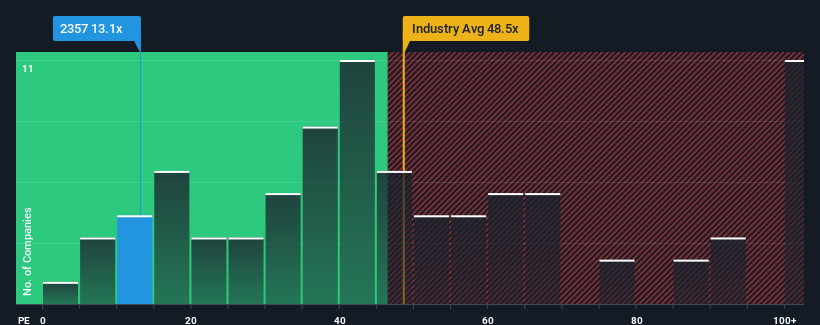

AviChina Industry & Technology Company Limited (HKG:2357) shareholders have seen a 27% increase in the share price over the last month, although the full-year gain remains a modest 9.4%. The company’s price-to-earnings (P/E) ratio stands at 13.1x, higher than nearly half of all companies in Hong Kong. Despite a recent decline in earnings, analysts predict a 13% annual growth in earnings per share (EPS) over the next three years, in line with market expectations.

Analysis of P/E Ratio and Growth Prospects

The high P/E ratio suggests that investors are optimistic about the company’s future prospects. However, the predicted growth rate is comparable to the market average, making the elevated P/E ratio curious. If the expected growth materializes, it may justify the current valuation. Nevertheless, if earnings growth fails to materialize, existing shareholders may face significant risks.

Key Findings and Risks

- AviChina Industry & Technology’s earnings fell by 12% in the last year.

- EPS is anticipated to grow by 13% annually over the next three years.

- The market is expected to deliver 15% growth per year.

- The company’s balance sheet is another critical area for risk analysis.

Investors should be cautious as the high P/E ratio may be weighing down the share price eventually. It is essential to review the company’s balance sheet and assess the associated risks. For a detailed analysis, refer to our free balance sheet analysis for AviChina Industry & Technology.

Conclusion

AviChina Industry & Technology’s stock has received a recent boost, but its elevated P/E ratio warrants careful consideration. Investors must weigh the potential for future growth against the risks associated with the current valuation. A thorough analysis of the company’s financials and growth prospects is crucial for making informed investment decisions.