Carpenter Technology Corporation’s Stock Performance

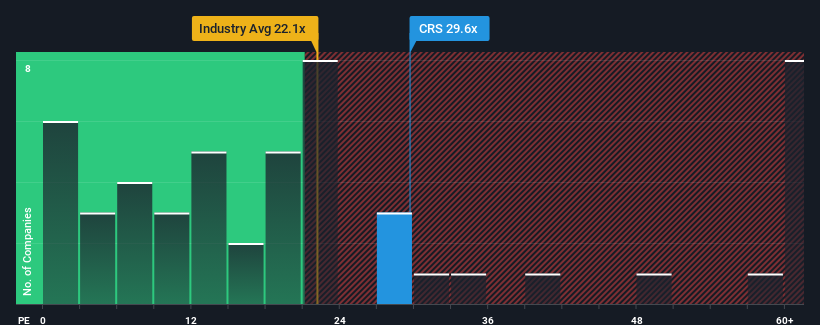

Carpenter Technology Corporation (NYSE:CRS) has seen its stock price surge 40% in the last month, following a period of volatility. This recent gain is part of a larger 106% increase over the past year. The company’s stock now trades at a price-to-earnings (P/E) ratio of 29.6x, significantly higher than the market average of 17x.

The high P/E ratio could be justified by Carpenter Technology’s impressive earnings growth. Over the last year, the company reported a 169% increase in earnings per share (EPS). However, EPS has shown minimal growth over the past three years, indicating mixed performance.

Growth Prospects

Analysts expect Carpenter Technology to achieve 21% annual growth over the next three years, outpacing the market’s projected 10% annual growth. This forecast has likely contributed to the company’s high P/E ratio and stock price.

The strong earnings growth and positive outlook have maintained investor confidence in Carpenter Technology. Unless there are significant changes in the company’s growth prospects, the current P/E ratio is likely to remain supported.

Key Considerations

Investors should also examine other factors, including risk factors that can be found on the company’s balance sheet. Our free balance sheet analysis for Carpenter Technology provides six simple checks on key factors.

For those looking for alternative investment opportunities, consider exploring companies with low P/E ratios that have demonstrated earnings growth potential.