While artificial intelligence (AI) has been the dominant market trend for two years, tariffs took center stage in early 2025. Despite this shift, AI remains a significant trend that’s not losing momentum. The temporary lack of focus on AI creates an investment opportunity to acquire industry leaders at discounted prices. The top three stocks on my shopping list are Nvidia (NVDA), Taiwan Semiconductor (TSM), and The Trade Desk (TTD).

Nvidia and Taiwan Semiconductor: A Strategic Investment Pair

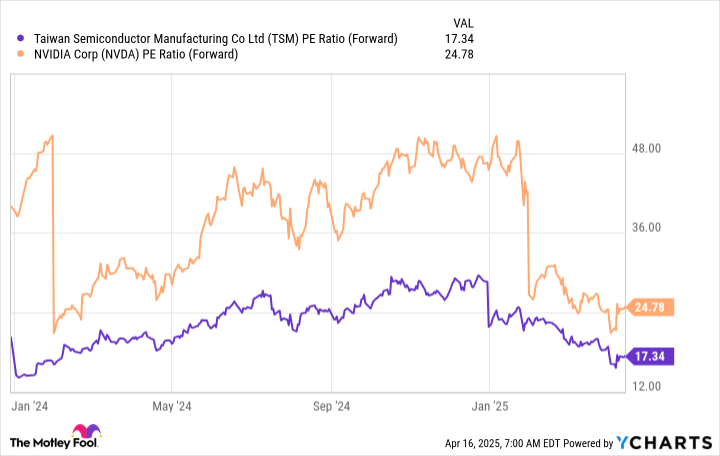

Nvidia and Taiwan Semiconductor are closely linked investments. Taiwan Semiconductor fabricates chips used in cutting-edge devices, including Nvidia’s graphics processing units (GPUs), which are crucial for AI model training due to their parallel processing capabilities. Data centers dedicated to AI training often contain over 100,000 GPUs, with Nvidia being the primary supplier due to its technological leadership.

Concerns about potential semiconductor tariffs are causing investor unease. Although semiconductors are currently tariff-exempt, the Trump administration is investigating possible tariff implementations. However, companies like Nvidia and TSMC are already taking steps to avoid these potential tariffs. TSMC has invested heavily in U.S.-based production facilities, including a $100 billion investment in Arizona for multiple fabrication facilities and research operations. This strategic move not only helps avoid tariffs but also meets the growing demand for advanced chips.

The Trade Desk: AI-Driven Advertising Solutions

The Trade Desk offers a different AI investment opportunity through its advertising platform. By leveraging AI to optimize ad placements and performance, The Trade Desk helps advertisers maximize their spending effectiveness. The company is currently migrating its customers to its AI-driven Kokai platform from the older Solimar platform. Although this transition caused a temporary revenue stumble in Q4, the long-term benefits will likely outweigh the short-term costs.

Despite being more expensive than Nvidia or TSMC at 28 times forward earnings, The Trade Desk’s growth potential and margin expansion capabilities make it an attractive investment. The stock has dropped about 65% from its all-time high, presenting a buying opportunity for investors looking to capitalize on the AI-driven advertising market.

All three stocks – Nvidia, Taiwan Semiconductor, and The Trade Desk – are currently undervalued, making them attractive buys for investors willing to take a long-term view on the AI trend.