Warren Buffett famously said, “Volatility is far from synonymous with risk.” This principle is particularly relevant when assessing a company’s financial health. Debt, often a key factor in bankruptcies, can be a significant marker of risk.

Beijing Asiacom and Its Debt

Beijing Asiacom Information Technology Co., Ltd (SZSE:301085) carries debt. This analysis examines whether this debt poses a risk to the company.

When Does Debt Become a Problem?

Debt can be beneficial, but it becomes problematic when a company struggles to meet its obligations. In worst-case scenarios, a company may declare bankruptcy if it cannot repay its creditors. More commonly, indebted companies may dilute shareholder value by raising capital at unfavorable prices.

Ideally, a company manages its debt effectively. Evaluating a company’s debt involves assessing its cash position and debt levels together.

Beijing Asiacom’s Debt Situation

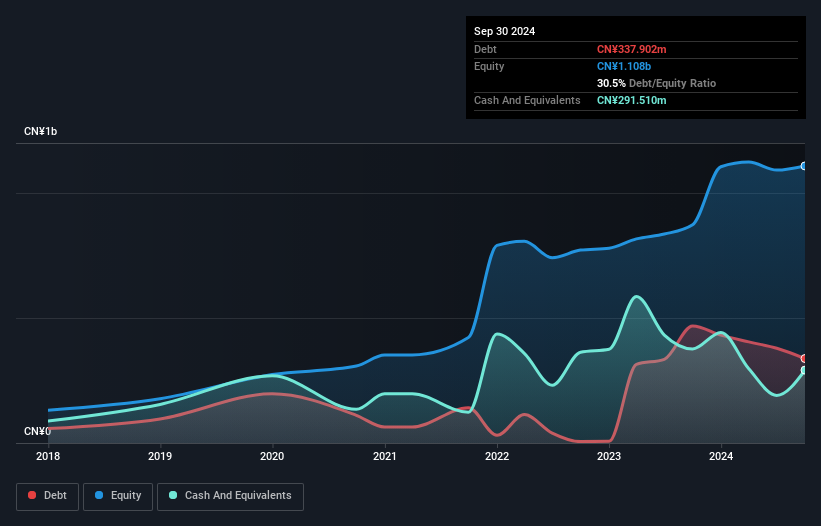

Data indicates that Beijing Asiacom had CN¥337.9 million in debt as of September 2024, down from CN¥468.4 million the previous year. However, it also held CN¥291.5 million in cash, resulting in net debt of approximately CN¥46.4 million.

SZSE:301085 Debt to Equity History March 25th 2025

Liabilities and Assets

According to the most recent balance sheet, Beijing Asiacom had CN¥913.8 million in liabilities due within a year and CN¥40.9k due beyond that period. Offsetting these liabilities, the company had CN¥291.5 million in cash and CN¥856.1 million in receivables due within 12 months. This means the company held CN¥233.8 million more in liquid assets than total liabilities. This short-term liquidity suggests that Beijing Asiacom can likely meet its debt obligations without difficulty, indicating a healthy balance sheet.

With minimal net debt, it appears Beijing Asiacom does not have a substantial debt burden.

Assessing the Debt Load

To measure the debt load relative to earnings, net debt is divided by earnings before interest, tax, depreciation, and amortization (EBITDA). Additionally, the analysis calculates how easily earnings before interest and tax (EBIT) cover interest expenses (interest cover).

While Beijing Asiacom’s low debt-to-EBITDA ratio of 0.55 suggests modest debt use, its EBIT only covered interest expense by 5.1 times last year, which merits closer inspection. It is worth noting that Beijing Asiacom’s EBIT fell by a considerable 22% over the past twelve months. If this decline persists, it will become more challenging to service the debt.

The balance sheet provides critical insights when analyzing debt, but the company’s earnings will ultimately influence its long-term financial health. Examining the earnings trend is crucial when evaluating debt.

Free Cash Flow Concerns

Ultimately, a company can only repay debt with cash. Over the past three years, Beijing Asiacom has recorded substantial negative free cash flow. While this may be due to investment in growth, it does make the debt riskier.

Conclusion

In conclusion, both Beijing Asiacom’s EBIT growth rate and its conversion of EBIT to free cash flow raise concerns, although the low net debt-to-EBITDA ratio offers some reassurance. Considering the factors discussed, Beijing Asiacom appears to be taking on some risks with its debt levels.

While the leverage may boost returns on equity, it would be prudent to monitor potential increases in debt.

For a detailed analysis and understanding of the company’s valuation, consider consulting additional resources. You can also view the 3 warning signs associated with Beijing Asiacom Information Technology Co. Ltd, as identified in the original article.