Silicon Motion Technology Corporation Dividend Analysis

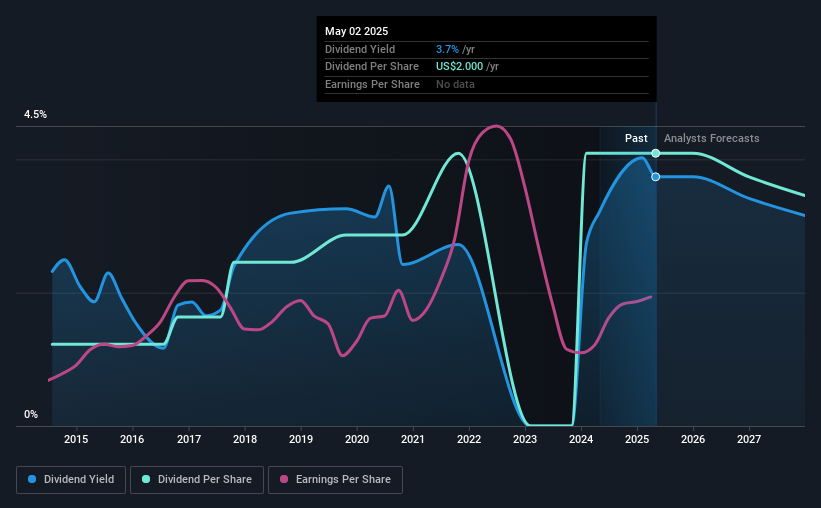

Silicon Motion Technology Corporation (NASDAQ:SIMO) is set to go ex-dividend in the next four days. To receive the upcoming dividend of US$0.4975 per share, investors must purchase the stock before May 8th, as the dividend will be paid on May 22nd. Over the last 12 months, the company has distributed a total of US$2.00 per share, resulting in a trailing yield of 3.7% based on the current share price of US$53.51.

The sustainability of the dividend is a concern as the company paid out 91% of its free cash flow in dividends last year, which is considered high. Although Silicon Motion Technology’s earnings per share have grown at an average rate of 8.8% over the last five years, the high payout ratio of cash flow raises concerns about the dividend’s sustainability. The company has increased its dividend at an average annual rate of 13% over the past 10 years, which is encouraging. However, the high cash flow payout ratio is a negative factor.

Dividend Sustainability Concerns

The company’s dividend payout ratio is 74%, which is relatively normal. However, the cash flow payout ratio of 91% is a concern. Companies need cash to cover expenses, and paying out most of it as dividends can be unsustainable. While Silicon Motion Technology’s earnings have been growing steadily, the high cash flow payout ratio is a warning sign.

Conclusion

From a dividend perspective, Silicon Motion Technology’s stock is not particularly attractive due to its high cash flow payout ratio. Although the company has a history of steady earnings growth and dividend increases, the current dividend payout characteristics are not favorable. Investors should be cautious and consider the risks involved.

Additional Information

For further analysis, including the company’s payout ratio and analyst estimates of future dividends, please refer to our detailed report on Silicon Motion Technology.