Analysts Lower Expectations for Jonhon Optronic Technology

Analysts covering Jonhon Optronic Technology Co., Ltd. (SZSE:002179) have adjusted their financial projections, leading to a more cautious outlook for the company. The revisions, which impact both revenue and earnings per share (EPS) forecasts for 2025, suggest a shift in sentiment among market observers.

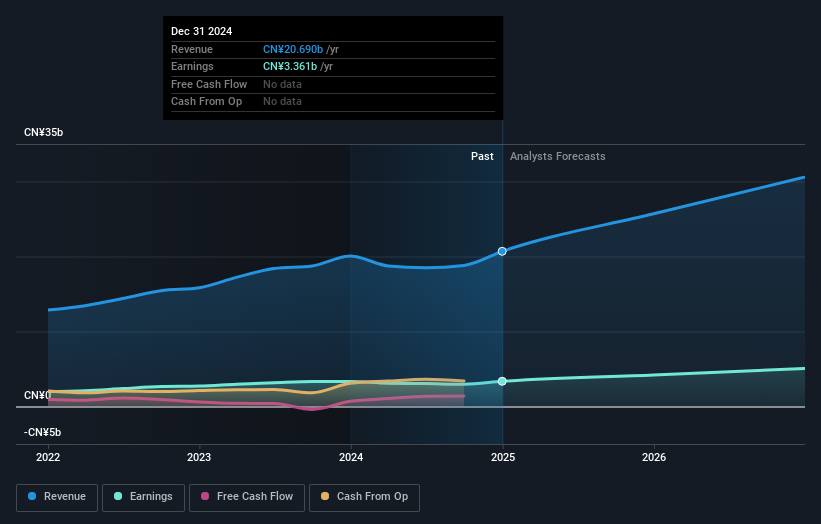

After the recent adjustments, the eight analysts providing coverage for Jonhon Optronic Technology now anticipate revenues of CN¥26 billion in 2025. Despite the downturn in the projections, this figure still represents a substantial 24% increase in sales from the last 12 months. Statutory earnings per share are also expected to climb, with an estimated 25% rise to CN¥1.99.

Prior to this update, the analysts had been forecasting higher revenues of CN¥30 billion and an EPS of CN¥2.26 for 2025. This revision reflects a notable shift towards a more pessimistic view of Jonhon Optronic Technology’s immediate prospects.

Despite the lowered earnings forecast, the analysts have maintained their price target at CN¥50.30, indicating that they do not believe the changes will significantly affect the company’s intrinsic value.

Performance Comparison

A deeper dive into Jonhon Optronic Technology’s growth compared to historical data and the broader industry landscape provides additional context. The analysts’ forecast of a 24% annualized growth rate for 2025 is notably strong. This follows the company’s historical growth of 17% per year over the past five years. However, the industry is projected to grow at 18% annually, thus demonstrating outperformance in the forecast acceleration in revenue.

The Bottom Line

The primary takeaway is the downward revision of EPS estimates, reflecting concerns over the company’s business conditions. Although analysts have also trimmed their revenue estimates, the forecasts still suggest better performance than the wider market. Given the expected decline for the coming year, investors might approach Jonhon Optronic Technology with some caution, despite the unchanged price target. However, the long-term performance of the company’s earnings remains more critical. Investors can access further details on the company’s financial trajectory through 2026 via the Simply Wall St platform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice.