Is Anhui Huaqi Environmental Protection & Technology Co., Ltd. Overvalued?

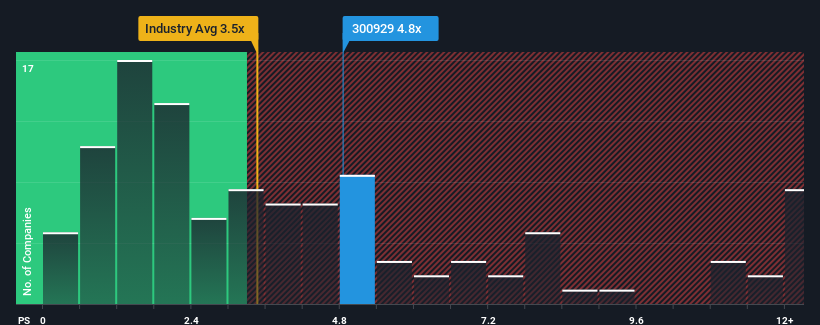

Anhui Huaqi Environmental Protection & Technology Co., Ltd. (SZSE:300929) currently trades at a price-to-sales (P/S) ratio of 4.8x. While this may seem high at first glance, considering that roughly half the companies in China’s Commercial Services industry have P/S ratios below 3.5x, it’s important to investigate the underlying reasons before making any investment decisions.

Recent Performance and Revenue Trends

A closer look at Anhui Huaqi Environmental Protection & Technology’s recent performance reveals a concerning trend. Revenue has declined over the past year, a situation that is not ideal from an investor’s point of view. This decline could be attributed to the current market expectations of the company’s future performance, which may be keeping the P/S ratio inflated. However, if the company fails to meet these expectations, investors could find themselves paying too much for the stock.

Although analyst estimates for Anhui Huaqi Environmental Protection & Technology are unavailable, examining the company’s earnings, revenue, and cash flow can provide a better understanding of its financial health.

Revenue Forecasts and the High P/S Ratio

The high P/S ratio would be justified if the company’s growth potential outpaced the industry average. However, the company’s revenue fell by 39% in the last year. Moreover, comparing it to the industry’s projected growth rate of 33% in the coming year, Anhui Huaqi Environmental Protection & Technology’s recent revenue performance paints a concerning picture.

Given these factors, the fact that Anhui Huaqi Environmental Protection & Technology’s P/S ratio surpasses that of most other companies in its industry is a source of concern. It appears that many investors are overlooking the recent poor growth rate, hoping for a change in the company’s outlook. If the recent negative growth rates persist, current shareholders may face future disappointment.

Current Investor Sentiment and Future Expectations

The P/S ratio serves as a gauge of current investor sentiment and future expectations. Considering Anhui Huaqi Environmental Protection & Technology’s declining revenue over the short-term, a souring sentiment is highly likely, which could drive the P/S ratio downwards. Unless the company’s financial circumstances improve, shareholders could reasonably experience challenges in the near future.

Potential Risks to Consider

It is important to note that every company faces risks, and in the case of Anhui Huaqi Environmental Protection & Technology, there are two warning signs to consider. Investors should carefully evaluate the company’s business fundamentals before investing.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.