China Rare Earth Resources And Technology Co. (SZSE:000831): High P/S Ratio Raises Questions

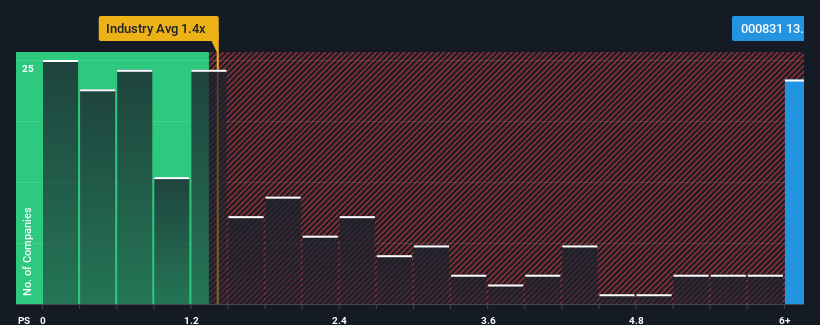

When nearly half of the companies in China’s Metals and Mining industry have price-to-sales ratios (P/S) below 1.4x, China Rare Earth Resources And Technology Co., Ltd. (SZSE:000831) stands out with a ratio of 13x. This raises the critical question: is this stock overvalued?

Recent Performance and Valuation

While the broader industry has seen revenue growth, China Rare Earth Resources And Technology has experienced a decline. This downturn could suggest that current investors are anticipating a significant recovery in revenue, which is maintaining the P/S ratio. If this recovery doesn’t materialize, investors might face losses.

Revenue Growth Forecast

A high P/S ratio often implies expectations that a company will significantly outperform its industry. However, China Rare Earth Resources And Technology’s revenue decreased by 48% over the last year. Looking back, the company’s revenue has shrunk by 11% in the last three years. Consequently, shareholders are likely disheartened by the company’s medium-term revenue growth rates.

However, analysts predict a notable revenue increase of 45% in the coming year, while the industry is only expected to grow by 14%. This projected growth could explain the high P/S ratio, as investors might be willing to pay a premium for the stock.

The Bottom Line

The price-to-sales ratio, although not always the best for valuation within certain industries, can indicate business sentiment. The analysis of China Rare Earth Resources And Technology suggests its strong revenue outlook is driving its high P/S. This indicates shareholder confidence in the company’s future revenue, which appears to be supporting its current valuation. Unless the market outlook shifts, the share price may prove stable. This is an area that requires further research and thought.

Disclaimer: This article is for informational purposes only and is not intended as financial advice.