Insider Ownership Dominates Jiangsu Bojun Industrial Technology (SZSE:300926)

Analysis reveals that the CEO of Jiangsu Bojun Industrial Technology Co., Ltd. (SZSE:300926), Yalin Wu, is the most significant insider, holding a substantial stake in the company. This insider dominance suggests a strong alignment of interests between leadership and shareholders, potentially driving company growth.

Ownership Structure and Insider Control

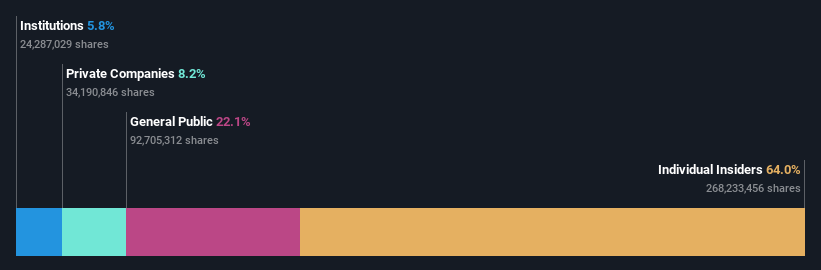

Understanding the ownership structure is critical to assessing the company’s potential. Insiders, primarily consisting of key individuals, account for approximately 64% of the total shares. This concentration of ownership implies that insiders stand to gain the most from the company’s success.

Last week’s 3.9% gain in stock value directly benefited these insiders, highlighting the impact of their investment.

Institutional Ownership

Institutional investors have a stake in Jiangsu Bojun Industrial Technology, indicating some level of credibility among professional investors. However, it is essential to consider the broader market context. Large institutional sell-offs can trigger notable price drops.

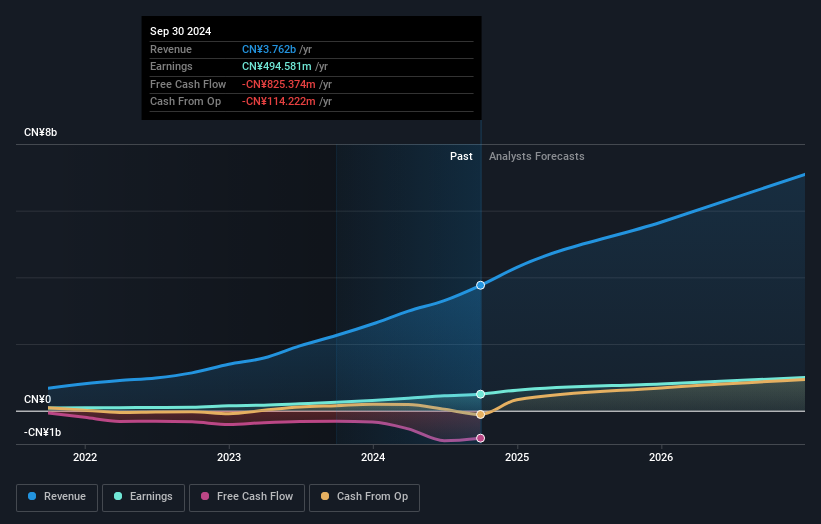

Earnings and Revenue Growth

Examining the company’s past earnings trajectory is vital for a complete evaluation.

CEO’s Significant Stake

CEO Yalin Wu holds the largest individual stake, possessing 64% of outstanding shares. This significant ownership suggests the CEO has considerable control over the company’s direction.

This high level of insider ownership is often viewed positively by investors because it implies the management is likely to act in the best interests of the company.

The second and third largest shareholders hold 8.2% and 2.6% of the outstanding shares, respectively.

Public and Private Company Ownership

The general public, comprising individual investors, holds roughly 22% of Jiangsu Bojun Industrial Technology’s shares, exerting a real, though not controlling, influence.

Private companies own 8.2% of shares, warranting further exploration to identify the ultimate beneficiaries.

Conclusion

While it’s essential to analyze ownership, a complete investment assessment requires additional information. Investors should also consider any warning signs and analyst forecasts for future growth.

Disclaimer: This article is based on historical data and analyst forecasts and does not offer financial advice.