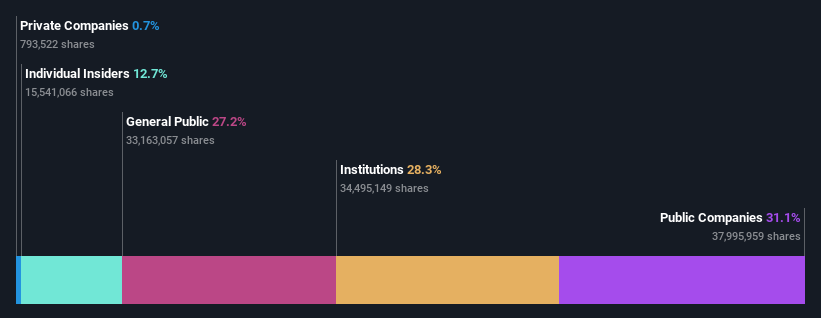

Ownership Structure of Hankook Tire & Technology

Hankook Tire & Technology Co., Ltd. (KRX:161390) has recently experienced a challenging week, with its stock price dropping by 5.1%. This decline has impacted both public companies and institutional investors who have significant stakes in the company. To understand the implications of this drop, it’s crucial to examine the ownership structure of Hankook Tire & Technology.

Significant Control by Public Companies

Public companies hold a substantial 31% stake in Hankook Tire & Technology, making them the largest shareholder group. This significant control implies that the general public has considerable influence over the company’s management and governance decisions. The top four shareholders collectively own 51% of the business, indicating a concentrated ownership structure.

Institutional Ownership Insights

Institutional investors own 28% of Hankook Tire & Technology, suggesting that they have a vested interest in the company’s performance. These institutions typically compare their returns to those of a benchmark index, which may influence their investment decisions. The recent drop in market capitalization to ₩4.8 trillion has put pressure on these institutional investors.

Insider Ownership

Insiders, including board members and top-level managers, hold a significant 13% stake in Hankook Tire & Technology, valued at ₩607 billion. This level of insider ownership is generally considered positive, as it suggests that the board is aligned with the interests of other shareholders.

General Public and Public Company Ownership

The general public holds a 27% stake in the company, giving them a real influence on how the company is run. Public companies currently own 31% of Hankook Tire & Technology stock, suggesting entwined business interests that may be strategic.

Conclusion

Understanding the ownership structure of Hankook Tire & Technology provides valuable insights into the company’s dynamics. The significant control held by public companies, combined with institutional and insider ownership, highlights the complex interplay of interests within the company. As the company moves forward, changes in ownership and investment trends will be worth monitoring.