Andes Technology’s P/S Ratio: A Closer Look

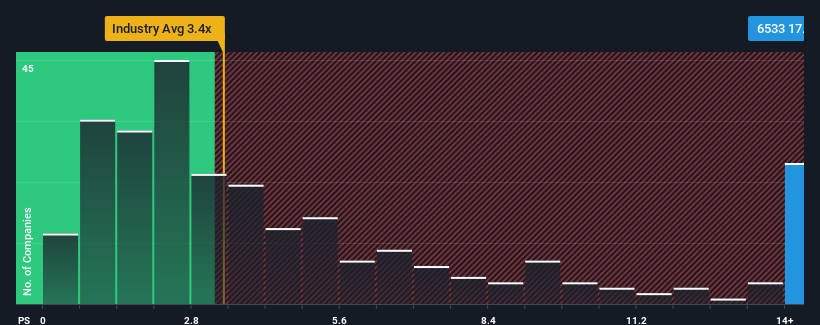

Andes Technology Corporation (TWSE:6533) shares have experienced a significant upswing, gaining 26% over the past month. However, investors shouldn’t necessarily celebrate just yet, as the stock is still down 18% over the last year. This recent jump might lead some to believe that Andes Technology is a stock to avoid. The company’s price-to-sales (P/S) ratio stands at 17.4x which is notably high when compared to the semiconductor industry in Taiwan, where almost half of the companies have P/S ratios below 3.4x. While the P/S ratio can provide insight, it’s essential to investigate the rationale behind such a high valuation.

What Does Andes Technology’s P/S Mean for Shareholders?

Andes Technology has demonstrated impressive revenue growth compared to its peers. The market appears to be betting on this trend continuing, thus justifying, to some extent, the elevated P/S ratio. If this growth doesn’t materialize, investors may be overpaying for the stock.

For those interested in analysts’ expectations, further details can be found in a free report on Andes Technology available here.

Revenue Growth Trends

To justify its high P/S ratio, Andes Technology needs to exceed the industry’s growth rate significantly. Over the past year, the company’s revenue has surged by 38%. Furthermore, over the last three years, revenue has grown by a remarkable 62%. The company’s revenue growth has undeniably been stellar.

Looking ahead, analysts project revenue to increase by 30% in the coming year. However, this projection is considerably less than the 15,113% projected growth for the broader industry. This disparity raises concerns about why Andes Technology is trading at a P/S higher than the industry average. It seems many investors are significantly more optimistic than analysts, potentially setting themselves up for disappointment if the P/S ratio adjusts to align with the growth outlook.

The Bottom Line

Andes Technology’s P/S ratio has increased due to the recent share price increase. While helpful, the price-to-sales ratio alone doesn’t tell the whole story. Based on the company’s growth forecasts, the current high P/S ratio seems unwarranted. The lower-than-average revenue estimates do not bode well for the elevated P/S ratio. Without considerable improvement in the revenue outlook, it would be challenging to deem this stock a good buy.

It’s crucial to consider potential risks. Notably, Andes Technology has one warning sign that investors should investigate here. Of course, established, profitable companies with solid earnings growth are often the safest bets. You may wish to review a free collection of other companies here that have reasonable P/E ratios and have grown their earnings strongly.

Disclaimer: This article by Simply Wall St is general in nature. It provides commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.