Chengdu Lihang Technology: Assessing Investor Sentiment and Growth Concerns

Despite a price-to-sales (P/S) ratio mirroring the industry average, Chengdu Lihang Technology Co.,Ltd. (SHSE:603261) appears to be facing challenges. This analysis examines the factors influencing investor sentiment and the company’s prospects.

A P/S Ratio That Raises Questions

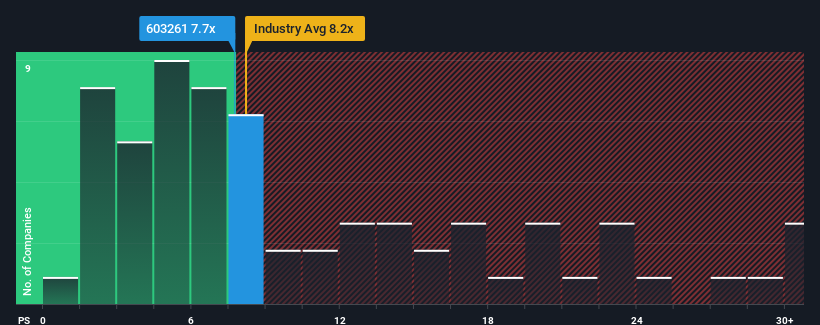

Chengdu Lihang Technology’s P/S ratio of 7.7x is comparable to the median of 8.2x for the Aerospace & Defense industry in China. While this might not immediately trigger concern, it’s crucial to understand if the valuation is justified, particularly given the company’s recent performance.

Revenue Decline: A Cause for Concern

One key factor is the company’s recent financial performance, specifically the decline in revenue. Investors may be optimistic about the company’s future, but the lack of growth raises questions about whether the current P/S ratio is sustainable.

Revenue Forecasts and P/S: A Disconnect?

A company’s P/S ratio is often tied closely to its expected growth. Looking back, Chengdu Lihang Technology’s revenue decreased by 30% in the past year. When considering that the industry is predicted to grow by 54% in the next 12 months, the current P/S ratio seems high. This discrepancy suggests either overvaluation or a belief that recent trends won’t continue.

Investor Sentiment

The current P/S ratio suggests that many investors are not overly worried about the recent revenue decline. However, a continuation of the current trends would likely weigh on the stock price eventually. Unless there is a significant improvement, the company’s shareholders may face future difficulties.

Key Takeaways for Investors

The analysis raises some concerns regarding the valuation of Chengdu Lihang Technology. Given the company’s stagnant revenue in comparison to a growing industry. Investors should consider whether the current P/S ratio accurately reflects the company’s financial health and future prospects.

Disclaimer: This analysis is based on historical data and analyst forecasts and is not financial advice.