Decline in Private Equity Investments

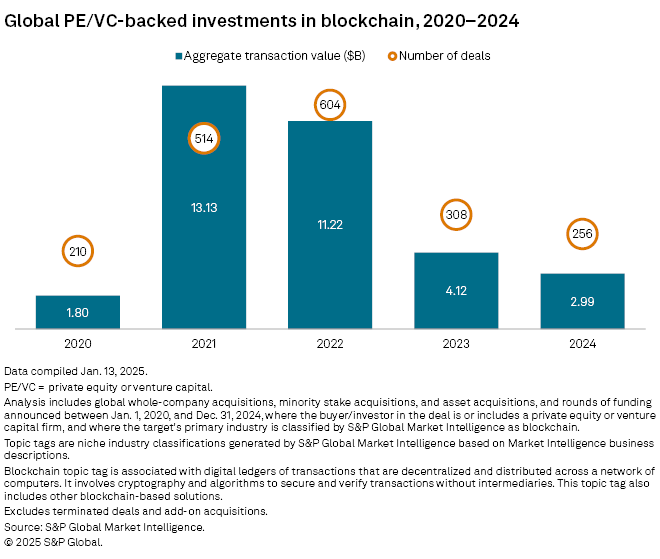

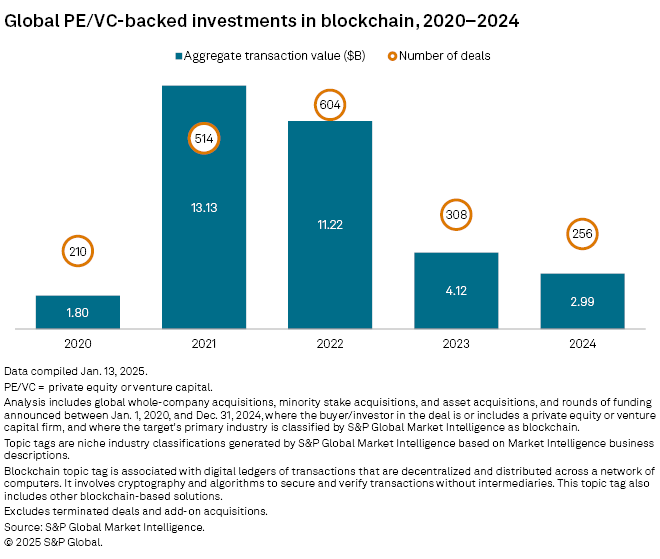

Global private equity and venture capital investments in blockchain technology continued their multiyear decline in 2024, according to S&P Global Market Intelligence data. Transactions focused on blockchain totaled $2.99 billion, representing a 27% annual decrease, while the number of deals dropped by nearly 17%. Investments in cryptocurrency, a digital asset that operates on blockchain technology, also fell by about 25% to $1.57 billion, reflecting investor caution in this speculative market.

Blockchain Beyond Cryptocurrency

Blockchain technology has found applications beyond the cryptocurrency sector, including healthcare and supply chain management. The recent surge in bitcoin’s price, driven by the new U.S. administration’s pro-crypto stance, has renewed interest in cryptocurrency investments. However, investors remain cautious, with many large venture capital-backed cryptocurrency projects failing to meet expectations. In contrast, blockchain technology has seen significant adoption in various industries due to its ability to provide transparency and security.

“Many large venture capital-backed cryptocurrency projects haven’t been as successful as hoped,” said Kisso Selvan, President of the Cambridge Blockchain Society. “On the other hand, we’ve seen massive pushes for blockchain technologies within regulatory frameworks. Most countries have moved to adopt blockchain for applications like supply chain management due to its increased transparency.”

The Rise of Generative AI

The emerging generative AI industry has overshadowed blockchain and cryptocurrency investments, as investors seek the next technological breakthrough. However, 451 Research, a technology research group within Market Intelligence, suggests that blockchain technology could benefit from its integration with generative AI. The decentralized ledger system of blockchain could complement AI applications across various industries, particularly where auditability and trust are critical concerns.

Regional Investment Trends

North America led in private equity-backed investments in blockchain and cryptocurrency companies. The region saw 111 blockchain deals worth $1.72 billion and 78 cryptocurrency deals valued at $781 million. Europe, including the UK, ranked second, with 48 blockchain deals totaling $654.4 million and 51 cryptocurrency deals reaching $489.2 million.

Notable Investments

The largest private equity-backed investment in blockchain was Doc.com Inc.’s $300 million funding round from Silver Rock Group. In cryptocurrency, Crypto Technology Ltd. received a $100 million investment led by Nomad Capital and No Limit Holdings.

Future Outlook

Josh Cincinnati, President of Interchain Foundation Ltd., expects renewed institutional investor interest in blockchain and cryptocurrency following the recent spike in bitcoin’s price. He anticipates enterprises will increasingly use blockchain systems to prove transactions without revealing customer information, reducing data liability.

As blockchain technology continues to evolve, its integration with other emerging technologies like generative AI is likely to drive further adoption across industries. While cryptocurrency investments remain speculative, the underlying blockchain technology is expected to play a crucial role in enhancing transparency and security in various sectors.