PAR Technology’s Price Surge: A Cause for Concern?

PAR Technology Corporation (NYSE:PAR) has seen a significant price increase recently, fueling investor interest. The stock has gained 26% in the last month alone and an impressive 104% over the past year. This raises the question: is this growth sustainable, or is the stock overvalued?

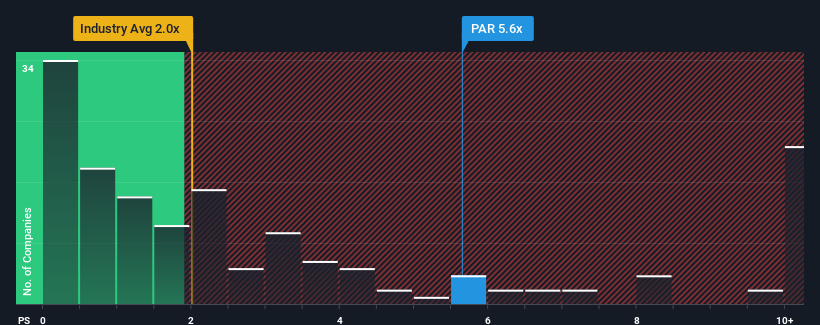

The company’s price-to-sales (P/S) ratio of 5.6x is significantly higher than the industry average. While nearly half of the companies in the U.S. electronic equipment sector have P/S ratios below 2.1x, PAR Technology’s number stands out. However, a high P/S ratio isn’t always a negative sign. It could reflect expectations of robust future growth.

Assessing PAR Technology’s Recent Performance

PAR Technology has demonstrated relatively strong revenue growth, outpacing many of its competitors. This performance has likely contributed to the market’s bullish outlook and the elevated P/S ratio. Continued strong revenue is crucial for justifying the stock’s current valuation; if the growth falters, existing shareholders may become concerned about the stock’s price.

Revenue Growth Metrics and the High P/S Ratio

A high P/S ratio often indicates that a company is expected to achieve substantial growth, exceeding industry averages. Examining past performance, PAR Technology increased its revenue by 30% last year. Furthermore, revenue has grown cumulatively by 80% over the past three years, highlighting the company’s impressive growth trajectory.

However, future projections may present headwinds for the company. Analysts estimate revenue will decline by 7.2% in the coming year, while the broader industry is forecast to grow by 9.1%. This discrepancy is a key factor impacting PAR Technology’s valuation.

Given this negative growth outlook, the company’s P/S ratio is somewhat intriguing. Investors seem to be optimistic, rejecting analysts’ more pessimistic forecasts and holding onto their stock. However, if the P/S ratio adjusts to reflect the company’s slower predicted growth, these investors may face disappointment.

Implications of PAR Technology’s P/S Ratio for Investors

The recent uptick in PAR Technology’s share price has elevated its P/S ratio. While this ratio isn’t the sole determinant of an investment decision, it offers valuable insight into market expectations for revenue. In the case of PAR Technology, its high P/S ratio, coupled with a projected decline in revenue, suggests potential risk.

Investors should proceed with caution at the current price levels, especially if revenue forecasts are not met. PAR Technology also presents two warning signs that investors should be aware of.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.