Cognizant Technology Solutions: Trailing Market Growth, but is the Stock Price Reflecting It?

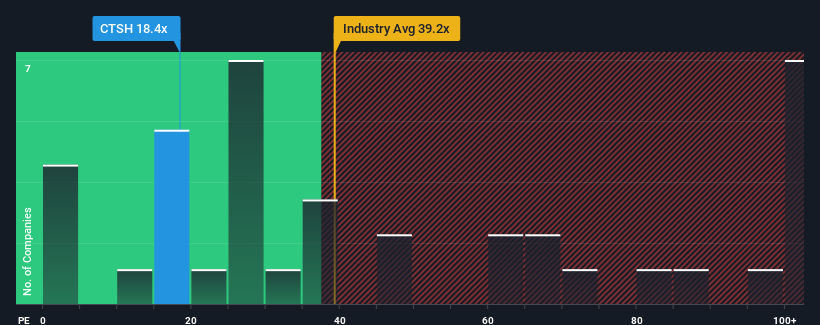

Many investors might not give a second thought to Cognizant Technology Solutions Corporation’s (NASDAQ:CTSH) price-to-earnings (P/E) ratio of 18.4x, especially since the median P/E in the United States hovers around 18x. However, a closer look might reveal an opportunity or a potential risk if the P/E isn’t justified.

Cognizant has shown solid recent performance, with earnings growth surpassing many other companies. Market expectations for a slowdown in earnings growth could explain why the P/E hasn’t risen further. This could be a signal of optimism for existing shareholders, regarding the future share price. However, the question remains: is the current P/E accurately reflecting future prospects?

For a comprehensive overview of analyst estimates, a free report on Cognizant Technology Solutions is available to shed light on future projections.

Growth Metrics and the P/E Ratio

A P/E ratio like Cognizant’s is typically justifiable when a company’s growth aligns closely with the market’s performance. Cognizant’s bottom line saw a 7.3% increase in the past year and a 12% rise in EPS over the last three years, partly boosted by recent performance. This represents respectable earnings growth.

Looking ahead, analysts predict an 8.8% annual earnings growth over the next three years. In contrast, the broader market is expected to expand by 11% annually, indicating a more attractive growth trajectory.

Considering these projections, the fact that Cognizant’s P/E mirrors that of many other companies is noteworthy. It suggests that investors in the company might be less pessimistic than analysts, possibly indicating a reluctance to sell their stock at current prices. Consequently, these shareholders could face disappointment if the P/E adjusts to reflect the growth outlook.

What the P/E Ratio Reveals

While the P/E ratio shouldn’t be the sole determinant in investment decisions, it serves as a valuable indicator of earnings expectations. The analysis of Cognizant’s forecasts reveals that its less favorable earnings outlook doesn’t appear to be fully reflected in its P/E.

When a weaker earnings outlook accompanies slower-than-market growth, the share price may be at risk, potentially driving the moderate P/E lower. Without improvements in these conditions, the current price levels may seem unjustified.

For a deeper understanding, it’s crucial to consider other significant risk factors, which can be found on the company’s balance sheet. A complimentary balance sheet analysis with six simple checks is available to identify potential risks.

If seeking alternative investment options, a free list of companies trading at low P/E ratios with demonstrated earnings growth is also available.