DuoLun Technology’s Recent Performance: A Cause for Concern?

DuoLun Technology Corporation Ltd. (SHSE:603528) shareholders have enjoyed a significant share price increase recently. The stock has surged 26% in the last month and an impressive 52% over the past year.

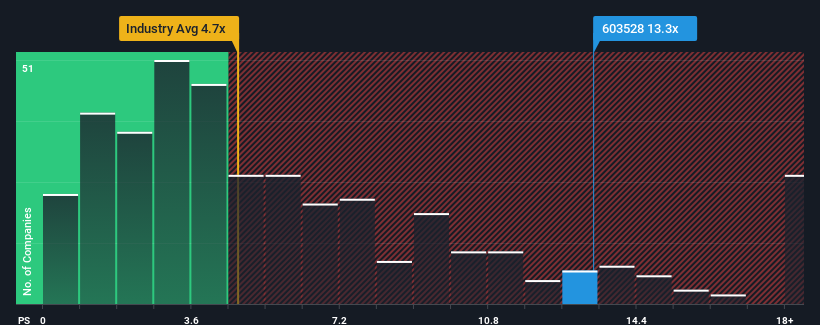

However, despite this positive trajectory, the company’s price-to-sales (P/S) ratio of 13.3x raises some questions. This figure appears high compared to other companies in China’s Electronic industry, where roughly half have P/S ratios below 4.7x, and values under 2x are commonplace. This discrepancy suggests that the stock may be overvalued.

Revenue Decline and Future Outlook

DuoLun Technology’s recent financial performance has been less than stellar. The company’s declining revenue contrasts sharply with the industry’s average revenue growth. The company’s revenue declined by 15% last year, and over the last three years, revenue has shrunk by 36% in total.

Looking ahead, the single analyst covering the company forecasts a 23% growth in the next year. This is notably lower than the 26% growth projected for the broader industry. The market might be pricing in a stronger return to revenue, but the current P/S ratio seems ambitious compared to current and projected performance.

Investor Sentiment vs. Analyst Forecasts

The substantial share price increase has led to a soaring P/S ratio. This situation highlights the significance of investor sentiment and future expectations.

Despite the analyst’s more conservative revenue growth projections, the P/S ratio seems unaffected. This disparity is concerning. Investors may be overly optimistic regarding the company’s future, potentially setting themselves up for disappointment if the P/S ratio eventually aligns with the growth outlook.

Investment Strategy and Risk

At this time, the high P/S ratio presents a cause for caution, particularly if revenue figures do not improve. Investors should remain vigilant and assess the associated risks.

Disclaimer: This analysis is based on historical data and analyst forecasts and is not financial advice. It does not constitute a recommendation to buy or sell any stock. Always consider your own financial objectives before making an investment. Simply Wall St has no position in any stocks mentioned.