AI Stock Dip: A Buying Opportunity

Recent market volatility, fueled by concerns about trade wars, has led to a sell-off in many sectors, and artificial intelligence (AI) stocks haven’t been spared. While the S&P 500 has declined roughly 6% at the time of this writing, many AI stocks have experienced even steeper drops. This presents what could be a short-term market correction, and I’m viewing this as an opportune moment to add to my holdings in some top AI companies.

Companies like Nvidia (NVDA), Alphabet (GOOG) (GOOGL), and Taiwan Semiconductor Manufacturing (TSM) are down roughly 20% from their recent highs. For investors with a long-term view, these could be attractive entry points. Let’s take a closer look at each one.

1. Nvidia: The GPU Powerhouse

Nvidia has been a leader in the AI stock market since 2023. Its graphics processing units (GPUs) are essential for training and running AI models, effectively driving the AI arms race. While some analysts have expressed concerns about demand, given the efficiency of newer AI models, Nvidia’s major clients are increasing capital expenditures. This suggests strong demand.

Nvidia is anticipated to have a very strong fiscal year. Management forecasts a 65% year-over-year increase to $43 billion in revenue for the first quarter of fiscal 2026, which would conclude around April 30. This anticipated growth will be spurred by the company’s latest Blackwell chip generation. Blackwell GPUs present significant performance improvements relative to the prior Hopper architecture, allowing users to build more efficient AI models.

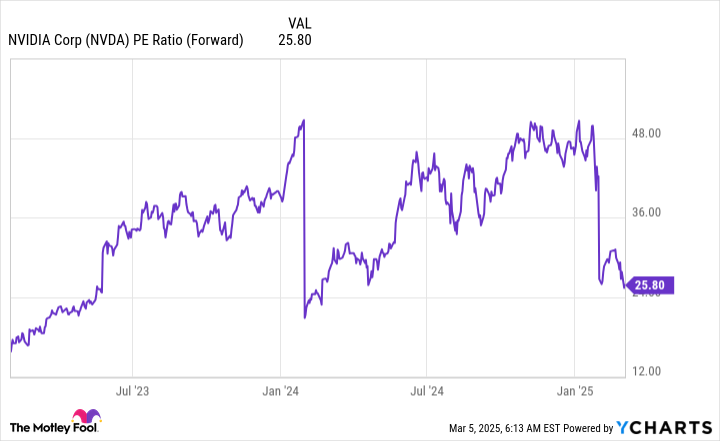

Analysts anticipate revenue growth of 56% for fiscal year 2026 (ending in January 2026), indicating continued expansion for Nvidia. However, the market doesn’t seem to have priced it appropriately. The stock currently trades at less than 26 times forward earnings, which is the lowest it has been in around a year.

This valuation represents a significant bargain, and investors should consider acquiring shares of this well-regarded company.

2. Alphabet: A Value Play

Alphabet’s valuation is even more attractive than Nvidia’s; the company’s stock trades at 21 times trailing earnings and 19 times forward earnings. In comparison, the S&P 500 has a ratio of 23.9 times trailing earnings and 21.6 times forward earnings, implying the broader market is a bit more expensive than Alphabet’s shares.

This appears illogical, considering Alphabet’s business, which is driven by Google search engine advertising, is flourishing. During the fourth quarter, its revenue grew by 12%, while earnings per share (EPS) jumped 31%. These figures do not align with a company typically trading at a discount relative to the broader market.

Analysts project 11% revenue growth in 2025 and 2026, indicating that Alphabet has the capacity to achieve market-beating growth. When combined with its comparatively low stock price, it’s set up to outperform the market over the next few years.

3. Taiwan Semiconductor: Addressing Trade Concerns

Taiwan Semiconductor (TSMC) seems to have managed to mitigate concerns about tariffs by announcing a $100 billion investment in the U.S. to build fabrication facilities, packaging facilities, and a research and development center. This is in addition to the $65 billion the company announced a few years ago, making the total investment $165 billion.

Because of this considerable investment, TSMC appears to have reduced the threat of tariffs, which weighed heavily on the company. Given the importance and innovation of the semiconductor manufacturer, ensuring they avoided tariffs was essential for the market.

With that risk likely subdued, investors can now focus on the company’s strong performance, which will continue to grow in the short and long term. According to the company’s projections, AI-related chips will experience a compound annual growth rate of 45% over the next five years. TSMC anticipates its revenue growth rate to achieve 20% over that same time frame.

Even with this potential, its stock trades at only 19.8 times forward earnings. This price makes TSMC’s stock cheaper than the market, which is unusual given its significance in the AI field. Taiwan Semi appears to be a sound buy, considering its current market price. Investors should take advantage of this value while the stock is experiencing a downturn.