Accton Technology Corporation (TWSE:2345) Receives Bullish Forecast Upgrade

Analysts have significantly upgraded their revenue projections for Accton Technology Corporation (TWSE:2345), sparking optimism among shareholders. The consensus view is now far more positive regarding the company’s business prospects.

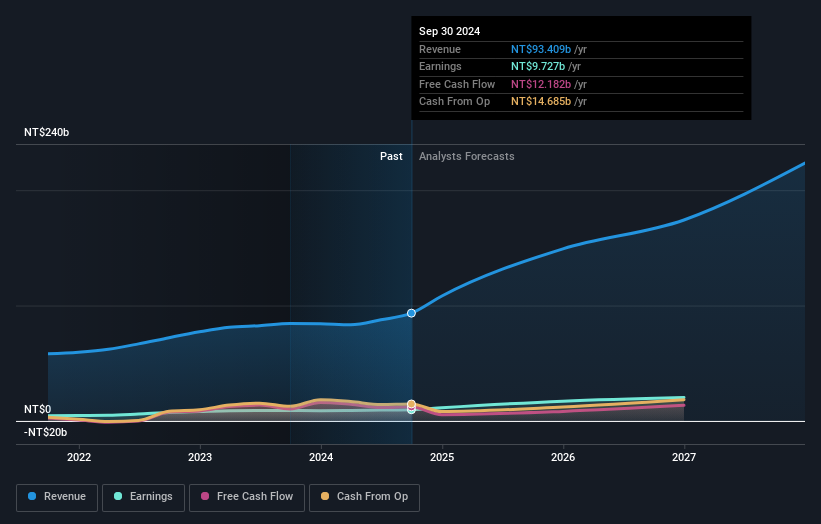

Following the revision, the consensus forecast among the seven analysts covering Accton Technology anticipates revenues of NT$149 billion in 2025. If realized, this would represent a substantial 60% increase in sales compared to the past 12 months. Earnings per share (EPS) are also projected to surge, rising by 75% to NT$30.49.

Previously, the analysts had modeled revenues of NT$130 billion and earnings per share (EPS) of NT$27.25 for 2025. This indicates a clear uptick in analyst sentiment, with both revenue and earnings per share estimates receiving substantial boosts.

Earnings and Revenue Growth February 20th 2025

Unsurprisingly, analysts have also increased their price target for Accton Technology, raising it by 10% to NT$870. These forecasts are interesting, and it’s useful to compare the projections to Accton Technology’s past performance and industry peers.

Analysts anticipate accelerated growth for Accton Technology, forecasting a 45% annualized growth rate through the end of 2025. This compares favorably with the company’s historical growth of 12% per annum over the last five years. In contrast, industry data suggests other companies with analyst coverage in a similar sector are predicted to increase revenue by 23% annually. Considering the anticipated acceleration in revenue growth, Accton Technology is expected to significantly outperform its industry.

The Bottom Line

The key takeaway from this upgrade is the analysts’ upward revision of the company’s earnings per share estimates for the upcoming year, reflecting an expectation of improved business conditions. They have also upgraded their revenue estimates, anticipating faster sales growth than the broader market. The price target increase further indicates growing optimism.

Given the substantial upgrade to next year’s forecasts, it might be an opportune time to re-evaluate Accton Technology. However, the long-term trajectory of the company’s earnings is more critical than the immediate outlook. Estimates extending to 2027 are available.

This article is for informational purposes only and does not constitute financial advice. It is based on historical data and analyst forecasts using an unbiased methodology. Simply Wall St has no position in the stocks mentioned.