Nanya Technology Forecasts Downgraded: Analysts Turn Bearish

Analysts have adjusted their expectations for Nanya Technology Corporation (TWSE:2408), signaling a more cautious outlook for the company.

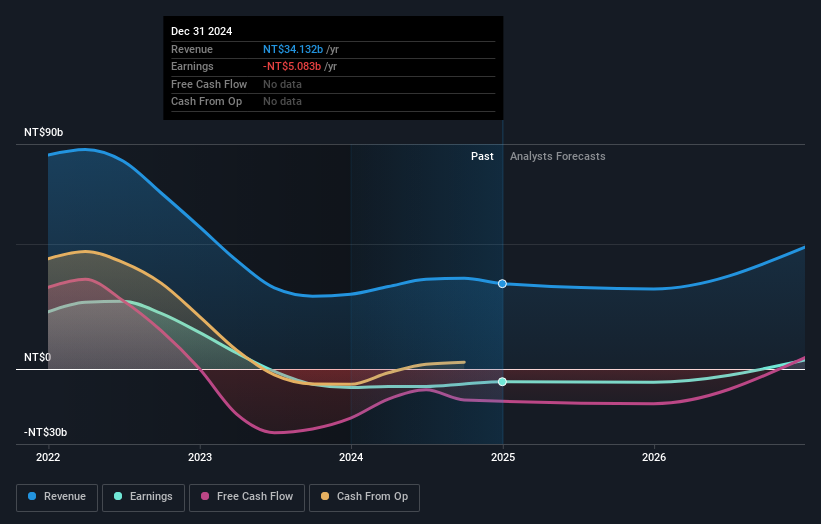

The consensus among eight analysts now projects revenues of NT$32 billion for 2025. This represents a 6.1% decrease in sales compared to the previous year’s performance. Furthermore, analysts anticipate a substantial increase in losses, with an expected loss of NT$1.90 per share.

Prior to this update, forecasts for 2025 were considerably more optimistic. Revenue projections stood at NT$47 billion, and earnings per share (EPS) were expected to be NT$2.07. The revised estimates reflect significantly more bearish sentiment regarding Nanya Technology’s prospects, with a considerable reduction in this year’s revenue projections.

These adjustments have also led to a decrease in the consensus price target, which fell by 19% to NT$41.30. This implies that the analysts believe lower earnings per share will lead to a reduced valuation for Nanya Technology.

It’s worth noting that the forecasted 6.1% annualized revenue decline for 2025, while negative, is an improvement compared to the company’s historical performance. Over the past five years, Nanya Technology’s revenues have shrunk by 13% annually.

In contrast, industry analysts estimate that the broader semiconductor industry revenues are expected to grow by 18% annually. This comparison suggests that analysts expect Nanya Technology to underperform the wider market despite its declining revenues.

The Bottom Line

The key takeaway from these revisions is that analysts expect Nanya Technology to become unprofitable this year, adding to investor concerns. With both revenue estimates and the price target being lowered, investors may show increased caution toward the stock. While the next year will be a challenge, the long-term trajectory of the company’s earnings is even more important. You can find estimates extending to 2026 on our platform.

This article is based on analysts’ forecasts and historical data and is not financial advice.