Nanjing Wondux Environmental Protection Technology Corp. (SHSE:688178) Sees Shares Soar, but Growth Concerns Emerge

Nanjing Wondux Environmental Protection Technology Corp. (SHSE:688178) has seen a significant boost in its stock value, with shares climbing 38% in the last month and an impressive 89% over the past year. Despite this substantial price increase, some analysts are questioning whether the company’s valuation is fully justified.

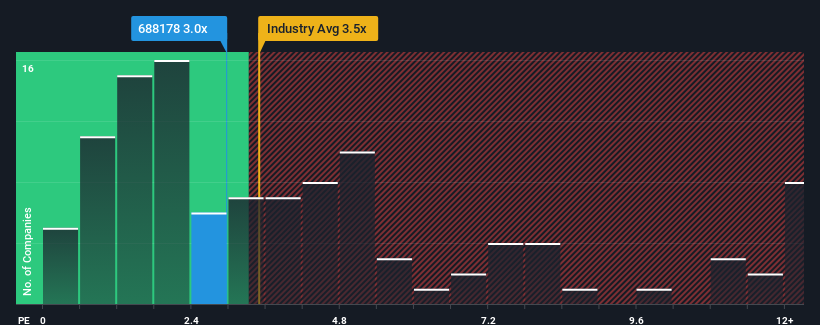

Even with the recent gains, the company’s price-to-sales (P/S) ratio currently stands at 3x. This is comparable to the median P/S ratio of 3.5x within the Commercial Services industry in China. While this might seem reasonable on the surface, the P/S ratio could be misleading. If the current valuation isn’t supported by future growth, investors might be missing out on opportunities or overlooking potential risks.

Revenue Decline Raises Questions

A closer look at Nanjing Wondux Environmental Protection Technology’s financial performance reveals a concerning trend: revenue has declined over the past year. This is generally not seen as a positive sign, and the market might be expecting a turnaround to justify the current valuation. If the company fails to improve its revenue, shareholders may become uneasy about the stock’s future.

Without analyst forecasts, assessing the company’s future involves examining recent financial trends. A free report on Nanjing Wondux Environmental Protection Technology’s earnings, revenue, and cash flow can help investors better understand its current direction.

P/S Ratio in Context

The company’s P/S ratio is typical for a business expected to deliver moderate, industry-aligned growth. However, the company’s revenue decreased by 23% over the past year and 41% over the last three years. This suggests a potential disconnect between the company’s valuation and its actual performance, particularly as the broader industry is projected to grow by 32% in the coming year.

Given the company’s decreasing revenue and industry growth forecasts, the current P/S ratio appears high compared to its peers. This may indicate that investors are less concerned about the company’s recent declines, but this optimism might be short-lived if the revenue trends continue.

Implications for Investors

Despite the recent share price increase, the company’s P/S ratio is now in line with the industry median. However, the shrinking revenue raises concerns when contrasted with the growing industry forecasts. Investors should be prepared for a possible share price decline if recent medium-term trends do not improve, which could drive down the company’s moderate P/S ratio.

Investors should explore potential risks associated with Nanjing Wondux Environmental Protection Technology. Furthermore, considering stocks with solid business fundamentals might offer alternatives. The focus on valuation is critical. Investors should assess whether Nanjing Wondux Environmental Protection Technology is undervalued or overvalued, which involves analyzing fair value, potential risks, dividends, and financial condition.