PAR Technology Corporation: Breakeven Point Anticipated Soon

PAR Technology Corporation (NYSE:PAR), a provider of cloud-based hardware and software solutions to the restaurant and retail industries, appears to be on the verge of a significant financial milestone.

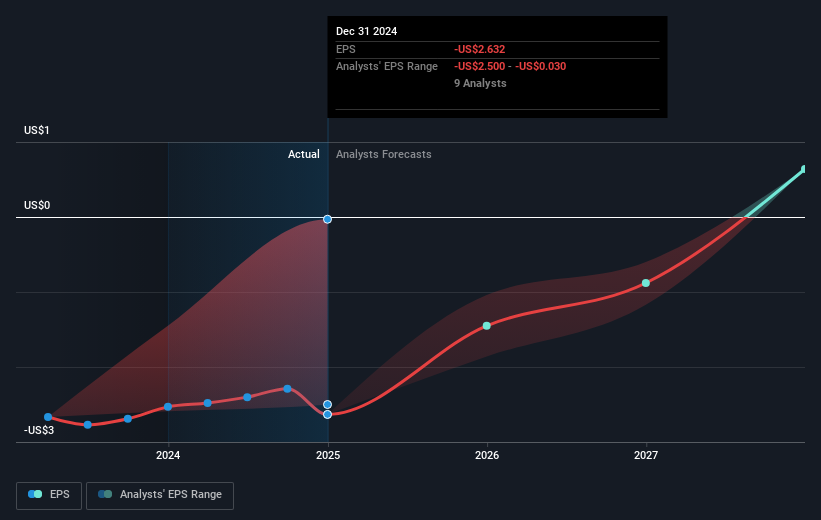

Analysts following the $2.7 billion market-cap company expect PAR Technology to achieve profitability in the near future. The company reported a loss of $90 million for the fiscal year ending December 31, 2024. The central question for many investors has been: “When will PAR Technology become profitable?”

Based on the consensus of six American Electronic analysts, PAR Technology is nearing its breakeven point. They forecast the company will record a final loss in 2026 and then turn a profit of $28 million in 2027. This projection suggests the company will reach breakeven approximately two years from now.

To achieve profitability by this timeline, the company will need to sustain an average annual growth rate of 77%, according to calculations based on a line of best fit. This growth projection is considered optimistic. If the company’s growth rate is slower, the breakeven point will likely be pushed further into the future.

While the specific factors driving PAR Technology’s growth are beyond the scope of this overview, it’s generally recognized that high forecast growth rates are common during investment periods. However, an important consideration is the company’s relatively high debt level. PAR Technology’s debt-to-equity ratio stands at 42%, exceeding the typical benchmark of 40%. Increased debt obligations can raise the risk associated with investing in a company that is currently operating at a loss.

For a more detailed analysis, including valuation and management team assessments, readers are encouraged to explore PAR Technology’s company page on Simply Wall St. A free research report is available to help visualize whether PAR Technology is currently mispriced by the market.

Disclaimer: This article is based on historical data and analyst forecasts and is not intended as financial advice. It does not constitute a recommendation to buy or sell any stock and does not account for any individual investor’s objectives or financial circumstances. Always conduct your own thorough research and seek advice from a qualified financial advisor before making any investment decisions. Simply Wall St has no position in any stocks mentioned.