Aoshikang Technology’s Stock Dips Amidst Ownership Dynamics

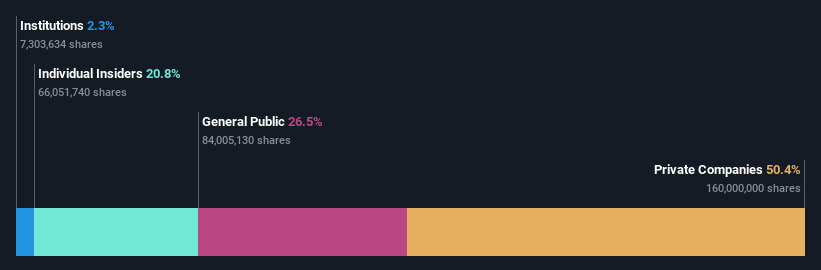

Aoshikang Technology Co., Ltd. (SZSE:002913) saw its stock price fall by 8.2% last week, prompting a closer look at the company’s ownership structure and potential shareholder influence. The company’s significant private company ownership suggests that major decisions are likely influenced by these key shareholders.

Key Ownership Insights

The largest shareholder of Aoshikang Technology is Shenzhen Beidian Investment Co., Ltd., holding a 50% stake. Insiders own 21% of Aoshikang Technology, demonstrating their vested interest in the company’s performance.

With the market capitalization at CN¥8.8b last week, private companies, holding the controlling stake, experienced the most significant losses compared to other shareholder groups. This concentration of ownership highlights the potential influence these entities wield.

Institutional and Insider Perspectives

Institutional investors hold a relatively small stake in Aoshikang Technology. This may indicate that while the company is on the radar of some funds, it isn’t yet a favorite among professional investors. However, growing earnings could draw the attention of more institutional investors in the future.

It is worth pointing out that hedge funds do not have a meaningful investment in Aoshikang Technology.

Shenzhen Beidian Investment Co., Ltd., with its 50% share, exerts substantial influence over the company’s direction. Furthermore, Bo He (13%) and Yong Cheng (5.7%) are also major shareholders. Yong Cheng, in addition to his shareholder role, also serves as Chairman of the Board.

Insiders, including board members, collectively hold a significant position in the company. With insiders owning CN¥1.8b worth of shares, their investments align their interests with those of other shareholders. This insider ownership is generally seen as a positive signal.

Public and Private Stakeholders

The general public owns 26% of the company, contributing to their influence on company operations. The significant ownership by private companies, which make up 50% of the stock, indicates that they may be related parties. This concentration warrants further research to fully understand the dynamics at play.

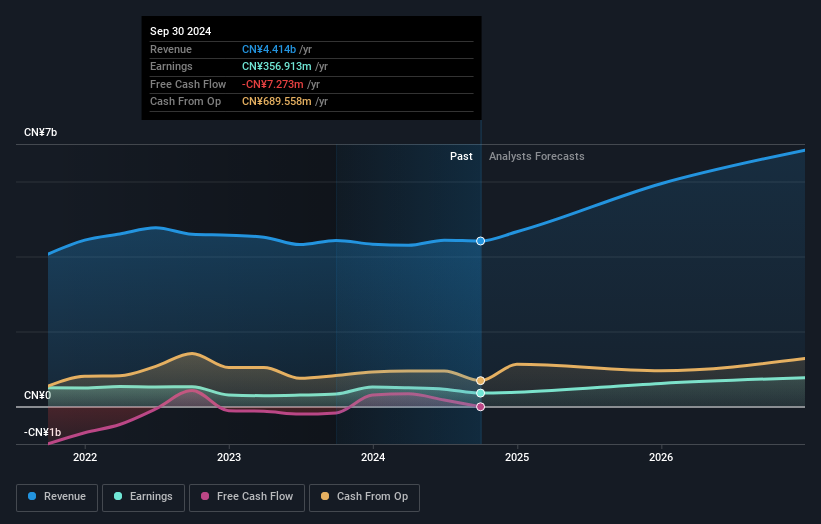

Analyzing the Future

To gain deeper insights into Aoshikang Technology’s future, investors may examine revenue growth and analyst forecasts. A look at the company’s history of revenue and earning is recommended.

Disclaimer: This article provides commentary based on historical data and analyst forecasts only, using unbiased methodology. It is not intended as financial advice and does not constitute a recommendation to buy or sell any stock. The analysis may not reflect recent price-sensitive announcements. Simply Wall St has no position in any stocks mentioned.

About SZSE:002913 Aoshikang Technology

Aoshikang Technology is involved in the research, development, production, and sale of printed circuit boards.