Carpenter Technology Corporation’s Stock Price Surges Following Strong Earnings Report

Carpenter Technology Corporation (NYSE:CRS) shareholders have reason to be pleased this week as the stock price jumped 17% to US$199 following the company’s latest third-quarter results. The company reported revenue of US$727m, roughly in line with analyst forecasts. However, statutory earnings per share (EPS) of US$1.88 exceeded expectations by 7.5%. Following the results, analysts updated their earnings model, prompting a closer look at whether they believe there’s been a significant change in the company’s prospects.

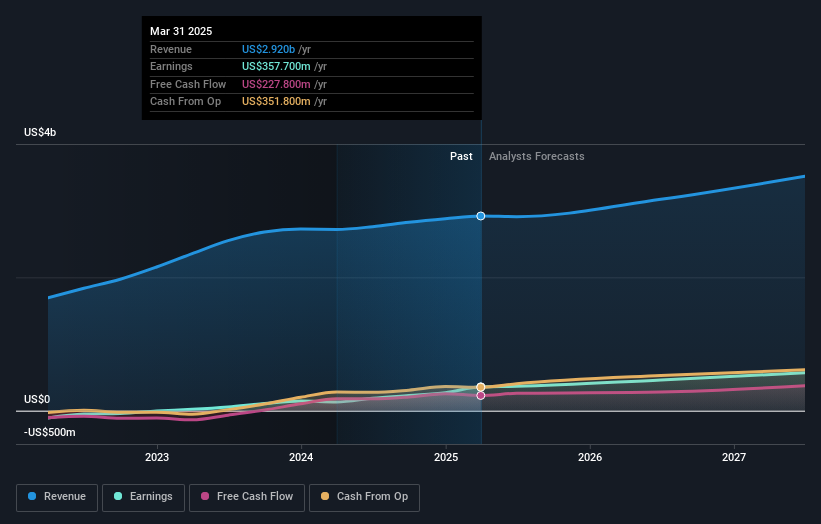

The seven analysts covering Carpenter Technology are now forecasting revenues of US$3.17b in 2026, representing an 8.6% improvement compared to the last 12 months. Per-share earnings are expected to increase by 28% to US$9.18. These forecasts are relatively consistent with previous estimates, suggesting that analysts don’t see a major change in the company’s prospects. The consensus price target rose 5.5% to US$247, potentially reflecting the predictability of Carpenter Technology’s earnings.

Analyst Price Targets and Revenue Growth Expectations

The range of analyst price targets for Carpenter Technology varies from US$200 to US$300 per share, indicating some differing views on the business. However, the estimates don’t vary enough to suggest extreme outcomes. Carpenter Technology’s revenue growth is expected to slow, with a forecast 6.8% annualized growth rate until the end of 2026. This is below the historical 11% p.a. growth over the last five years but still higher than the industry average of 4.2% annual growth.

The Bottom Line

The analysts’ steady earnings forecasts and the slight increase in the price target suggest that there’s been no major change in Carpenter Technology’s prospects. The company is still expected to grow faster than the wider industry. Long-term earnings power remains more important than next year’s profits. Investors may want to consider the company’s debt load and long-term estimates available through 2027 on financial analysis platforms.