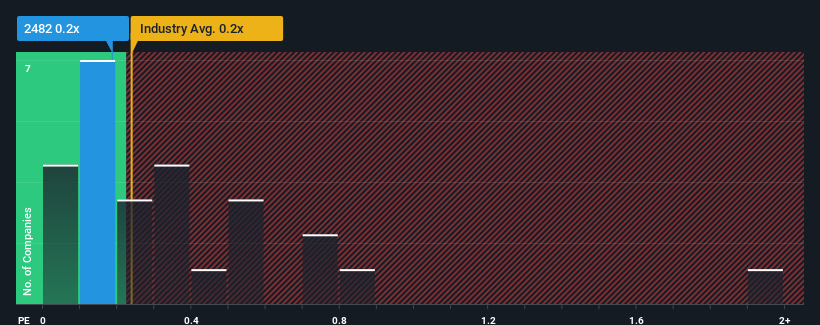

Logory Logistics Technology Co., Ltd. (HKG:2482) has seen its share price drop by 31% over the past 30 days, erasing some of its recent gains. Despite this decline, the stock remains up 51% over the last year. The company’s price-to-sales (P/S) ratio stands at 0.2x, which is similar to the median P/S ratio for the logistics industry in Hong Kong.

Recent Performance and P/S Ratio

Logory Logistics Technology has demonstrated strong revenue growth, with a 34% increase over the last year and a 20% growth over the last three years. However, its recent medium-term revenue growth is weaker compared to the industry’s expected 9.7% growth in the next 12 months. The company’s P/S ratio is typical for a company with moderate growth expectations, similar to the industry average.

Implications for Investors

The plummeting stock price has brought Logory Logistics Technology’s P/S ratio in line with the industry average. While the P/S ratio may not be the best measure of value in certain industries, it can indicate business sentiment. The company’s weak three-year revenue trends, combined with slower-than-industry growth, suggest that the share price may be at risk of declining further, bringing the P/S ratio back in line with expectations.

Key Considerations

- Logory Logistics Technology’s strong revenue growth may be expected to wane, keeping the share price and P/S ratio from rising.

- The company’s momentum is weaker than the industry’s expected growth.

- Investors should be cautious as the current prices may be difficult to maintain if recent revenue trends continue.

Conclusion

Investors should carefully consider Logory Logistics Technology’s recent performance and industry outlook. While the company has shown strong revenue growth, its weaker medium-term prospects and industry comparison suggest potential risks. It’s essential to review the company’s balance sheet and earnings growth to make informed investment decisions.