Shandong Sito Bio-technology’s Share Price Up, But Is Revenue Telling the Real Story?

Shandong Sito Bio-technology Co., Ltd. (SZSE:300583) shareholders have reason to be optimistic, as the share price has experienced a significant rise in the past month. The stock has seen a 28% gain, recovering from previous lows, and is up 45% over the last year. However, a closer look at the company’s financials raises questions about the sustainability of this growth.

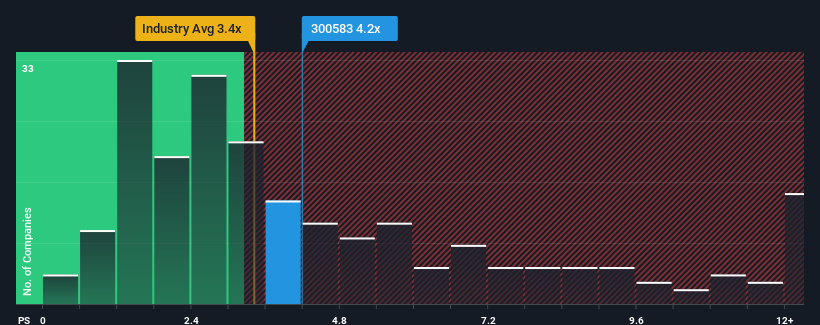

With a price-to-sales ratio (P/S) of 4.2x, some investors might believe Shandong Sito Bio-technology is not a worthwhile investment, particularly when compared to the broader Chinese pharmaceuticals industry, where nearly half the companies have P/S ratios below 3.4x. However, this ratio alone doesn’t tell the whole story.

Recent Performance

Shandong Sito Bio-technology’s financial performance has been less than stellar in the recent past. Revenue has been declining, a factor that could explain the high P/S ratio if investors believe the company can still perform better than the industry in the near future. If that proves not to be the case, current shareholders may be concerned about the value of their stock.

It’s worth noting that analyst estimates for Shandong Sito Bio-technology are currently unavailable.

Revenue Growth Analysis

The high P/S ratio suggests that the company is expected to outperform its industry peers. Unfortunately, a look back at the company’s performance reveals that revenue growth last year declined by 14%. This wipes out any gains made over the last three years, with almost no change in overall revenue. This reveals a mixed result when it comes to increasing revenue over that period.

When comparing the company’s recent revenue trends with the industry’s one-year growth forecast of 211%, Shandong Sito Bio-technology seems less attractive.

This makes the fact that the company’s P/S exceeds its industry peers all the more worrying. Many investors appear to be considerably more bullish than recent results would suggest, as they have no intention of letting go of their stock at any price. However, continuation of recent revenue trends is likely to weigh heavily on the share price in the long run.

The Bottom Line

The increase in Shandong Sito Bio-technology’s share price has sharply lifted the company’s P/S. While the P/S ratio shouldn’t be used in isolation when deciding whether to sell a stock, it can be a helpful indicator of the company’s future prospects.

The fact that Shandong Sito Bio-technology currently trades at a higher P/S relative to the industry is odd, since its recent three-year growth rate is less than the wider industry forecast. With slower revenue growth than the industry and a high P/S ratio, there is a significant risk of the share price going down.

If recent revenue trends continue, shareholders’ and potential investors’ investments are at risk of paying an excessive premium. Further, the company has two warning signs that investors must be aware of.

It’s important to avoid basing investment decisions on initial ideas and focus instead on companies that have growing profitability.