Circle Internet Group Stock Surges 30% After Senate Passes Stablecoin Legislation

The stock of Circle Internet Group (NYSE: CRCL), the company behind the USDC stablecoin, surged 30% to reach as high as $199.60 on June 18. This significant increase came a day after the Senate passed the GENIUS Act, dealing with stablecoin legislation, with a 68-30 vote.

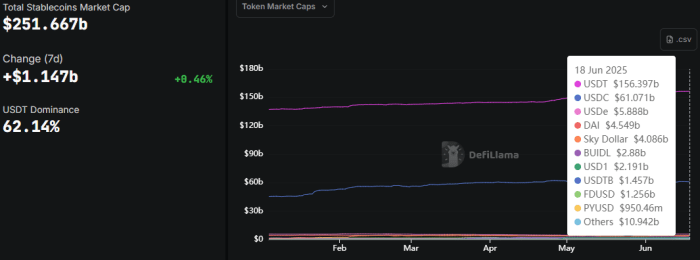

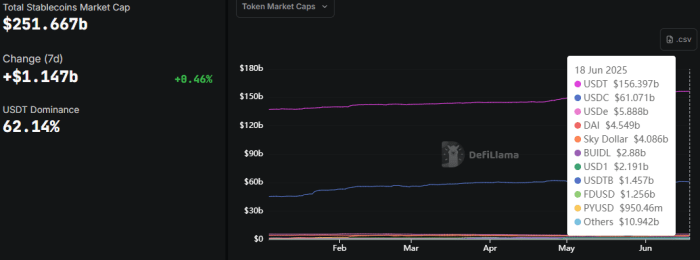

A stablecoin is a type of cryptocurrency designed to maintain a stable value, unlike traditionally volatile cryptocurrencies such as Bitcoin. Circle’s USDC achieves this stability by being pegged 1:1 to the U.S. dollar. According to DeFiLlama, the total stablecoin market cap is $251.66 billion.

Tether’s USDT is the largest stablecoin, with a market share of $156.39 billion, accounting for 62% of the market. USDC, with a market cap of $61.07 billion, accounts for nearly 25% of the market, making it the second-largest stablecoin.

Circle made a spectacular debut on June 5, with Wall Street giants such as JP Morgan Chase, Citigroup, and Goldman Sachs as underwriters. The stock opened at $69, 124.19% above the IPO price of $31. The stock reached its previous all-time high of $165.60 on June 16 amidst the Iran-Israel conflict and hit a new record high following the Senate’s passage of the bill.

Circle CEO Jeremy Allaire wrote on X, “History is being made, as the US Senate passes the GENIUS Act, taking us one step closer to breakthrough legislation being signed into law that will drive US economic and national competitiveness for decades to come.”

The positive sentiment also affected other crypto-related stocks. Coinbase (Nasdaq: COIN), the largest crypto exchange in the U.S., soared 16% to $295.70. Robinhood (Nasdaq: HOOD) also rose 4.50% to $78.33.

The passage of the GENIUS Act and its potential impact on stablecoin legislation have generated significant interest in the cryptocurrency market, particularly in companies like Circle Internet Group and Coinbase.