The initial fervor surrounding artificial intelligence (AI) in the market during 2023 and 2024 has begun to wane in 2025. After a period where it seemed AI stocks could only rise, a downturn has taken hold. Companies like Palantir Technologies and Tesla, which are heavily involved in AI, have seen their stock prices drop by over 30% from their peak values. Investors are concerned about a potential slowdown in spending for these companies, coupled with broader market weakness linked to recession fears and the Trump administration’s proposed tariffs. This price correction presents a buying opportunity for long-term investors. Here are two AI-focused stocks that analysts believe are positioned for long-term gains despite the recent dip.

Alphabet: Pioneering Innovation

Alphabet (GOOG 0.76%) (GOOGL 0.79%), the parent company of Google, YouTube, and Google Cloud, has experienced fluctuating perceptions from Wall Street. While often lauded as a leading innovator in AI, developing new technologies at the forefront of the field, its position has come under scrutiny over time. The narrative has shifted as a result of increasing competition from companies like OpenAI. Despite the pessimism at the start of 2025, now seems an opportune time to invest in this high-quality business.

In 2024, Alphabet’s revenue increased by 15% year-over-year, reaching $350 billion. Its operating income surged by 33% to $112.4 billion, demonstrating that the company is not being severely impacted by the rise of AI competitors. Alphabet continues to be innovative across its broad business divisions. The company is making AI accessible by integrating new tools into Google Search, offering cloud computing services through Google Cloud, and expanding its robotaxi service, Waymo, in major U.S. cities. However, this is just the beginning of the innovations offered by Alphabet. Within its Google Deepmind division, researchers are pursuing advanced AI developments, like integrating language models in humanoid robots. Moreover, they are experimenting with quantum computing. Based on these factors, there is no proof that Alphabet is faltering in the age of AI.

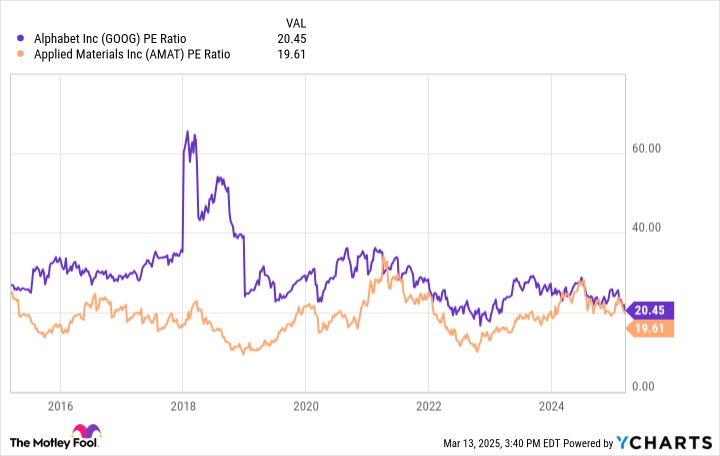

With its stock price down 20% from its all-time high, Alphabet has a price-to-earnings (P/E) ratio of 20, which is below the S&P 500 average of 28. For investors willing to hold their shares for the long term, now seems like a good entry point, despite the emergence of new competition and macroeconomic threats, like tariffs.

Applied Materials: The Core of AI

Applied Materials (AMAT -1.49%) differs significantly from Alphabet in that it isn’t a consumer-facing business. Instead, the company develops and sells machinery crucial to semiconductor manufacturing. Without advanced semiconductors, AI tools would not be viable. Applied Materials, along with other semiconductor equipment companies, enables manufacturers to shape, process, and analyze tiny transistors on semiconductors.

The company plays a crucial role in the AI supply chain, enabling the compact 3-nanometer distances between transistors. Over the last few decades, as the semiconductor market expanded, so did Applied Materials, growing into a global giant. The industry is projected to continue growing faster than global GDP supported by increased AI spending, which should further benefit the company. Over the past decade, Applied Materials has nearly doubled its sales revenue, and the management has reduced its outstanding shares by about one-third through consistent share buyback programs. The management plans to allocate a minimum of 80% of its free cash flow to dividends and buybacks in the future. Recently, the board of directors authorized a supplementary $10 billion buyback and a 15% dividend increase.

With a P/E ratio now below 20, Applied Materials appears to be an inexpensive growth stock that offers attractive capital returns, making it a suitable investment for long-term holding.