Logory Logistics Technology’s Stock Performance and Financial Analysis

Logory Logistics Technology Co., Ltd. (HKG:2482) has seen a significant 49% increase in its stock price over the last week. However, concerns arise about whether the company’s inconsistent financials might impact this momentum. This analysis focuses on Logory Logistics Technology’s Return on Equity (ROE) and its implications.

Understanding Return on Equity (ROE)

ROE is a crucial metric for shareholders as it measures how effectively their capital is reinvested. It is calculated using the formula: Return on Equity = Net Profit ÷ Shareholders’ Equity. For Logory Logistics Technology, the ROE is 6.3% = CN¥44m ÷ CN¥706m (based on the trailing twelve months to December 2024). This means for every HK$1 of shareholders’ capital, the company made HK$0.06 in profit.

ROE and Earnings Growth

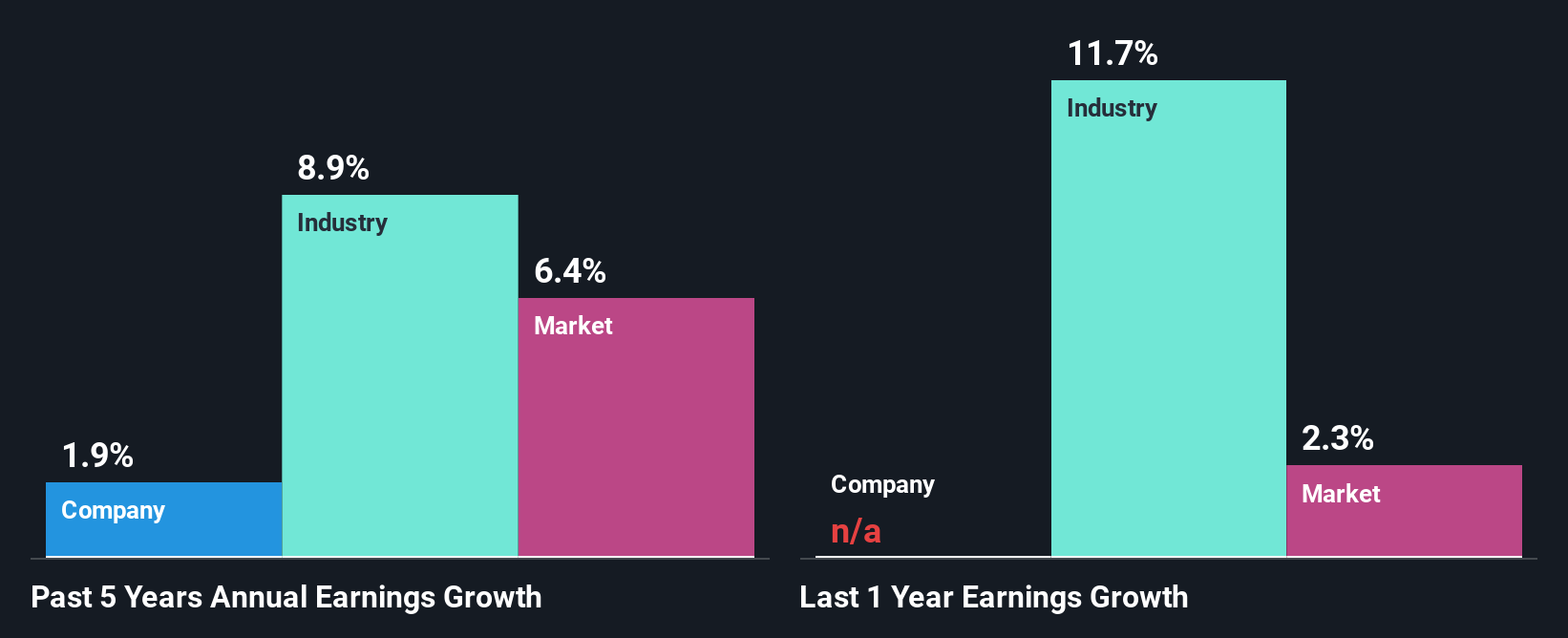

While Logory Logistics Technology’s ROE is similar to the industry average of 7.3%, its net income growth over the past five years has been flat. The company’s low ROE and lower-than-industry-average growth raise concerns. The industry average growth was 8.9% in the same period.

Efficient Use of Profits

Logory Logistics Technology does not pay regular dividends, suggesting that all profits are reinvested. However, this hasn’t translated into earnings growth, indicating potential underlying issues with the business.

Conclusion

The analysis of Logory Logistics Technology reveals mixed results. Despite retaining most of its profits, the low ROE and stagnant earnings growth are concerning. Investors should consider these factors when evaluating the stock’s future prospects. For a deeper insight, examining the company’s past earnings, revenue, and cash flows is recommended.

Further Analysis

To understand Logory Logistics Technology’s performance better, reviewing the detailed graph of its past earnings, revenue, and cash flows could provide valuable insights. This additional analysis might help investors make more informed decisions about the stock.