Healthcare State of Health Tech 2024: Resilience and the Rise of AI

In its second annual report, [Organization Name] explores the remarkable resilience of the health tech sector. This analysis delves into both public and private markets, with a specific focus on the scaling of early-stage companies in the rapidly evolving landscape of artificial intelligence (AI).

Introduction: The Year of Resilience

Looking back on the health tech sector in 2024, the word that best encapsulates the story is resilience. Like a phoenix, the sector has displayed exceptional adaptability and strength in the face of ongoing market challenges.

In the ‘State of Health Tech 2023’ report, [Organization Name] provided an in-depth analysis of market cycles and corrections, as well as the increasing scrutiny of business models. This past year has seen a new wave of companies not just surviving, but thriving in this dynamic environment.

The standards for success have undoubtedly risen. Investors are demanding clearer pathways to profitability, more efficient growth, and a distinct approach to value creation. Despite these challenges, there are encouraging signs of recovery in private market deal-making, particularly for companies that have achieved product-market fit and are scaling effectively.

Perhaps the most significant development of the past year has been the surge of interest and innovation in artificial intelligence within healthcare. Rock Health estimates that venture capitalists are allocating 38% of new investment dollars in healthcare to AI-enabled technology. This “era of cognition,” driven by advancements in AI and machine learning, is poised to transform healthcare delivery and management.

We’ve seen hundreds of new companies emerge at the intersection of health and AI, with more than 20 startups quickly achieving product-market fit and growing from $1 to $10 million in annual recurring revenue (ARR) in record time.

This report assesses the current state of the health tech market, analyzes the performance of both public and private companies, and publishes, for the first time, benchmarks of health AI companies emerging as a new category. We also explore emerging trends and offer predictions for the future of health tech.

2024 Market Review

Health Tech Public Market Performance

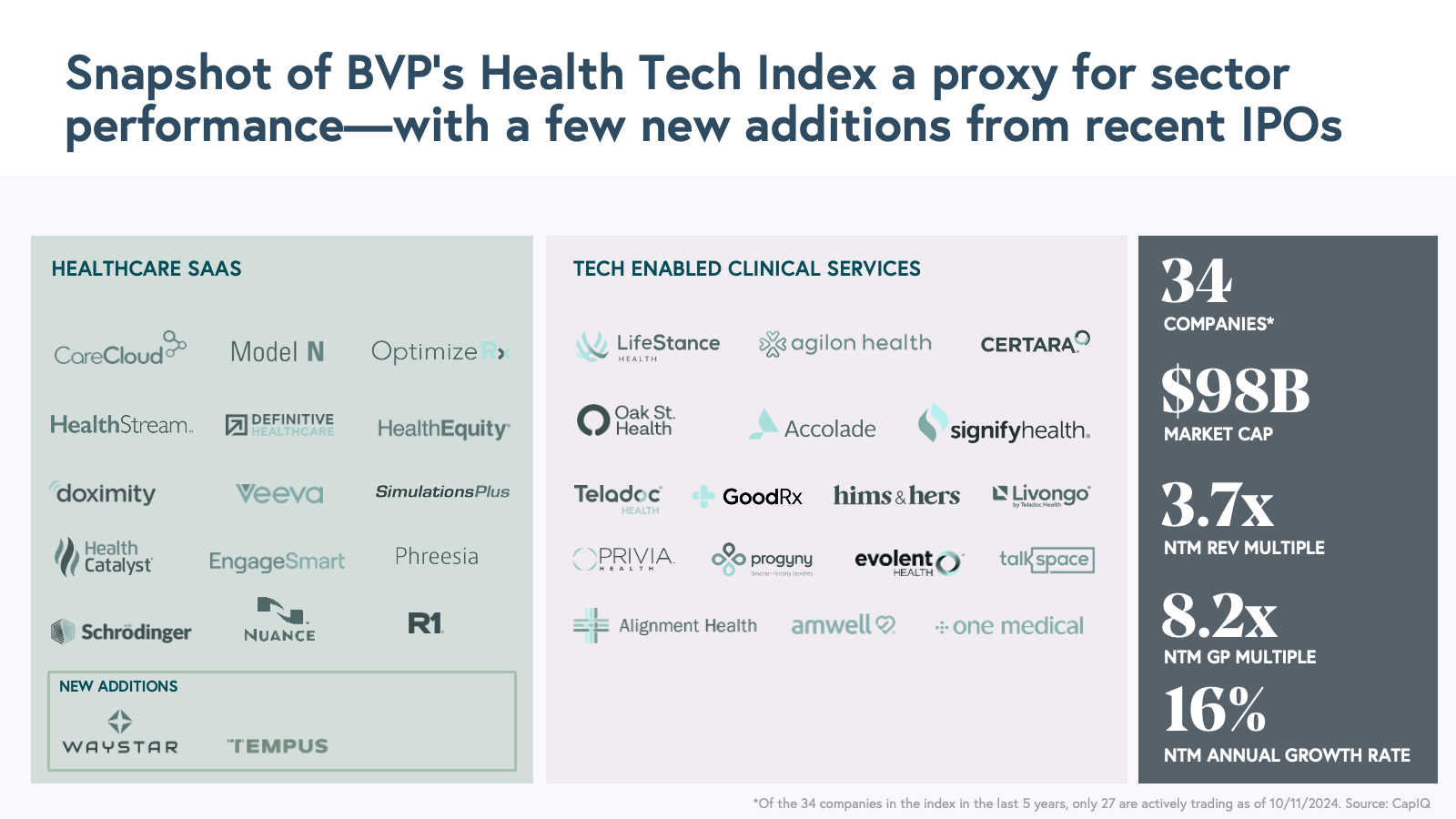

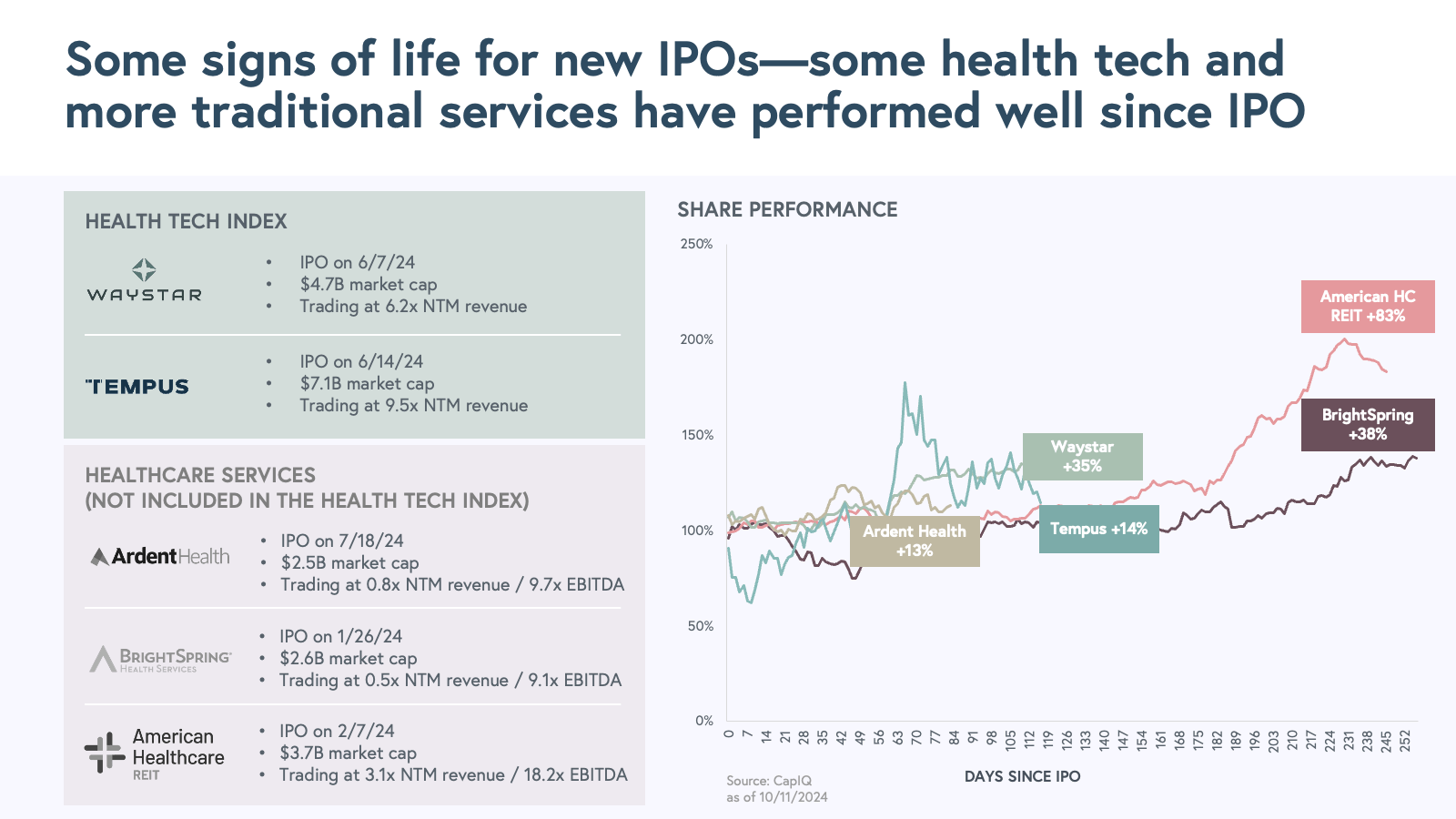

To gauge the overall performance of the sector, [Organization Name] has updated its health tech index, which offers a snapshot of public market performance. This year, the index welcomes two new companies: Tempus and Waystar, both of which completed their initial public offerings (IPOs) in 2024.

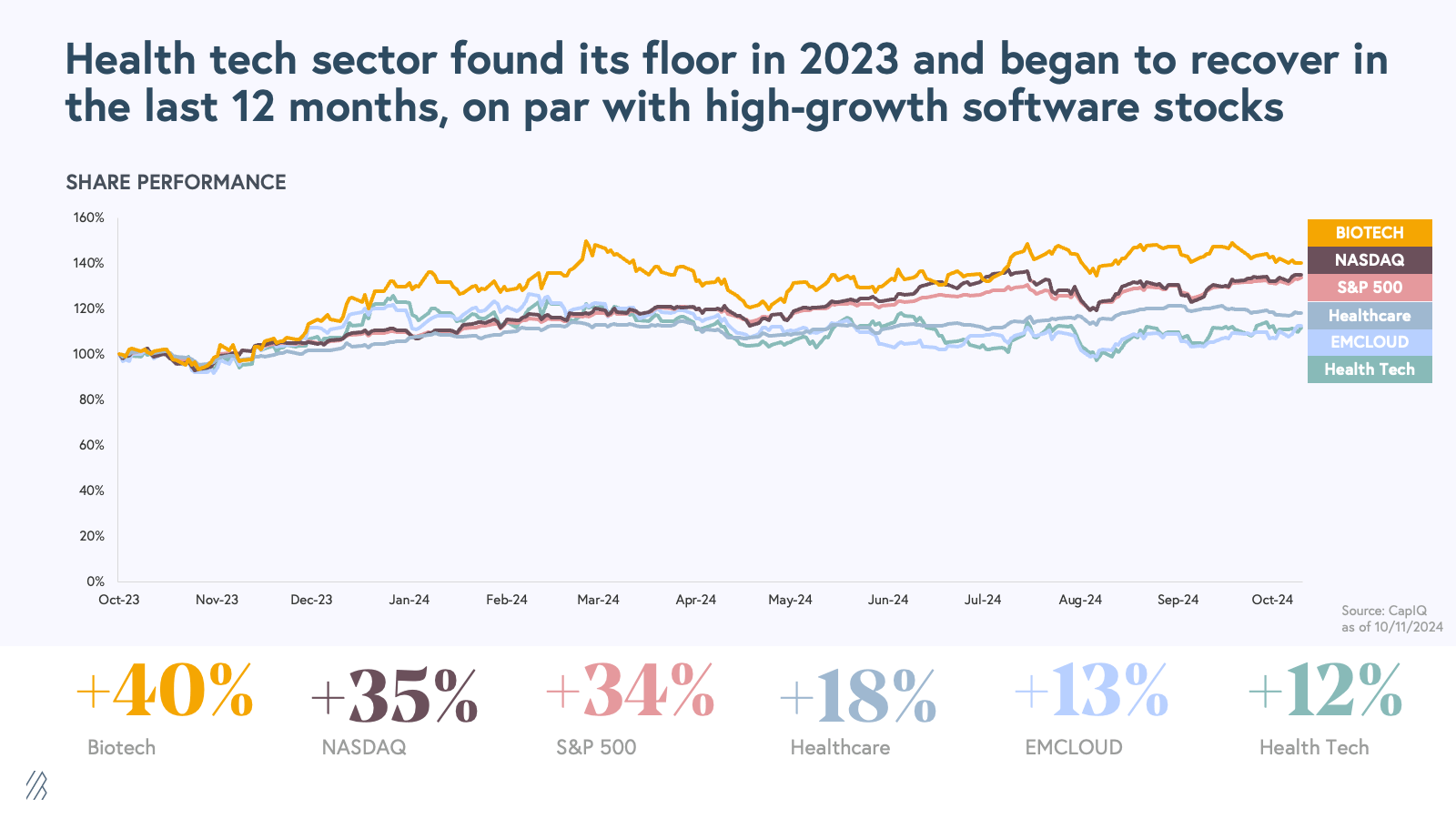

Our expanded index now includes 34 companies, representing a total market capitalization of $98 billion. While the sector’s performance remains below its 2021 peak, there have been notable improvements compared to last year’s report. In the last 12 months, positive signs of recovery have emerged:

- Public health tech stocks have increased in value by 12%.

- Performance is in line with high-growth software stocks and the incumbent healthcare index.

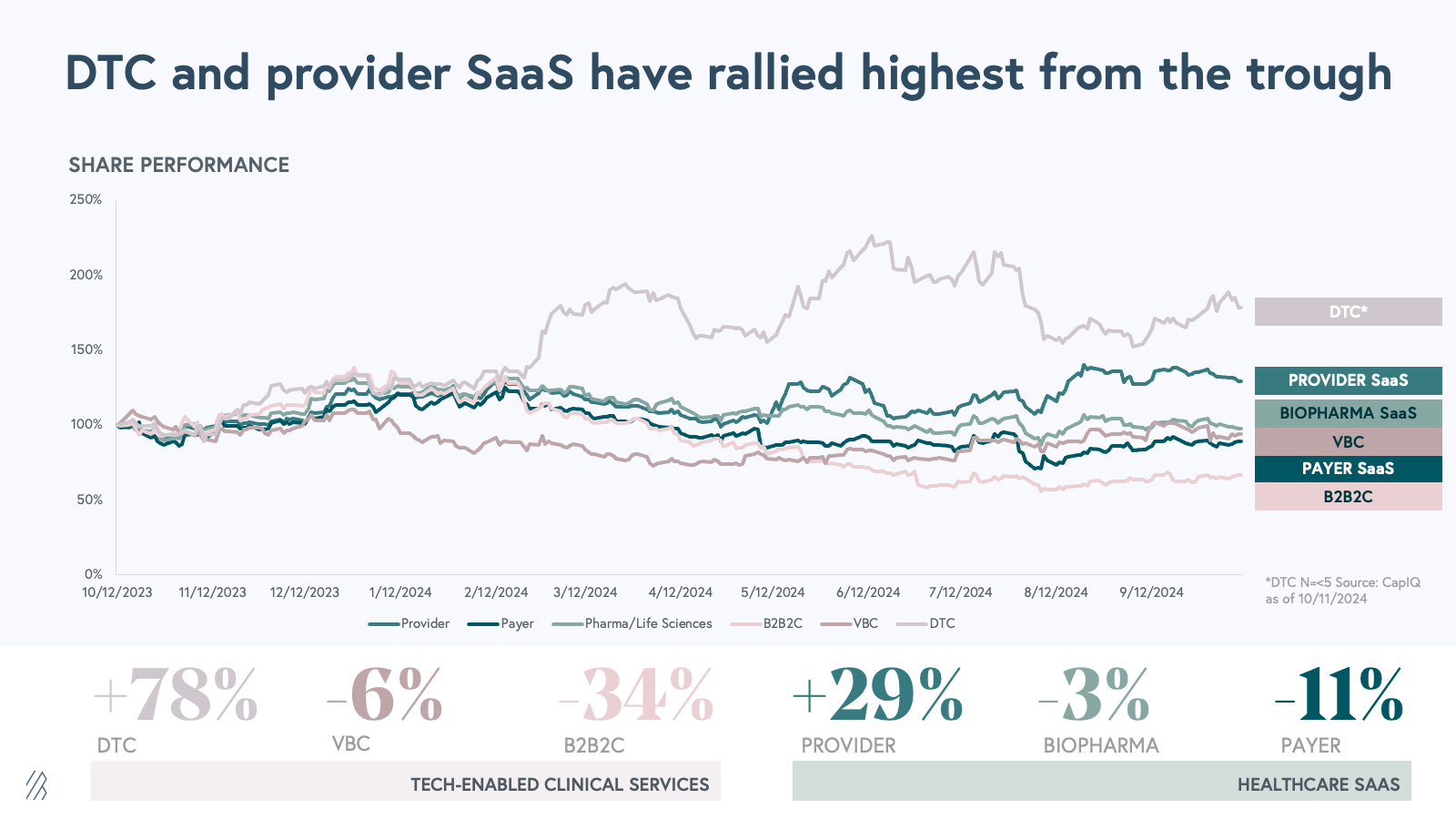

- The direct-to-consumer (DTC) subsector saw the strongest rebound from its 2022 low, gaining approximately 25% in 2024, driven by exceptional performance from companies such as HIMS.

Investors have traditionally been wary of DTC healthcare companies due to consumer behavior and distribution challenges. However, recent performance suggests that consumer demand and broader market trends, including GLP-1 and longevity treatments, may usher in a renaissance for this model. The increased interest in this segment is promising.

On the healthcare software side, provider SaaS has also seen improvement, supported by the addition of Waystar and Tempus to our index. This demonstrates the need for a new cohort of IPOs to reinvigorate the sector.

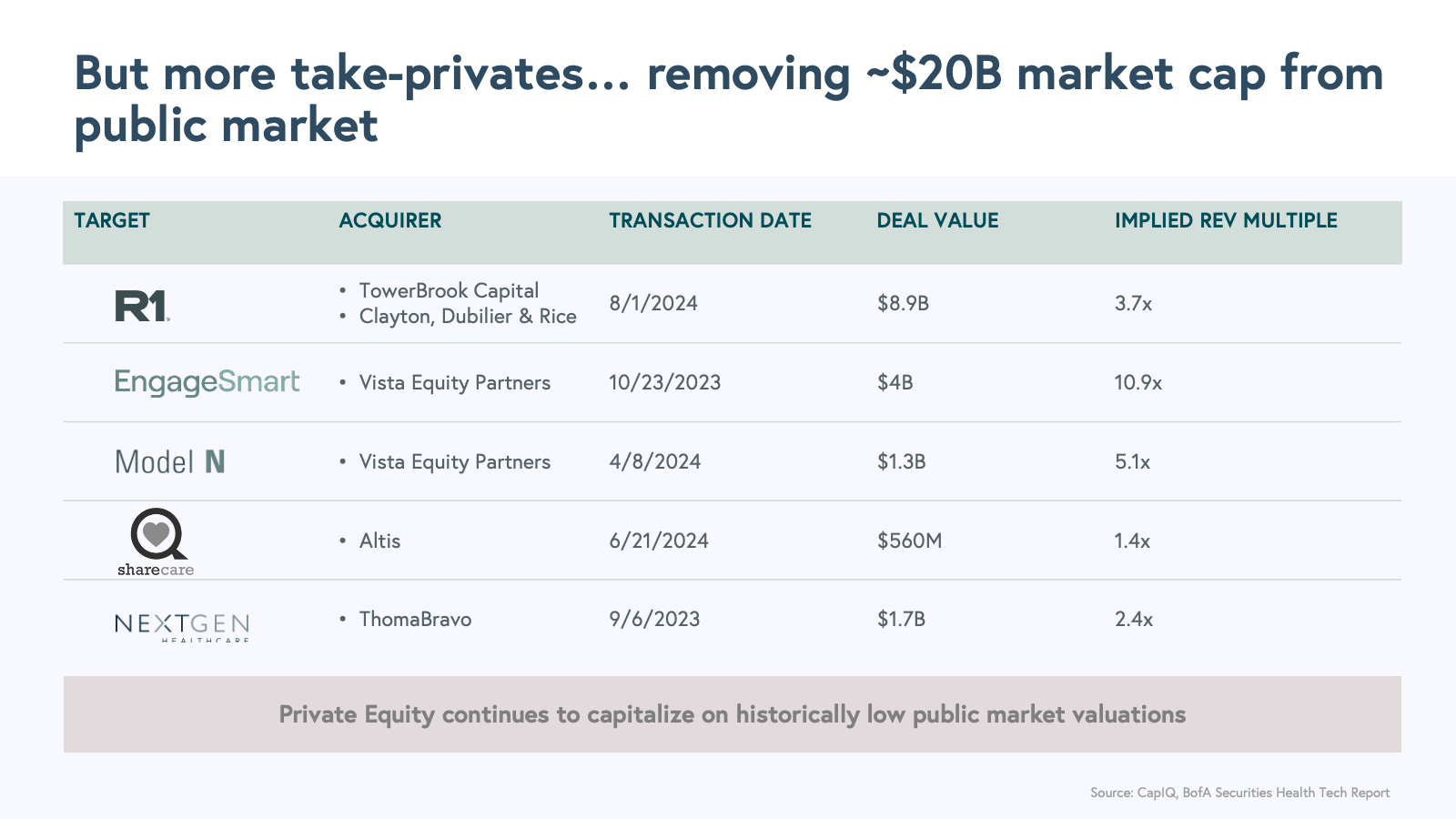

In addition to the solid post-IPO performance of Waystar and Tempus, several healthcare services companies have gone public, injecting much-needed energy into the health tech’s public cohort. This positive momentum has been partially offset by a $20 billion reduction in market capitalization due to take-private transactions.

Private equity firms have been actively acquiring public health tech companies due to historically low valuations. Noteworthy examples include R1 RCM’s $8.9 billion take-private in August and EngageSmart’s $4 billion take-private in October 2023. While these deals reflect the underlying value in the sector, they’ve also reduced the overall public market capitalization of health tech companies. This signals a turning point, where investors recognize the value of overhauling these businesses with new technology, particularly AI.

Looking ahead to 2025, there’s cautious optimism for a new cohort of companies that could potentially go public and revitalize the sector. Factors that could make this happen include:

- Improved macroeconomic conditions and easing of interest rates by the Federal Reserve.

- Removed uncertainty from the presidential election outcome.

- Successful IPOs in other markets, including high-growth cloud, biotech, and fintech.

- A cohort of private companies across tech-enabled clinical services and healthcare SaaS companies awaiting their debut.

These companies are showing continued strong profitable growth, untapped market opportunity, and proven ROI to their customers. These companies have the potential to serve as benchmarks for the next generation of public health tech firms. The success of these upcoming IPOs will be crucial in attracting investor attention and encouraging innovation and growth in the sector. This demonstrates a healthy environment for innovation.

Private Market Investment Activity

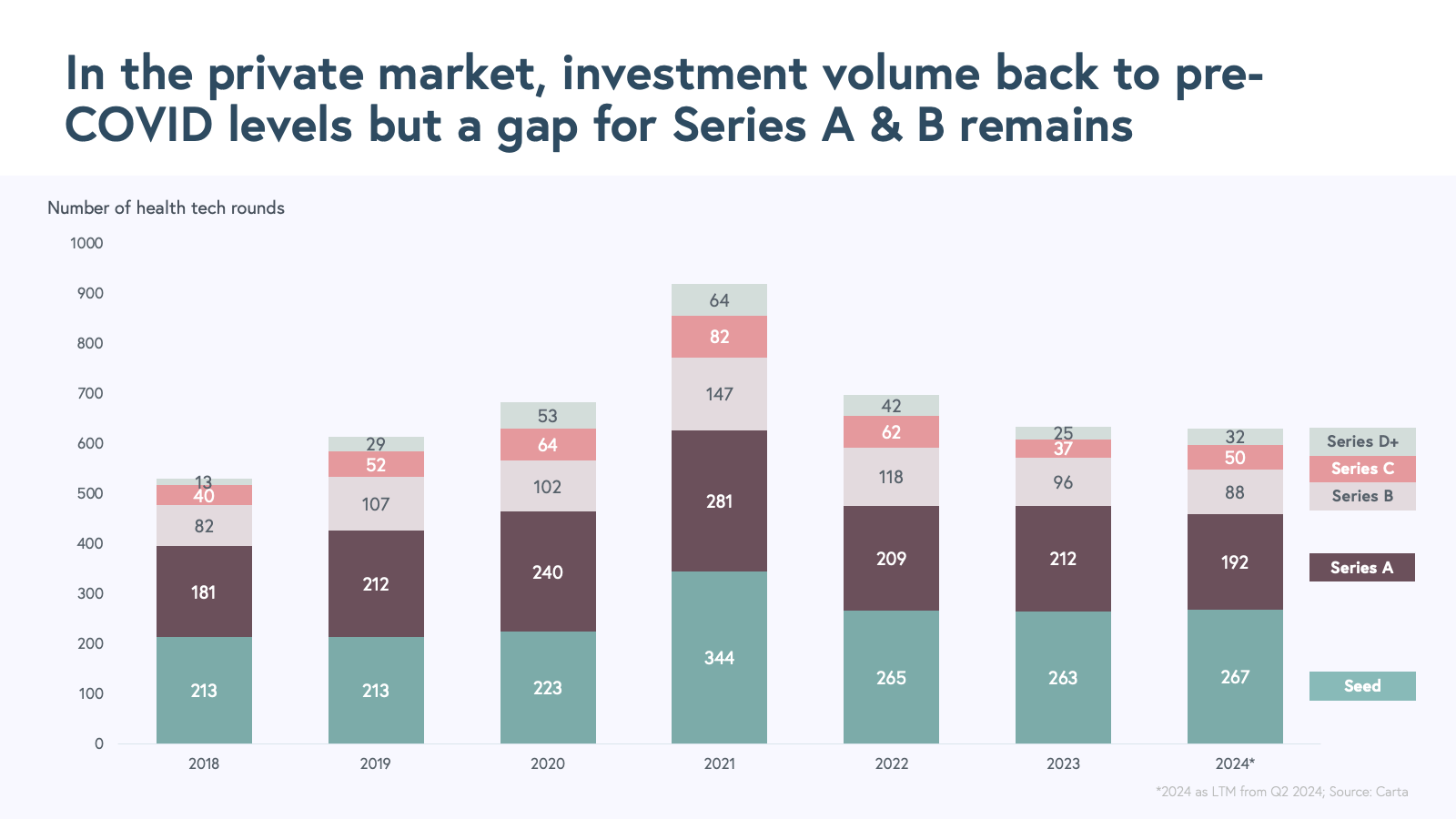

The private health tech market in 2024 demonstrates resilience and adaptability. Following a period of market correction, signs of recovery are evident. Private market investments have rebounded to pre-COVID levels, according to Carta data, with Seed and Series C+ deals nearing 2020 volumes. We have witnessed a bustling scene of new Seed-stage companies sprouting at the intersection of AI and healthcare. Established businesses with scale that have refined their focus on growth and profitability have successfully secured later-stage rounds in 2024.

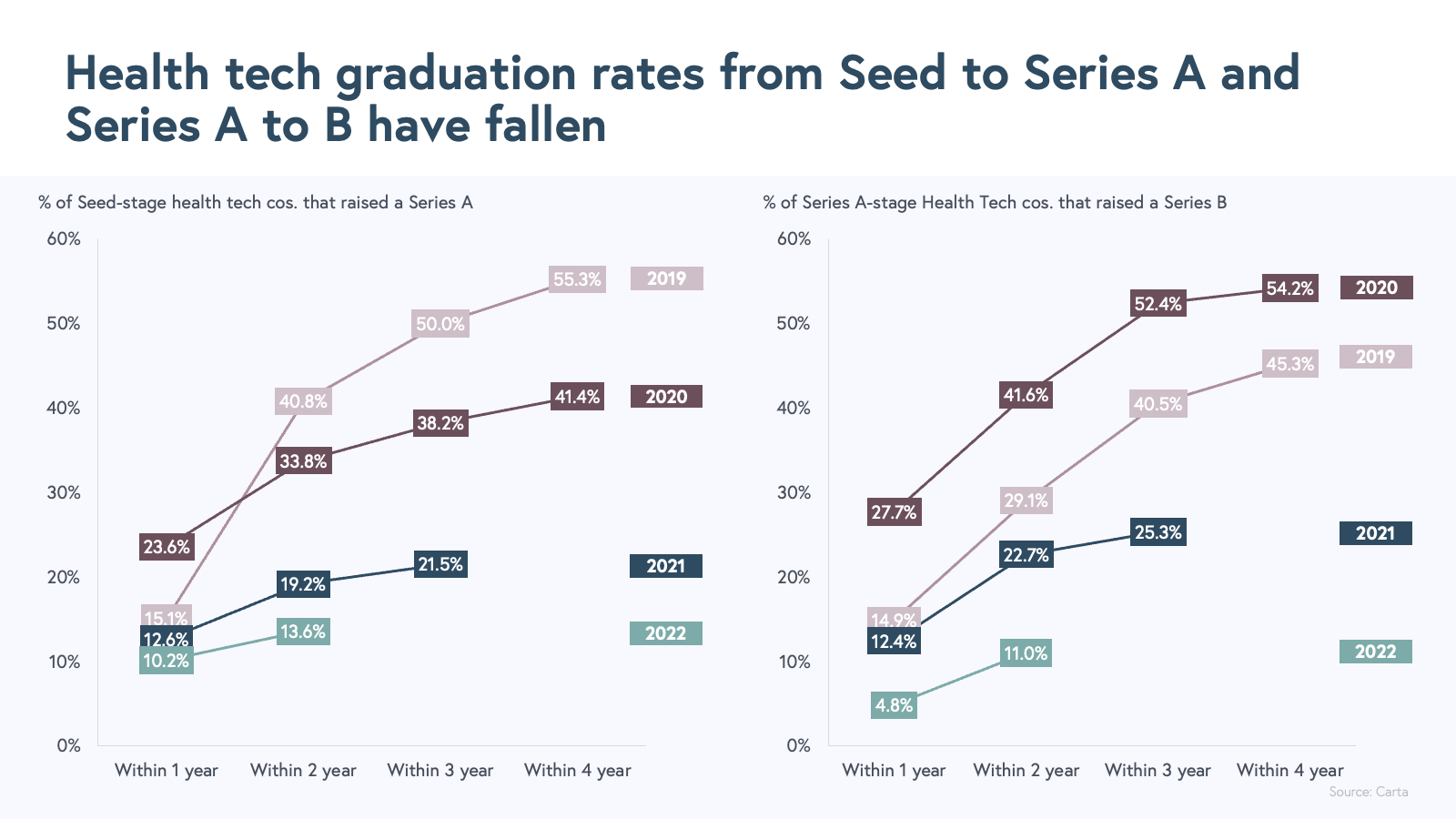

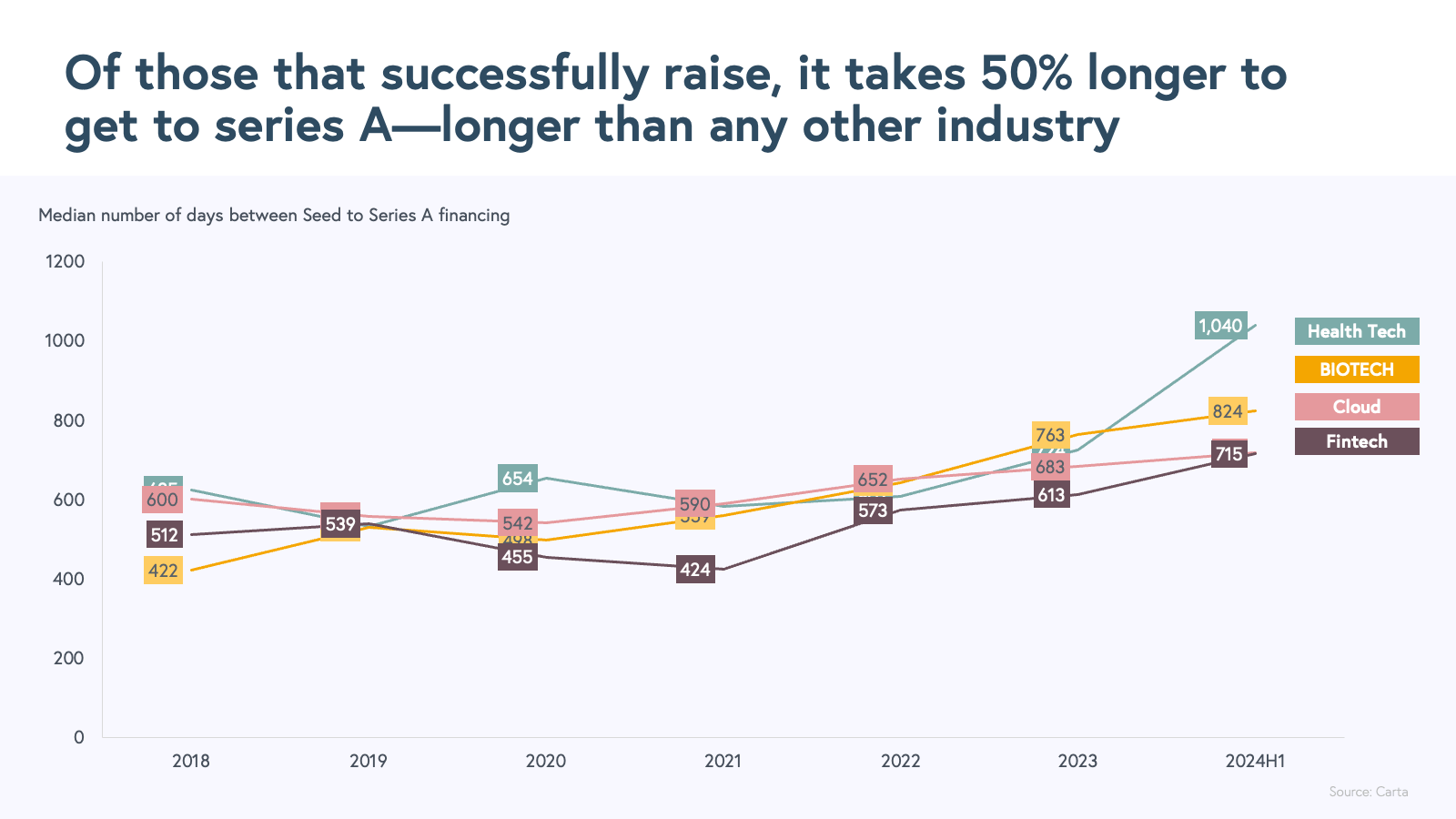

Yet, a gap remains: declining Series A and B financings. This highlights challenges faced by early-stage ventures. The rate at which Seed-funded companies advance to Series A has significantly decreased for recent cohorts. The challenges are pronounced in the health tech market. Companies that raised Series A financing in 2021 and 2022 are experiencing difficulties in securing Series B funding.

Given the more difficult financing conditions and a rising bar for early-stage startups, a Series A and B playbook for $1-10 million ARR businesses will be released in the coming months. This will include guidance for entrepreneurs to succeed in today’s market depending on their business model and will include a refreshed version of their benchmarks initially published in our April 2023 Scaling Health Tech Businesses report.

Valuation Dynamics

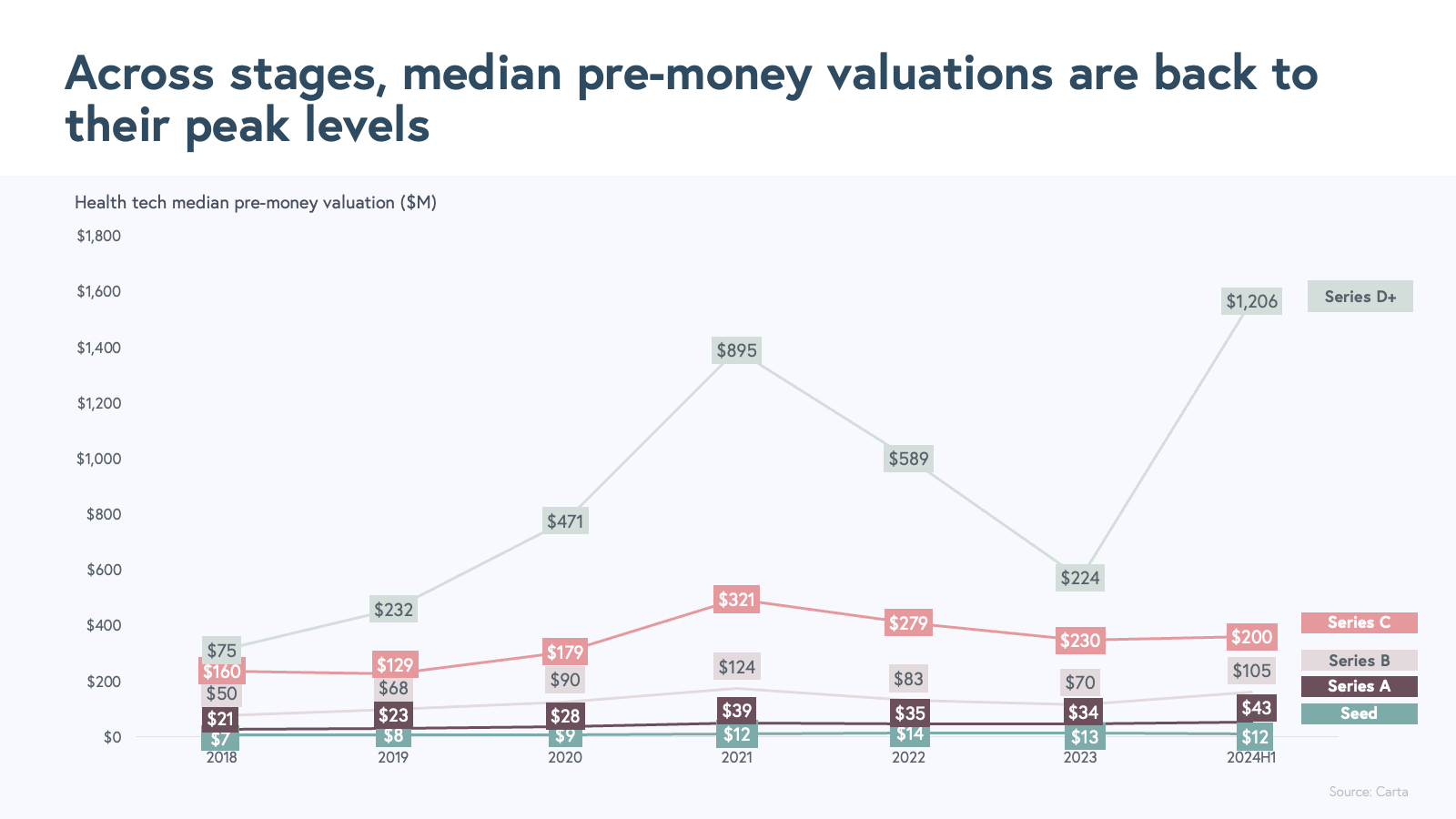

The good news is that valuations have rebounded to peak levels. 2024 health tech companies are achieving their highest median pre-money valuations across stages compared to the last few years. This is driven by several factors.

For Series D+ rounds, “Phoenix” companies––those that have recovered following the market correction––are commanding higher valuations. These companies, such as Grow Therapy, Equip, and Maven, have shown significant growth, scale, and strong unit economics.

At the Seed through Series C stages, investments in AI-focused startups are driving the rise in early-stage valuations. The AI factor has been the fuel for these surges.

The AI Factor

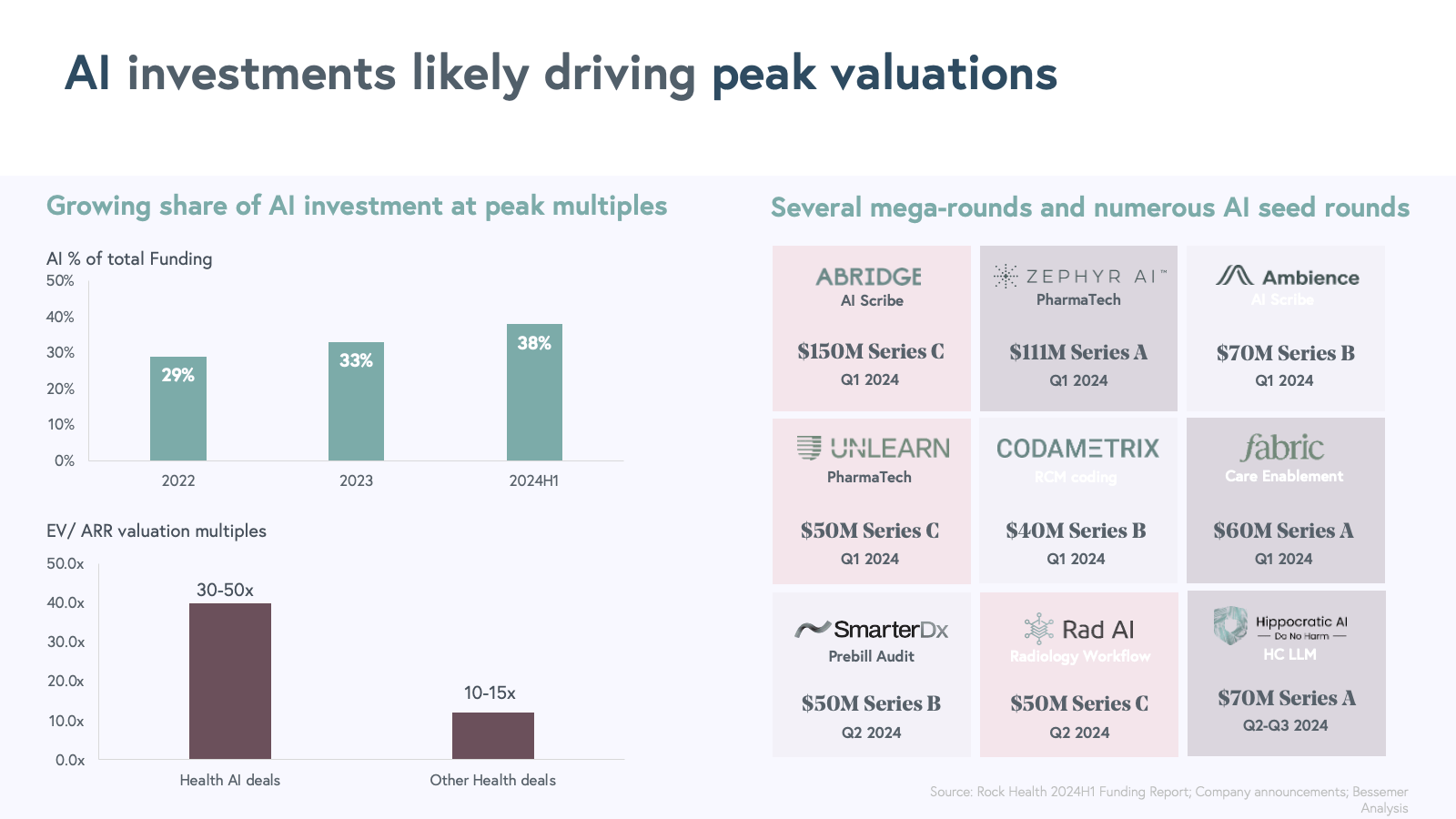

The influence of artificial intelligence on health tech cannot be overstated. The share of health tech dollars invested in AI-focused companies has increased by nine percentage points in just two years, reaching 38% in 2024 to date.

At 30-50x EV/ARR multiples, the valuations that some of these AI companies are commanding can range 2-5x higher than their non-AI counterparts. These high valuation multiples showcase the private market excitement for new business models, market, and technology category creation.

We’re seeing multiple “mega rounds” of >$50 million invested capital in exciting categories like AI-scribes, revenue cycle management (RCM), and back-office admin automation. Many of these companies have seen strong commercial market pull as providers, payers and pharma stakeholders are focused on developing AI strategies and are more willing to experiment with products that drive measurable ROI. The impact of AI is clearly visible here.

Scaling in the Age of AI: Benchmarks for a New Business Model

Over the last year, a group of Series A and B companies have rapidly reached scale with a new business model called “AI Services-as-Software”. We have closely studied this group and are publishing a new set of benchmarks for these companies in the $1-10 million ARR range.

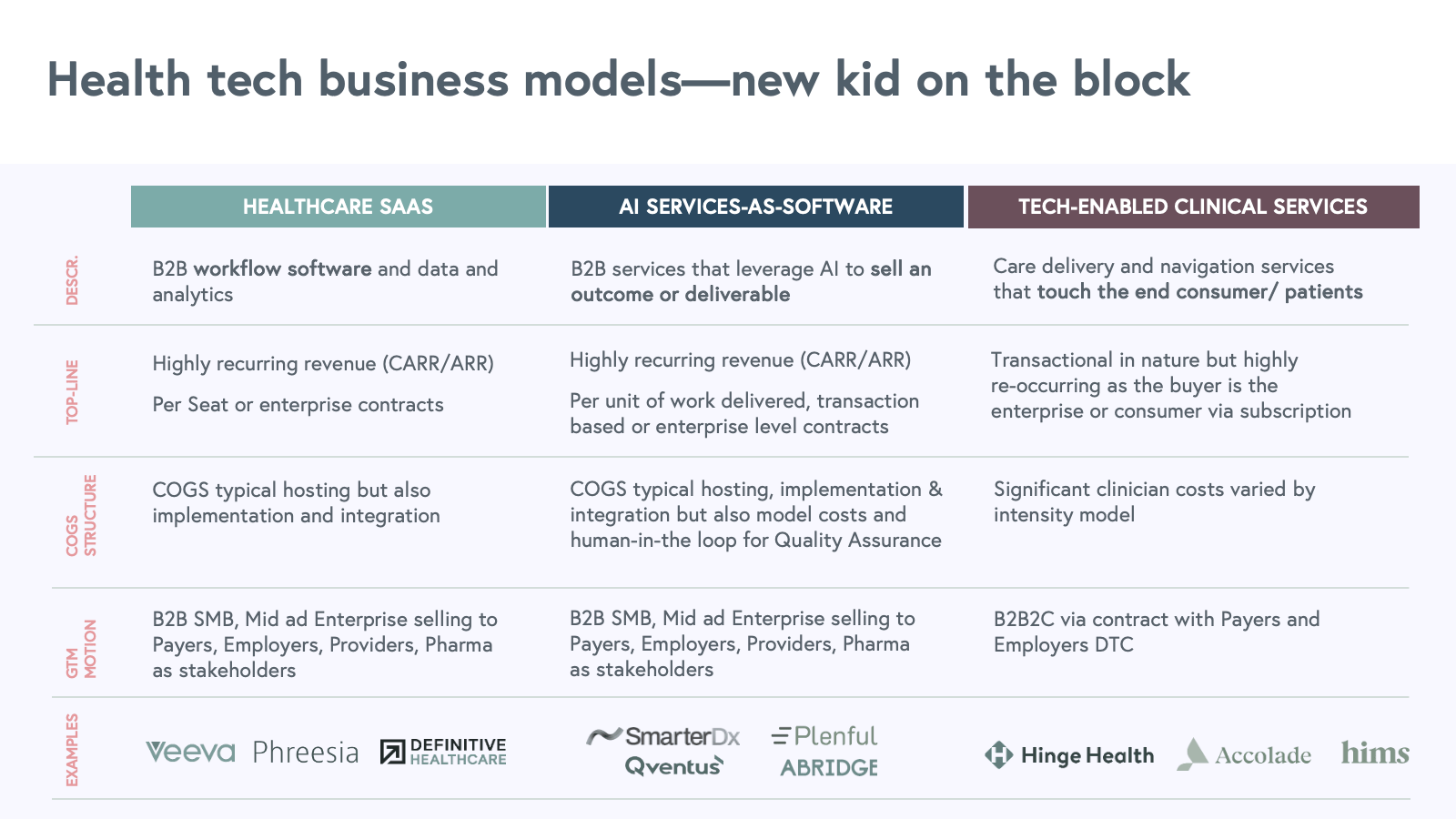

Let’s first revisit the Health Tech business models:

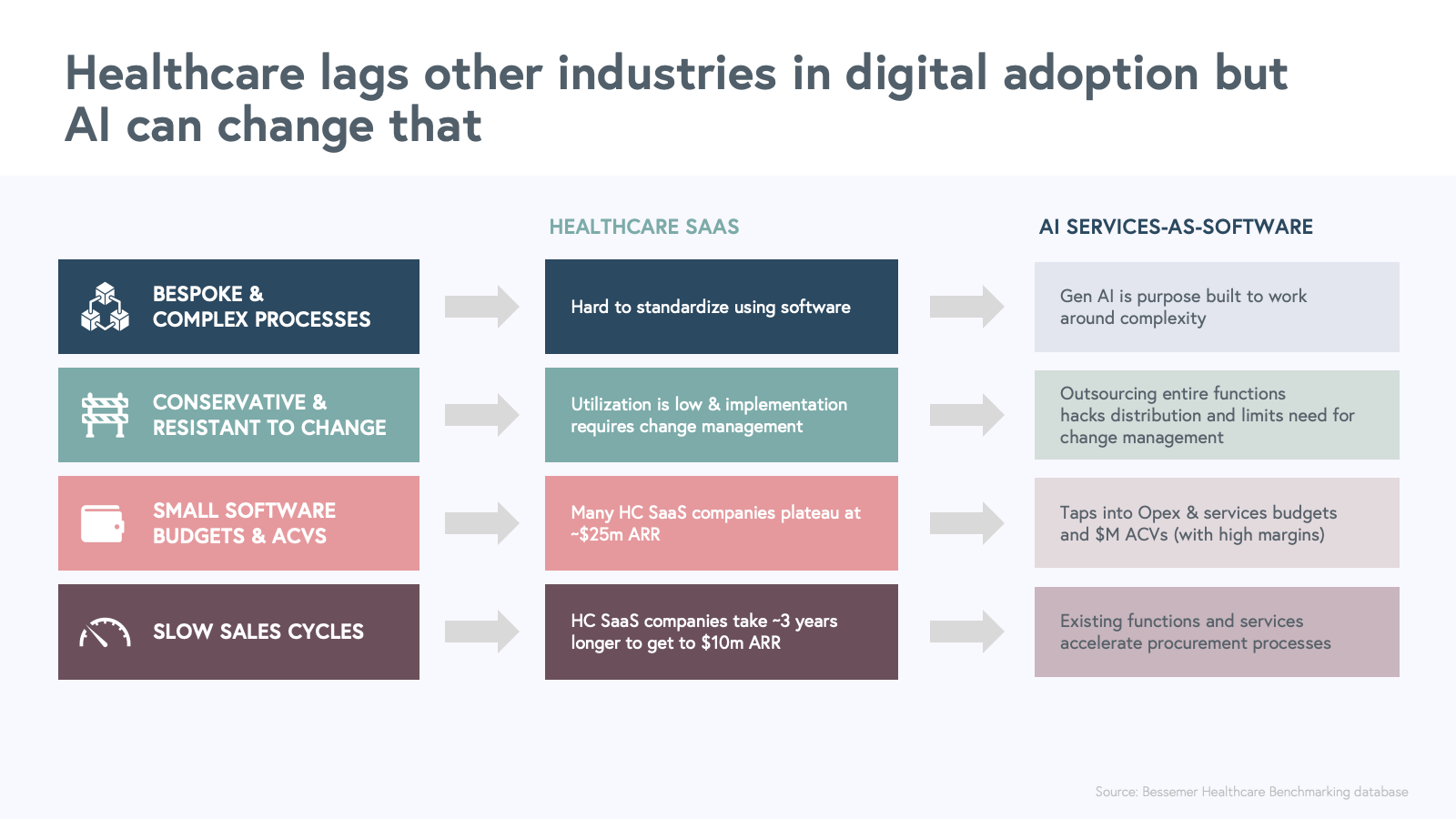

- Healthcare SaaS: Traditional B2B workflow software, data, and analytics businesses selling to various stakeholders.

- Tech-enabled clinical services: Care delivery and navigation services leveraging technology to enhance care delivery.

- AI Services-as-Software: B2B services that leverage AI to sell an outcome for various stakeholders. These businesses use AI to autonomously perform tasks that have typically required human intervention.

AI Services-as-Software: A New Paradigm

In last year’s report, we predicted the rise of AI-powered “Services-as-Software,” and 2024 has proven this model’s rapid adoption. These businesses use AI to perform tasks that typically required human intervention. By leveraging AI capabilities, they streamline processes and handle work for B2B customers across providers, payers, and pharma.

Examples of this model in our portfolio include:

- Abridge: Automates medical documentation and clinical note generation.

- SmarterDx: AI-powered clinical review and quality audits of complex medical claims.

- Qventus: Automated surgery scheduling and surgical operations.

- Plenful: Back-office automation and data management for specialty pharmacies.

These companies help operational teams with routine tasks, reducing administrative spend and addressing the healthcare labor shortage. AI Services-as-Software companies allow organizations to allocate their workforce more efficiently.

While many healthcare companies are leveraging AI in their products, AI Services-as-Software companies are enabling a new category where service is delivered as a product. For example, SmarterDx offers an AI-powered clinical audit layer for complex medical claims, streamlining a process usually done by humans.

Healthcare has traditionally lagged behind other industries in digital adoption. AI Services-as-Software companies are well-positioned to change that trajectory. Because these companies take on entire end-to-end chunks of work, they limit the need for change management, which makes their products easier to adopt.

AI Services-as-Software Benchmarks

Early benchmarks from a cohort of approximately 20 companies that fall in this business model suggest an accelerated go-to-market trajectory compared to traditional SaaS models.

Here are the benchmarks for AI Services-as-Software companies compared to prior business models:

-

AI Services-as-Software companies show unprecedented speed to hit $10M ARR and on average grow as fast, or faster, than tech-enabled clinical services.

We hypothesize that the higher growth rates and faster sales cycles are driven by the urgency from buyers to test these AI-enabled solutions. It is crucial for these companies to get past the experimental phase by demonstrating clear ROI, ideally selling to stakeholders with established budgets. Some level of transactional or services revenue is normal in this business model.

-

AI Services-as-Software companies are experiencing record-breaking sales cycles due to high industry demand and are seeing customer acquisition cost (CAC) payback periods similar to those of SaaS.

-

Gross margins vary within subcategories of AI Services-as-Software companies. We see three types of AI Services-as-Software companies:

- Copilots: AI tools automating tasks.

- AI-first services: AI services with a human in the loop.

- Agents: AI tools replacing workers by automating workstreams.

While gross margins vary (10% to 90%), the average is 60%. Although these companies may have lower gross margins than traditional SaaS businesses, companies with strong product-market fit and growing scale are able to get some economies of scale for model costs. These companies are often attacking much more complex use cases.

-

AI Services-as-Software businesses have similar efficiency scores as traditional software despite the variety of gross margins. This profitable growth is encouraging for these startups.

These early benchmarks are encouraging for a new way of digitizing the healthcare industry. [Organization Name] will be monitoring these companies as they scale and will be reporting additional learnings.

Where are we going?

Emerging Trends and Predictions

As we look to the future of health tech, several key trends and opportunity areas are emerging. Here are our top predictions for the coming year:

-

Payer administration insourcing: Services-as-Software adoption accelerates

We anticipate new companies focused on payers and third-party administrators (TPAs). There is an appetite to reduce costs, improve quality and maintain greater control using AI-first services. Expect more solutions for utilization management and streamlined direct contracting with providers.

-

Transparency tooling in pharmacy: Navigating the evolving landscape

The rising costs of prescription drugs are a focus of bipartisan efforts aimed at enhancing transparency and streamlining drug channels. We see significant opportunities for companies that can provide tools for rebate transparency and management, and for the implementation of new pricing policies.

-

AI-Assisted clinical services: Empowering independent providers.

AI has the potential to augment clinical capabilities. Key areas of opportunity include risk stratification, triage and care navigation, symptom tracking and analysis, and more tech-first Managed Services Organizations. Tech-first is key here.

-

Value-based care system of record: Enabling the shift to risk-based models

The transition to risk-based programs is creating a need for streamlined processes in value-based care models. Opportunities in this area, include risk stratification, platforms for managing contracts, and data capture systems to measure impact and attribution of lowering the cost of care.

Embracing the Future of Health Tech

The trends and predictions highlighted here represent just a few opportunities in the health tech space. The resilience and innovation of digital health companies, coupled with the potential of AI, signals a new era in healthcare. While challenges remain, the health tech sector is well-positioned to drive improvements in healthcare delivery, outcomes, and cost-effectiveness.

To the entrepreneurs, investors, and innovators: your perseverance and creativity continue to inspire us. As we move forward, let’s embrace the lessons learned, leveraging them to build a healthier future for all.

Footnotes

- Thanks to Karen Jiang for her invaluable help.

- [Organization Name] has renamed “Tech-Enabled Services” to “Tech-Enabled Clinical Services” to reflect this segment.