Silicon Motion Technology’s Impressive Stock Performance: A Look at the Fundamentals

Silicon Motion Technology Corporation’s (NASDAQ:SIMO) stock has seen a notable 5.9% increase in the past week. This begs the question: Is this recent surge justified by the company’s financial performance? This analysis dives into the key financial indicators to determine their potential role in this price movement, specifically focusing on Silicon Motion Technology’s Return on Equity (ROE).

ROE is a crucial metric for investors, as it reveals how effectively a company reinvests its capital. Essentially, ROE demonstrates the profit generated for each dollar of shareholder investment.

How ROE is Calculated

ROE is calculated using the following formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

Based on the formula, Silicon Motion Technology’s ROE is 12%:

12% = US$91m ÷ US$774m (Based on the trailing twelve months to December 2024).

This means that for every $1 of shareholder investment, the company generated a profit of $0.12.

ROE and Earnings Growth: What’s the Connection?

ROE measures a company’s profitability. To understand its growth potential, we must consider how much profit the company reinvests or “retains.” Generally, the higher the ROE and profit retention, the greater the potential for company growth.

Silicon Motion Technology’s Earnings Growth And 12% ROE

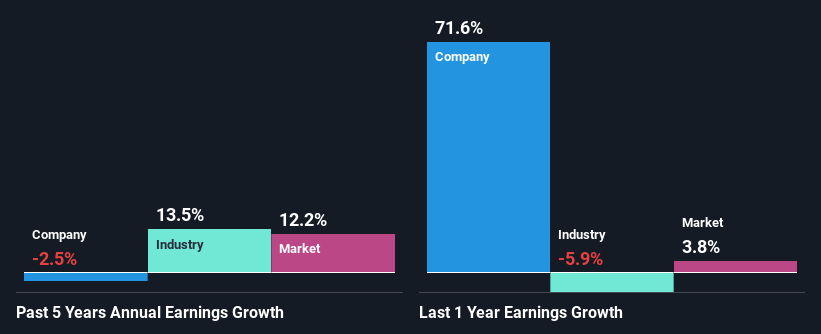

Silicon Motion Technology appears to have a decent ROE of 12%. When compared to the industry average, which is also 12%, the company’s performance seems standard. The 2.5% net income decline reported by Silicon Motion Technology is, therefore, a bit surprising. This suggests that other factors might be affecting the company’s growth, such as significant dividend payouts or competitive pressures.

Comparing Silicon Motion Technology’s performance with the industry reveals a cause for concern: while the company’s earnings have decreased, the industry has experienced a 13% growth rate over the same five-year period.

Is Silicon Motion Technology Efficiently Utilizing Profits?

Despite a typical three-year median payout ratio of 28% (retaining 72% of its profits), Silicon Motion Technology has shown a decrease in earnings, as previously noted. This suggests potential growth-related challenges. Another factor could be the company’s history of dividend payments, which may take precedence over business expansion.

The company is projected to continue paying out around 32% of its profits over the next three years, according to the latest analyst consensus data. Even though the payout ratio is not expected to change much, forecasts estimate that Silicon Motion Technology’s future ROE will rise to 17%.

Summary

Silicon Motion Technology presents some positive aspects. However, the combination of high ROE and high profit retention should ideally translate into strong earnings growth, which is not the case here. This could indicate external threats impacting the company’s growth. Despite the recent declines, the consensus among industry analysts is that the company’s earnings growth rate will improve substantially. Further analysis of the company’s future earnings growth can be found in the provided report on analyst forecasts.