China Electronics Huada Technology: Is the Price Right?

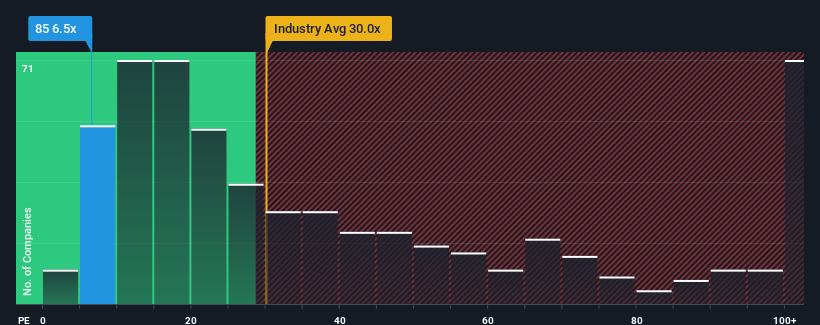

China Electronics Huada Technology (HKG:85) currently presents a price-to-earnings (P/E) ratio of 6.5x. This could be interpreted as a bullish signal, given that many Hong Kong companies have significantly higher P/E ratios, often exceeding 11x and sometimes even 23x. However, such a low P/E ratio warrants a deeper dive to understand the underlying rationale.

One concerning factor is the deterioration of earnings over the past year. This trend likely contributes to the suppressed P/E, with market expectations anticipating that the disappointing performance will continue to unfold. For investors already holding the stock, this is not a good sign. Potential investors, on the other hand, could see this as an opportunity, if they believe the stock is undervalued.

To get the full picture on earnings, revenue and cash flow for the company, a more comprehensive report providing historical performance can be valuable.

Growth Concerns

To justify its current P/E ratio, China Electronics Huada Technology would need to demonstrate robust growth surpassing the market average. Examining the company’s earnings over the past year, profits have decreased dramatically, with a 50% drop. Though EPS hasn’t taken a step backward over the past three years because of earlier growth. This may leave shareholders less than satisfied at the unstable medium-term growth rates.

When comparing the recent medium-term earnings trajectory with the market’s projected 19% expansion for the next year, the company appears less attractive on an annualized basis. Such a scenario helps explain why the stock’s P/E sits below its peers, with most investors anticipating continued limited growth and, as a result, are only willing to pay a lesser amount for the stock.

Key Takeaway

Generally, in assessing a company’s overall health, the price-to-earnings ratio is a good first step. In the case of China Electronics Huada Technology, the three-year earnings trends contribute to its low P/E. Investors appear to believe the potential for earnings improvement may not be great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, the share price will likely remain constrained.

Investors should note that there are a few warning signs to consider before investing. However, for more information, it is recommended to explore the list of stocks with solid business fundamentals for other potential investment options.