Q1 Earnings Review: Healthcare Technology Stocks

The first quarter earnings report for key healthcare technology stocks revealed mixed results across the industry. Among the eight major companies analyzed, revenues collectively exceeded analyst expectations by 4.4%, while forward guidance was 1% below estimates. Despite this, the average stock price of these companies has risen 6.9% since the earnings announcements.

Hims & Hers Health (NYSE: HIMS)

Hims & Hers Health reported a significant revenue increase of 111% year-over-year, reaching $586 million. This performance beat analyst expectations by 8.3%. The company’s strong quarterly results included a substantial beat in EPS estimates and better-than-expected full-year EBITDA guidance. CEO Andrew Dudum noted, “We’re starting 2025 with incredible momentum. Millions of people are turning to us for access to care that is personal, affordable, and has the potential to drive better outcomes.” The company added 137,000 new customers, bringing the total to 2.37 million. Consequently, Hims & Hers Health’s stock price has risen 45.4% to $60.99.

Other Notable Performers

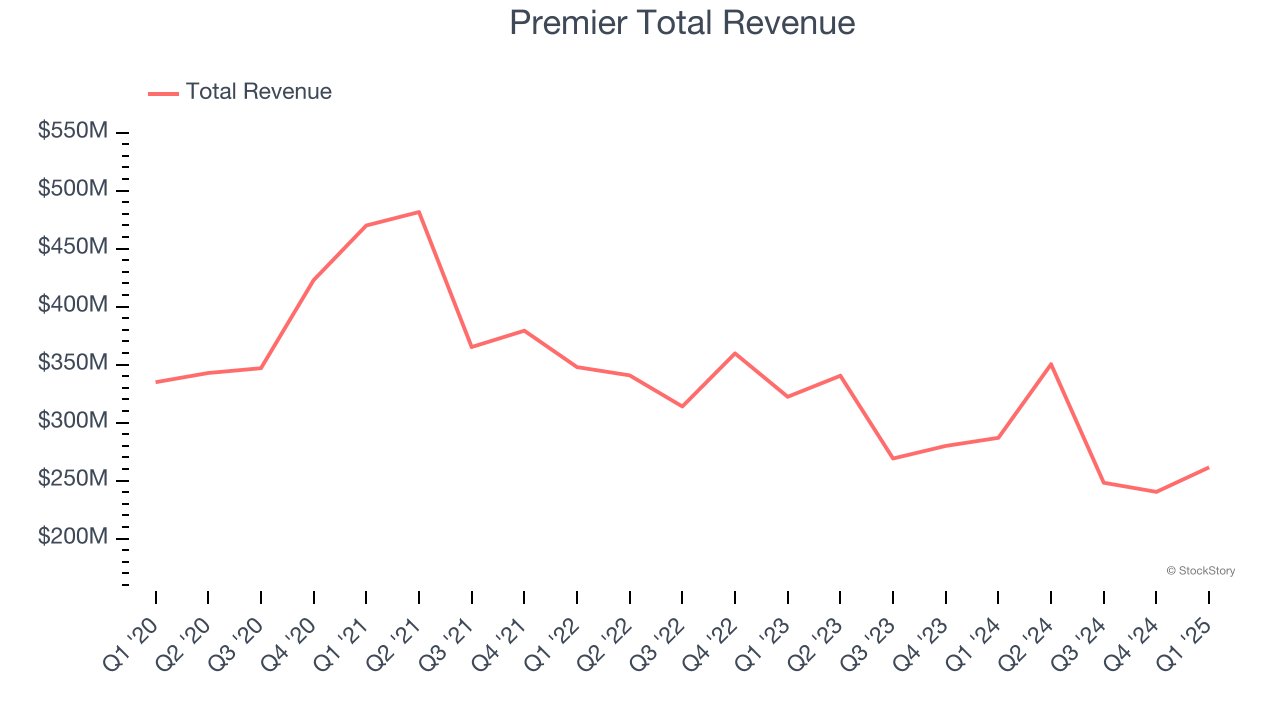

Premier (NASDAQ: PINC)

Premier, a healthcare improvement company, reported revenues of $261.4 million, an 8.9% decrease year-over-year. Despite this decline, the company outperformed analyst expectations by 7.4%. Premier’s stock is up 9.1% since the earnings report, currently trading at $22.40.

Astrana Health (NASDAQ: ASTH)

Astrana Health, a technology-powered healthcare platform, saw revenues of $620.4 million, a 53.4% increase year-over-year. However, this fell short of analyst expectations by 2.5%. The stock has dropped 18.9% since the report, trading at $27.08.

Evolent Health (NYSE: EVH)

Evolent Health reported revenues of $483.6 million, down 24.4% year-over-year. While this beat analyst expectations by 4.9%, the company’s full-year revenue guidance was slightly above estimates, and EPS estimates were significantly missed. The stock is down 20.2% at $8.59.

GoodRx (NASDAQ: GDRX)

GoodRx’s revenues were $203 million, up 2.6% year-over-year, meeting analyst expectations. However, the company missed EPS and customer base estimates, losing 200,000 customers to total 6.4 million. The stock is up 5% at $3.97.

Market Context

The healthcare technology sector’s performance comes amid a backdrop of economic stabilization following the Fed’s rate hikes in 2022 and 2023. Recent rate cuts have supported market performance, with major indices reaching new highs. Investors are now considering the potential impacts of tariffs, corporate tax cuts, and the broader economic outlook for 2025.

For investors looking for stable growth opportunities, our analysis of market-beating stocks with strong fundamentals is available. These companies are positioned for growth regardless of the macroeconomic climate.