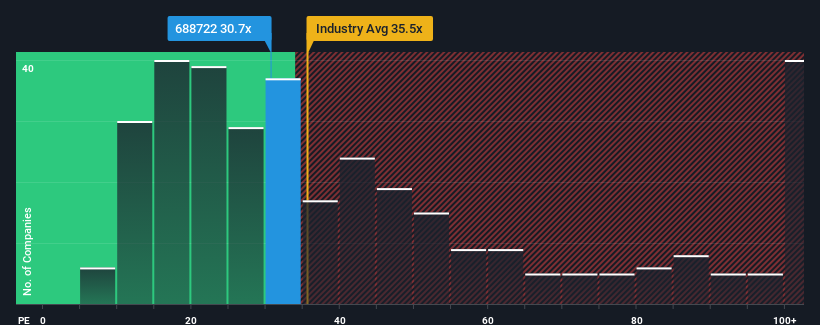

Beijing Tongyizhong New Material Technology’s P/E Ratio Analyzed

Beijing Tongyizhong New Material Technology’s (SHSE:688722) P/E of 30.7x appears low compared to the Chinese market, where many companies have higher ratios. However, a closer look is needed to understand the drivers of this lower valuation.

Analyzing the P/E Ratio

One explanation for the low P/E could be the company’s recent financial performance, which has seen a decline in earnings.

Growth and Future Expectations

The company’s earnings fell 40% in the last year. While the company did experience strong growth in the years prior, this recent decline is a factor investors are considering. The market is expected to grow by 37% over the next year.

Understanding Investor Sentiment

The P/E ratio reflects investor sentiment and expectations for future performance. Investors might be hesitant, anticipating continued limited growth and are only willing to pay less for the share value as a result. The company has one warning sign that investors should be aware of.

Disclaimer: This article is for general informational purposes only and should not be considered financial advice.