Accton Technology: Strong Fundamentals Amidst Recent Market Concerns

It’s understandable not to be overly enthusiastic about Accton Technology (TWSE:2345) at first glance, especially considering its recent 13% stock decline over the past month. However, a deeper dive into its financial health may reveal a different story. Given that a company’s fundamentals typically drive long-term market outcomes, Accton Technology warrants a closer examination. This analysis will focus on the company’s return on equity (ROE).

Return on equity, or ROE, is a crucial metric for investors, as it indicates how effectively a company utilizes shareholder capital. Essentially, it measures a company’s profitability in relation to its shareholders’ equity.

Calculating Accton Technology’s ROE

The ROE formula is as follows:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

Based on this, Accton Technology’s ROE is:

33% = NT$9.7b ÷ NT$29b (Based on the trailing twelve months to September 2024).

The ‘return’ represents the income generated by the business over the past year. In simpler terms, for every NT$1 of shareholder capital, the company generated NT$0.33 in profit.

The Importance of ROE in Earnings Growth

ROE serves as a key indicator of a company’s profitability. The rate at which a company reinvests or “retains” these profits, combined with how efficiently it does so, helps assess its potential for earnings growth. Generally speaking, companies with a high ROE and a good profit retention rate tend to experience higher growth compared to those that lack these qualities.

Accton Technology’s Earnings Growth and 33% ROE

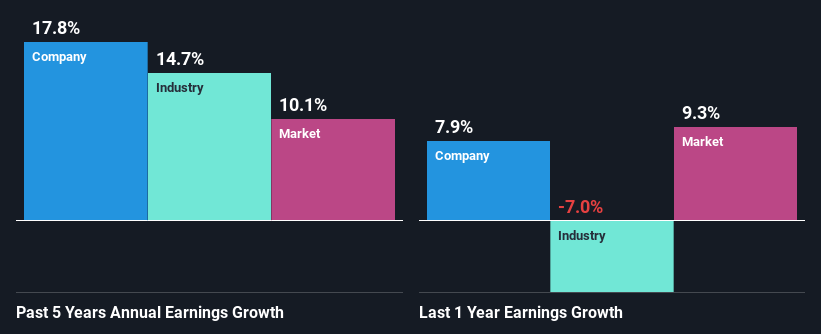

A key positive is Accton Technology’s impressive ROE. Furthermore, its ROE significantly surpasses the industry average of 11%. This has likely contributed to Accton Technology’s decent net income growth of 18% over the last five years. When comparing Accton Technology’s net income growth to the industry average of 15%, the company’s performance is notably stronger.

Earnings growth is a key metric in stock valuation. Investors should consider whether expected earnings growth or decline is already factored into the stock price to gauge if the stock has upward potential or is heading for difficulties. If you are interested in Accton Technology’s valuation, you can check out this gauge that compares the company’s price-to-earnings ratio to the industry.

Effective Use of Retained Earnings?

Accton Technology’s high three-year median payout ratio of 57% (or a retention ratio of 43%) suggests that its growth hasn’t been significantly hindered, even while returning a substantial portion of its income to shareholders. The company has also consistently paid dividends for at least a decade, demonstrating its commitment to sharing profits.

Analysts anticipate the company’s future payout ratio to remain steady at 63% over the next three years. Interestingly, Accton Technology’s ROE is predicted to increase to 42% despite an unchanging payout ratio.

Conclusion: A Positive Outlook for Accton Technology

Overall, Accton Technology’s performance appears promising. The high ROE, in particular, has fostered impressive earnings growth. Even with only a relatively small portion of its profits reinvested, the company has still managed to grow its earnings, which is commendable. Based on current analyst estimates, the company’s earnings are expected to accelerate in the coming period.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.