Hangzhou Innover Technology Shares See Recent Gains, Prompting Investor Scrutiny

Shares of Hangzhou Innover Technology Co., Ltd. (SZSE:002767) have experienced a notable upswing, with a 26% increase in the last thirty days. This follows a year-long rally, showing a 53% increase. However, despite this positive momentum, some analysts are questioning the company’s valuation.

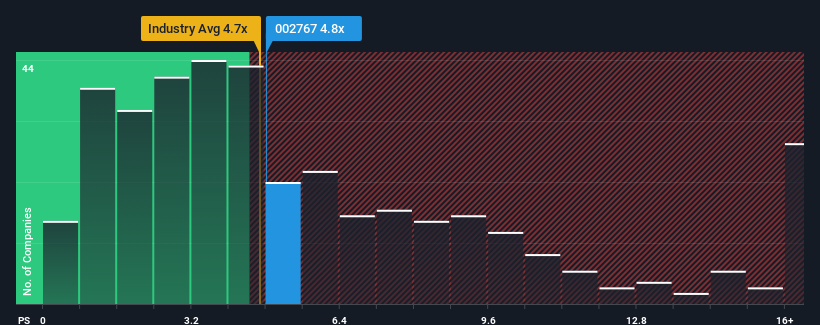

Currently, the company’s price-to-sales (P/S) ratio stands at 4.8x. This is relatively in line with the median P/S ratio of 4.7x for the Electronic industry in China. This similarity raises questions about whether the market is accurately assessing Hangzhou Innover Technology’s growth potential.

Analyzing Recent Performance

One point of concern for the company is its revenue growth. Over the last year, revenue growth has been stagnant. While revenue has increased by 50% in aggregate over the past three years, the recent slowdown is noteworthy. Analysts will be seeking further information on the reasons behind this slowdown.

Growth Forecasts and Industry Comparison

The P/S ratio is justifiable when a company’s growth closely mirrors the industry’s. However, the recent growth rate of Hangzhou Innover Technology is not as attractive compared to the industry’s one-year growth forecast of 27%. The contrast raises questions of whether the share price is aligned with the company’s recent growth figures.

The Final Word

In conclusion, Hangzhou Innover Technology’s stock has enjoyed increasing momentum, placing its P/S level in line with the broader industry. While the price-to-sales ratio has limitations, it provides a business sentiment indication. As a result, the current average P/S ratio raises some eyebrows due to recent growth rates. Unless the company shows significant improvements in its medium-term performance, maintaining the current P/S ratio may be challenging. Investors should be aware of the associated investment risks that are present.

Disclaimer: The information presented is based on historical data and analyst forecasts and is not intended as financial advice. It does not constitute a recommendation to buy or sell any stock. Simply Wall St has no position in any stocks mentioned.