shares outstanding provides the intrinsic value per share. The result suggests the company trades near fair value. However, this is only an approximate valuation and should be used with caution.

Key Assumptions

Important inputs for a DCF analysis include the discount rate and the projected cash flows. For Guangdong Huicheng Vacuum Technology, the cost of equity serves as the discount rate, rather than the cost of capital (WACC). The analysis uses a discount rate of 8.1%, which based on a levered beta of 1.013.

SWOT Analysis

- Strengths: Earnings growth over the last year exceeds the industry average. Debt is well covered by earnings.

- Weaknesses: Earnings growth over the past year is below its 5-year average. Dividends are low compared to the top 25% of dividend payers in the Machinery market. Expensive according to P/E ratio and estimated fair value.

- Opportunities: Annual earnings are forecast to grow faster than the Chinese market.

- Threats: Debt is not well covered by operating cash flow. The company pays a dividend but has no free cash flows.

Looking Ahead

While valuation is crucial, it is just one element to consider when assessing a company. It is best to use the DCF model to analyze assumptions to see if they will lead to over or undervaluation. Changes in growth rates or cost of equity can significantly impact the results. Further research is needed on the risks, future earnings, and other solid business fundamentals of the company.