Jiangxi Xinyu Guoke Technology: Examining the Stock’s Prospects

Recent market performance might easily lead investors to overlook Jiangxi Xinyu Guoke Technology (SZSE:300722), especially given an 11% stock decline over the past three months. However, a closer analysis reveals a company with robust financials, potentially presenting a valuable opportunity for investors. This analysis focuses on the company’s return on equity (ROE) and its implications for potential shareholders.

Understanding Return on Equity (ROE)

Return on equity is a key financial metric used to gauge how effectively a company uses shareholder capital. It essentially measures a company’s profitability in relation to its equity. This ratio is calculated using the following formula:

ROE = Net Profit (from continuing operations) / Shareholders’ Equity

Based on the trailing twelve months ending September 2024, Jiangxi Xinyu Guoke Technology’s ROE is 13%, calculated as CN¥78 million in net profit divided by CN¥619 million in shareholders’ equity. This means the company generates a profit of CN¥0.13 for every CN¥1 of shareholder investment.

ROE and Earnings Growth

ROE provides valuable insights into a company’s potential for earnings growth. Companies with higher ROE, especially when coupled with high profit retention rates, tend to exhibit higher growth rates compared to those lacking these characteristics. This concept is critical when evaluating Jiangxi Xinyu Guoke Technology.

Comparing ROE and Growth

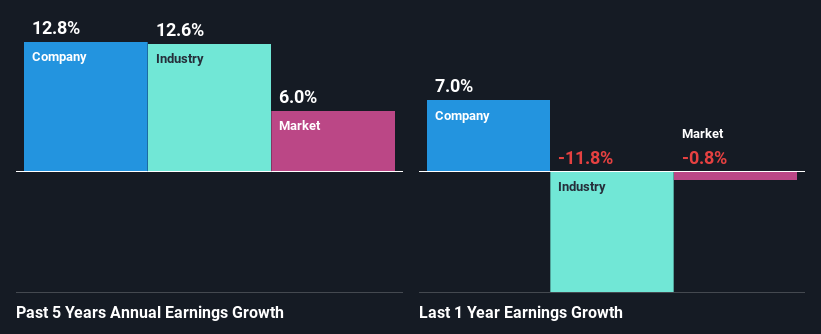

Jiangxi Xinyu Guoke Technology’s ROE stands at a respectable 13%, significantly exceeding the industry average of 5.7%, reflecting the company’s effective capital management. This finding correlates with moderate growth in net income, a significant factor when measuring the company’s long-term value. The article states that over the past five years, the company saw a 13% net income growth.

Comparing the company’s growth rate to industry averages, the growth is currently similar.

Evaluating Efficient Profit Reinvestment

The company demonstrates efficient use of profits through a medium three-year median payout ratio of 44% and a retention ratio of 56%, contributing positively to earnings. The company’s consistent dividend payments over seven years further reflect shareholder commitment.

Summary

In conclusion, Jiangxi Xinyu Guoke Technology presents a relatively healthy financial profile. The company effectively reinvests a considerable portion of its profits at a high rate of return, which has led to significant earnings growth.