The Rise of AI and Big Tech

Advances in artificial intelligence (AI) are poised to revolutionize the economy and society. From chatbots and image generators to financial forecasting tools, AI applications are becoming ubiquitous, promising to transform the way we live and work. Generative AI (GenAI) is being adopted at a much faster pace than other transformative technologies. Recent evidence points to AI’s wide-ranging impact on labor markets, productivity, local economies, women’s employment, capital markets, public finances, and the broader financial sector.

Behind this wave of innovation lies a significant trend: the growing role of large technology firms, commonly referred to as ‘big techs,’ across the AI supply chain. Big techs have been consistently investing in AI, accounting for 33% of the total capital raised by AI firms and nearly 67% of the capital raised by generative AI firms in 2023. While big techs have accelerated AI development, their expanding influence raises critical questions about competition, innovation, operational resilience, and financial stability.

The AI Supply Chain and Big Tech’s Role

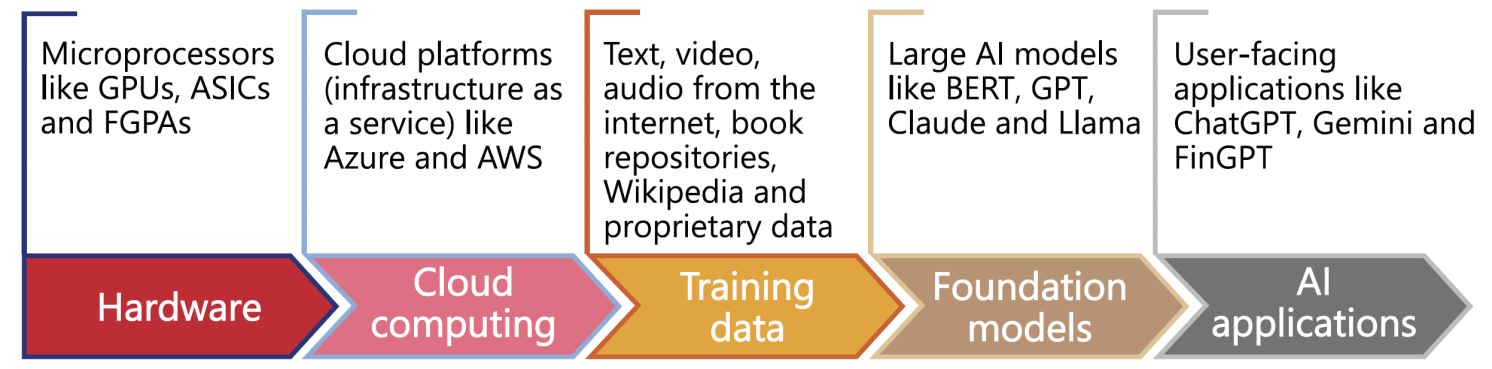

The AI supply chain comprises five key layers: hardware, cloud computing, training data, foundation models, and user-facing AI applications. Big techs are active in all these layers. In cloud computing, the backbone of AI development, three big techs – Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform – dominate the market, controlling nearly 75% of the infrastructure-as-a-service segment.

Big techs also provide vertically integrated service ecosystems on their platforms, often at a discount. Their influence extends beyond cloud computing to training data, foundation models, and AI hardware. For instance, they have access to rich pools of user-generated data, which is crucial for AI training. Meta has Instagram, Facebook, and WhatsApp, while Google has Gmail, Maps, Play Store, and Google Search.

Implications for Economic and Social Outcomes

The control exerted by a few firms over AI provision can have profound consequences for economic and social outcomes. Limited competition can lead to higher prices, reduced consumer choice, suppressed wages, and stifled innovation. Moreover, big techs’ control over AI direction raises the risk of privately profitable advancements diverging from socially desirable ones.

A concentrated AI supply chain also creates operational vulnerabilities and increases systemic risk, threatening financial stability. Regulatory challenges are significant due to the AI supply chain’s complexity and the rapid pace of technological progress.

Regulatory Challenges and Potential Solutions

Addressing concentration in AI provision is complex due to the multiple markets involved and differing regulatory authorities. International cooperation is challenging given the differences in legal frameworks and geopolitical interests. Despite these obstacles, potential policy responses include encouraging data-sharing agreements, creating public datasets for AI training, ensuring fair access to cloud infrastructure, and promoting interoperability.

Conclusion

AI has the potential to drive economic growth and improve economic and social outcomes. However, to realize this potential, the AI ecosystem must remain competitive and fair. Excessive influence by a handful of technology companies over AI provision risks stifling socially beneficial innovation, exacerbating inequalities, and creating systemic vulnerabilities. Regulatory authorities must carefully monitor AI provision and gather evidence on market conduct, operational vulnerabilities, and concentration to address these challenges effectively.